by Blaine Dickason

Senior Vice President

Trading and Fixed Income Portfolio Management

“Two percent is and will remain our inflation target.” (Federal Reserve Chair Jerome Powell at Jackson Hole, August 25th, 2023)

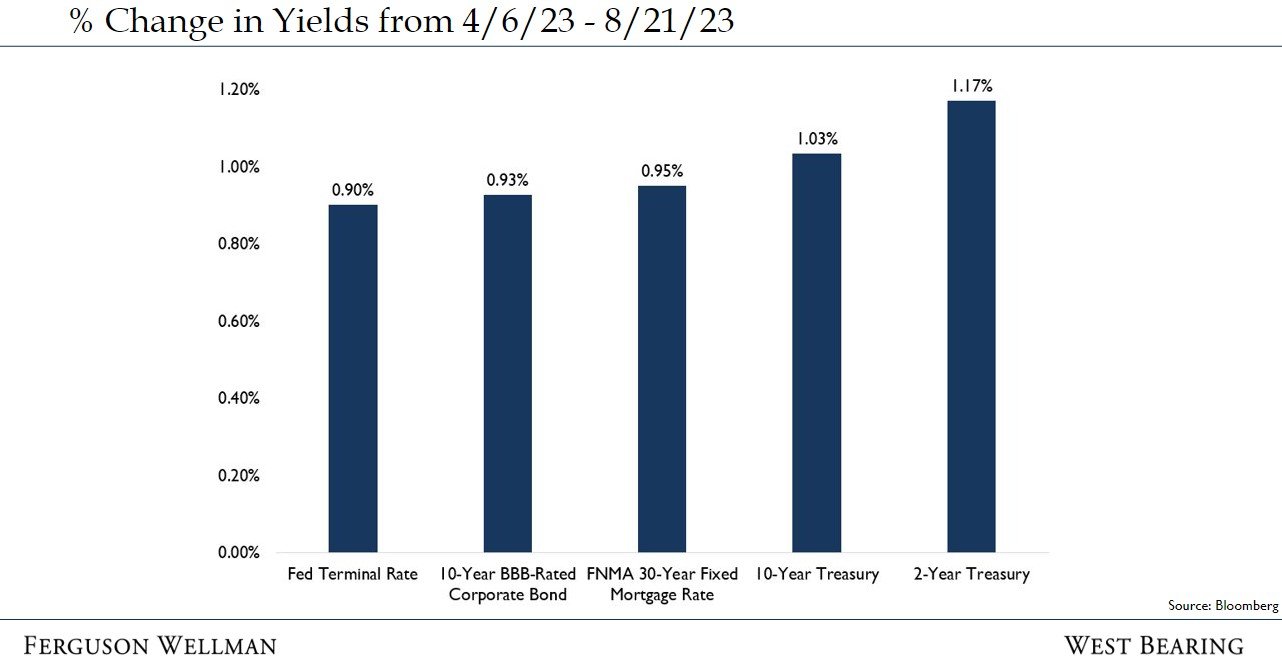

This week, yields on the benchmark 10-year U.S. Treasury rose to their highest level since 2007. Earlier this spring, market stress linked to the banking sector led safe-haven buyers to the safety of U.S. Treasuries, and the 10-year Treasury hit a year-to-date low of 3.30% in early April. Monday’s intraday high yield of 4.35% represented a significant correction as bonds have given up the entirety of their gains for the year. Interest rates, bond yields, and other measures of the cost of borrowing are a barometer for any economy, so understanding the factors behind these rising pressures can be key to any investment outlook. Below are some contributing factors to the last several months of rising yields.

Improved Economic Outlook - Over the last several months, better than expected economic data, as well as the continued decline of inflation have increased the market’s expectation for a so-called ‘soft-landing’ for the U.S. economy. This outcome is when the Federal Reserve’s interest rate tightening cycle does not result in a recession. We know from history that this ideal outcome is rarely achieved – however, given the long and variable effects of higher interest rates on the economy, it may take several years before a unanimous consent of a soft-landing outcome is achieved.

Higher for Longer – The recent spate of strong U.S. economic data has demonstrated the impressive resilience of the U.S. economy. Given GDP growth has been better than expected and above its long-term trend so far in 2023, the bond market has begun anticipating the Federal Reserve will keep their policy rate around current elevated and restrictive levels longer than expected in order to deliver the below-trend growth they believe will allow inflation to sustainably return to their 2% target. This dynamic is also likely why the 2-year Treasury yield has risen the most since April (see chart above).

Increased Supply of Treasuries – After running a budget deficit of over $1.3 trillion in 2022, the United States is on track for a $1.6 trillion budget deficit this year. Treasury bond sales are needed to cover this difference. Goldman Sachs projects that the increase in bond sales needed to cover growing deficits over the next 10 years will drive bond yields higher by another 0.4-0.8%.

Fed Balance Sheet Runoff – COVID-related stimuli led the Fed’s balance sheet to more than double, peaking at nearly $9 trillion in early 2022. Starting last year, the Fed has allowed those purchased bonds to mature without reinvesting, at a pace of up to $100 billion per month. As a result, their balance sheet is now nearly 10% smaller. The net result for bond markets is that the former largest buyer of Treasuries is no longer in the market and higher yields may be necessary to attract the remaining pool of buyers to purchase U.S. government debt.

Fitch Downgrade – At the beginning of August, Fitch Ratings downgraded their long-term rating of the United States, citing an expected fiscal deterioration over the next three years and a growing general debt burden. While none of their highlighted issues could be called surprising, it did refocus attention on the sustainability of our government’s finances. It also called into question if higher yields will be required to incentive bond buyers to continue financing our federal budget.

As investors, we consider bonds for the income they provide in client portfolios. A borrower’s perspective, however, is that yields represent the cost of money. Whether you are borrowing thousands for a home mortgage, millions for a factory expansion, or trillions to finance the U.S. government, higher yields are a drag on economic activity as higher interest costs can crowd out other spending plans, or even make project financing unviable. Soft landing or not, this summer’s rise in yields will provide an opportunity to add income from new bond purchases while simultaneously pressuring private and public entities needing to borrow money.

Takeaways for the Week

10-year Treasury yields set a 16-year high this week, hitting 4.35% on Monday.

According to Fannie Mae, 30-year fixed mortgage rates hit their highest level since 2001 this week.