This week, Oregon residents experienced the first taste of fall. Evenings, once long and balmy, gave way to early, crisp sunsets. Leaves, damp from evening rain and morning dew, began dropping from trees. Pumpkins appeared on porches to greet the trick-or-treaters that would soon walk door-to-door. Lastly, capital markets demonstrated similar signs of change with company earnings announcements and macroeconomic data reports, ending a fairly quiet week by setting the stage for more significant releases of information in the coming weeks and months. Surely, fall is upon us.

When evaluating a company's financial health, earnings are a goldmine of information investors use to understand a company's performance and future prospects. These reports provide information that is quantitative (revenue, earnings per share, price-to-earnings ratios and return on equity) and qualitative (upcoming goals, milestones or management action items). Some investors go further, analyzing the tone used by company personnel during management presentations and in public documents.

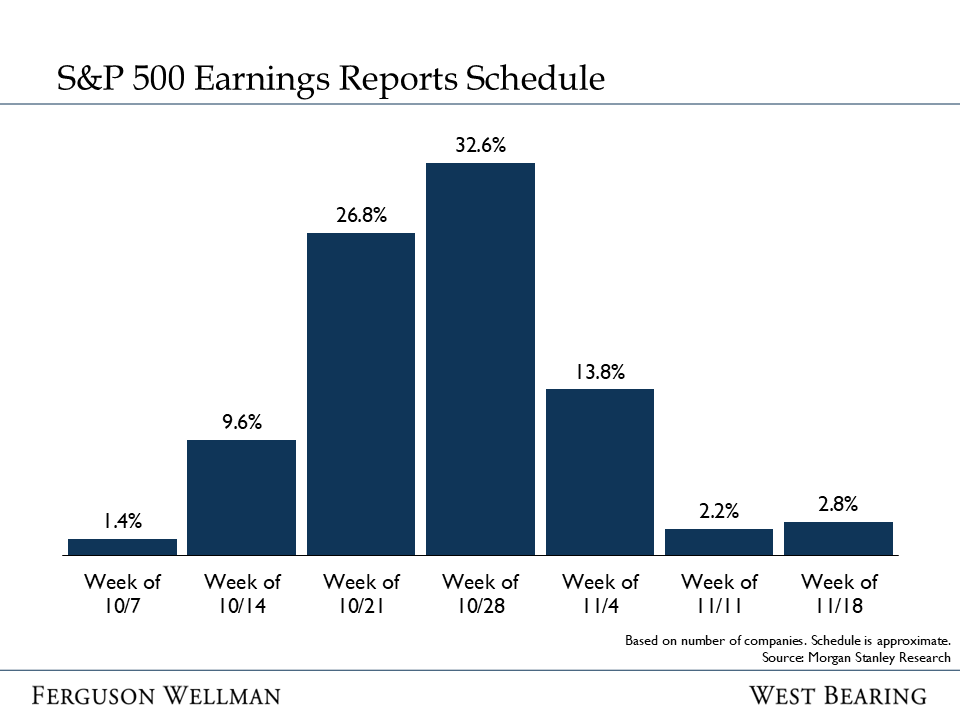

Approximately 10% of the S&P 500 companies reported this week. Factoring in these results, overall year-over-year expected sales growth now sits at roughly 4.6%, and earnings growth at around 3.4%. While this most current earnings estimate is slightly lower than the September 30 figure of 4.4%, it still puts the index on track for the fifth consecutive quarter of year-over-year growth. However, the remaining 85% of S&P 500 companies have yet to report, and their results will either confirm or change the current trajectory of these growth trends.

Source: Morgan Stanley Research

On the economic front, Thursday saw the release of both the September retail sales and weekly unemployment claims data. The retail sales report showed a seasonally adjusted, month-over-month 0.4% gain for September, compared to the prior month’s 0.1% increase. The weekly unemployment data showed 241,000 new claims, which was below consensus estimates of 262,000 and last week’s 260,000. There were also 1.87 million continuing unemployment claims, which was slightly higher than last week’s 1.85 million. These indicators, along with better-than-expected September jobs creation (+254,000 versus the estimated +140,000), are helping assuage investor fears of a more acute economic contraction.

However, expectations should be moderated as heightened geopolitical tensions, recoveries from back-to-back hurricanes on the East Coast and the aftermath of multi-day port strikes across the U.S. are all adding ‘noise’ to standard economic performance metrics. This ‘noise’ comes in the form of temporary increases in the unemployment rate and decreases in affected areas’ economic activity. All of these events make it even more important to view every data point as a piece of a larger puzzle. Though it will take time for these events’ impacts to subside, upcoming statistics and data releases will help draw clearer trends as time passes.

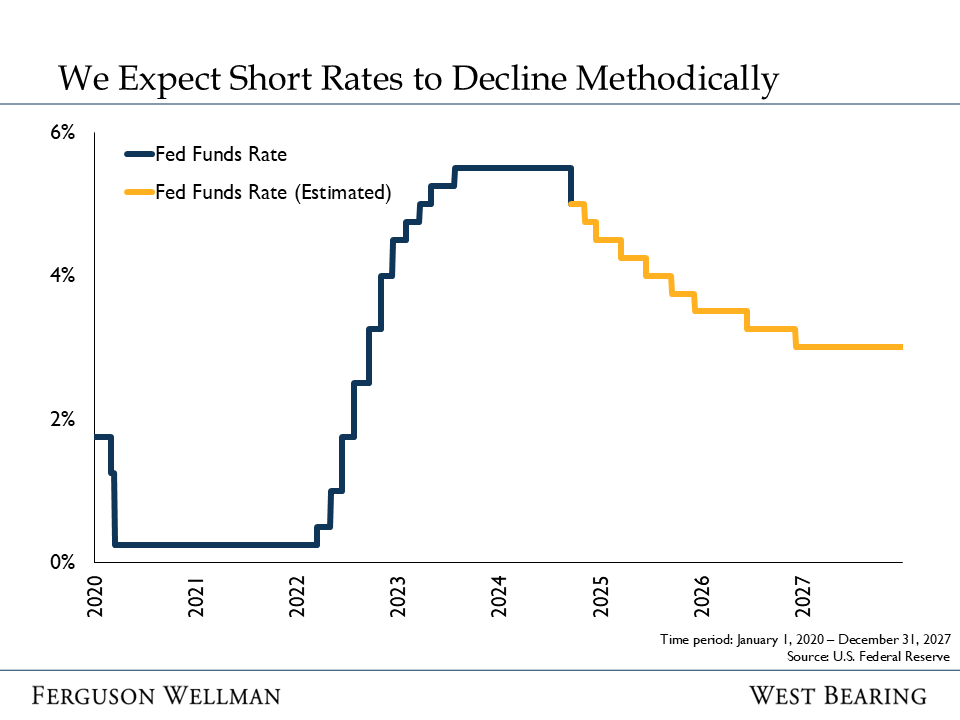

As the week draws to a close, the stage is set for investors to receive more information and clarity about the state of the U.S. economy. All current data is leading investors and markets to price in a 90% chance of two additional 25 basis point Federal Funds Rate cuts in 2024. The remaining 10% chance does not represent a larger rate cut but indicates that one of these rate cuts may not occur at all due to the strength of the U.S. economy and job markets. The market’s view aligns with our own, both in the immediate term and long run; we continue to expect future rate cuts to come in smaller, measured and steady increments.

Source: U.S. Federal Reserve

Takeaways For the Week:

Approximately 10% of S&P 500 companies reported earnings results this week. Results so far indicate year-over-year sales and earnings growth of around 4.6% and 6.4%, respectively

Retail sales data released on Thursday shows a seasonally adjusted, month-over-month 0.4% gain for September compared to August’s 0.1% sales increase