by Jason Norris, CFA

Principal

Equity Research and Porfolio Management

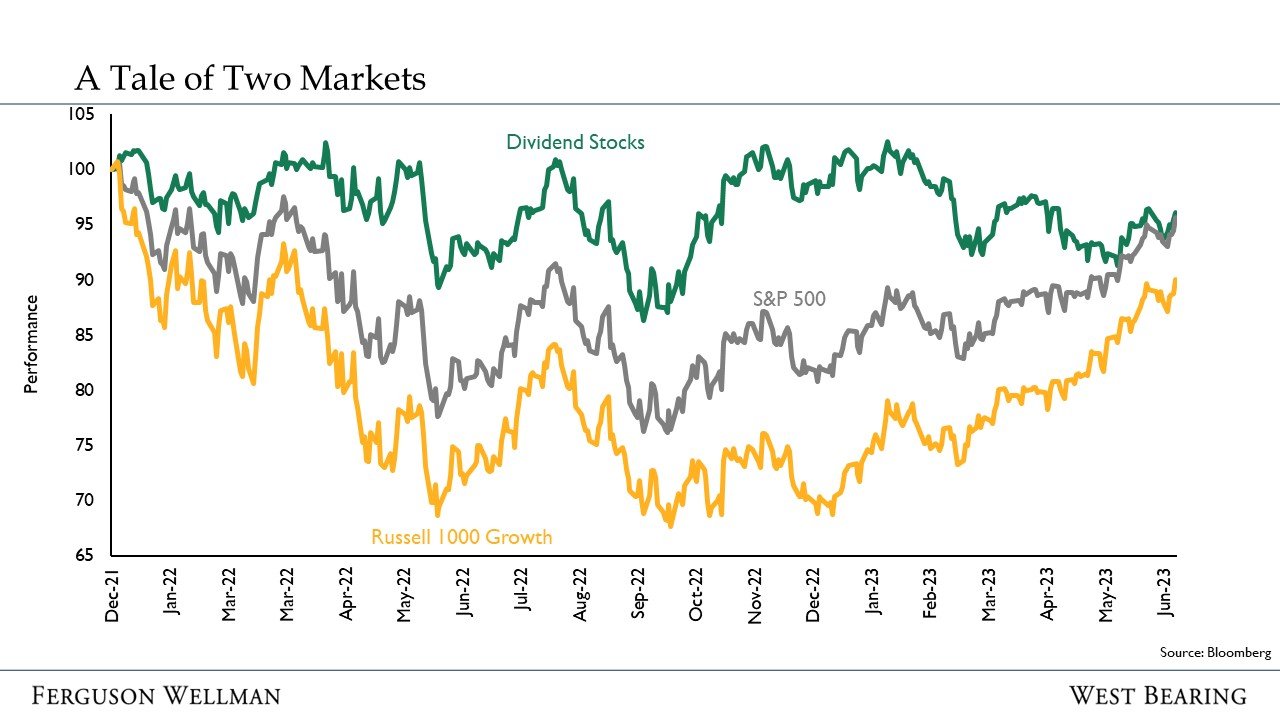

Over the last 18 months we have seen the tale of two markets. Looking at returns through June, large-cap growth stocks have driven returns resulting in the S&P 500 returning just under 17%. However, a slice of the market which is lagging meaningfully is dividend-paying stocks. Looking at a basket of dividend ETFs through June, returns are a paltry -2%. These results can cause a lot of frustration with investors; however, investing is not a sprint, it’s a marathon. When considering last year, dividend-paying stocks is where you wanted to be invested.* The chart below compares the two time periods’ total returns. Both years stand out for the strong relative performance of dividend payers in 2022, followed by poor relative performance this year.

However, when looking over the entire period, as seen below, the S&P 500, as well as dividend stocks, are back in a dead heat. The best performer this year, large cap growth, is still playing catch up after the large hole that was dug last year.

What’s important is to avoid chasing the “hot dot.” Buying last year’s winners and selling last year’s losers is not a winning strategy. Understanding what you are invested in, and why, is key to staying disciplined. Avoiding getting caught up in short-term gains and losses is important in obtaining your investment objectives and managing your risk. A recent study from George Mason University found that on average, attempting to market time your investments, specifically equity investments, will cost an average of 1.0% per year, which can add up over time.

Therefore, whether you are invested in large cap growth stocks (higher risk, higher reward) or dividend payers (maximizing income and reducing volatility), attempting to time the market in those equity classes has historically not worked. Staying disciplined with your investment objectives is the key to obtaining your investment goals.

Takeaways for the Week:

Better than expected inflation data was a tailwind for equities and bonds with the S&P 500 rallying 2.5% with the 10-year U.S. Treasury yield falling 0.25% to 3.80%

Second quarter earnings kicked off this week. Earnings were mixed for the banks and United Healthcare beat lowered expectations. The next two weeks are when we will get the bulk of reports to gauge corporate health

*The dividend-paying stocks consist of the Dow Jones Dividend ETF, the S&P Dividend ETF and the Schwab Dividend ETF.