by Joe Herrle, CFA, CAIA

Vice President

Alternative Assets

“Have you used ChatGPT?” Wherever I go, whatever the context, I keep getting this same question. Clearly, the excitement around artificial intelligence (AI) is real… look at the stock market. Companies at the forefront of AI, like Microsoft and Nvidia, have seen share prices increase by 40% and 178% over the last six months, respectively. These are just the two largest names in AI, but many others are seeing share price increases. This excitement around a new technology echoes back to the “dot-com bubble,” begging the question: is the hype real, or are we in a bubble?

We believe that AI is a transformational technology that will have far-reaching implications for how companies operate and how people work. Today, anyone can easily access the technology through ChatGPT or Google’s Bard to perform any number of time-saving tasks. As the technology progresses, we can only imagine the efficiencies that might be achieved.

So, the tech is real, but are the stock prices justified? Just like in the dot-com era of the late 90s, valuations seem stretched. There will be winners and losers as the wheat is separated from the chaff and in some cases, the valuations will be justified. But there are more ways to play the AI boom than by only investing in the leading companies; additional value can be found in focusing on the investment themes that will benefit from the adoption of AI.

The most obvious way to invest in AI is in names like Nvidia, which makes the processing chips that make computing possible, and Microsoft, which is helping pioneer the software. However, there is an entirely separate industry that all this technology relies on: data centers. The reliance on data centers to compute and store data has risen exponentially since the dawn of the internet. Just like it was clear in the dot-com era that Amazon and the rise of e-commerce would require loads of industrial warehouse space, AI and the massive amounts of data it creates will require a tremendous number of servers that must be housed within data centers.

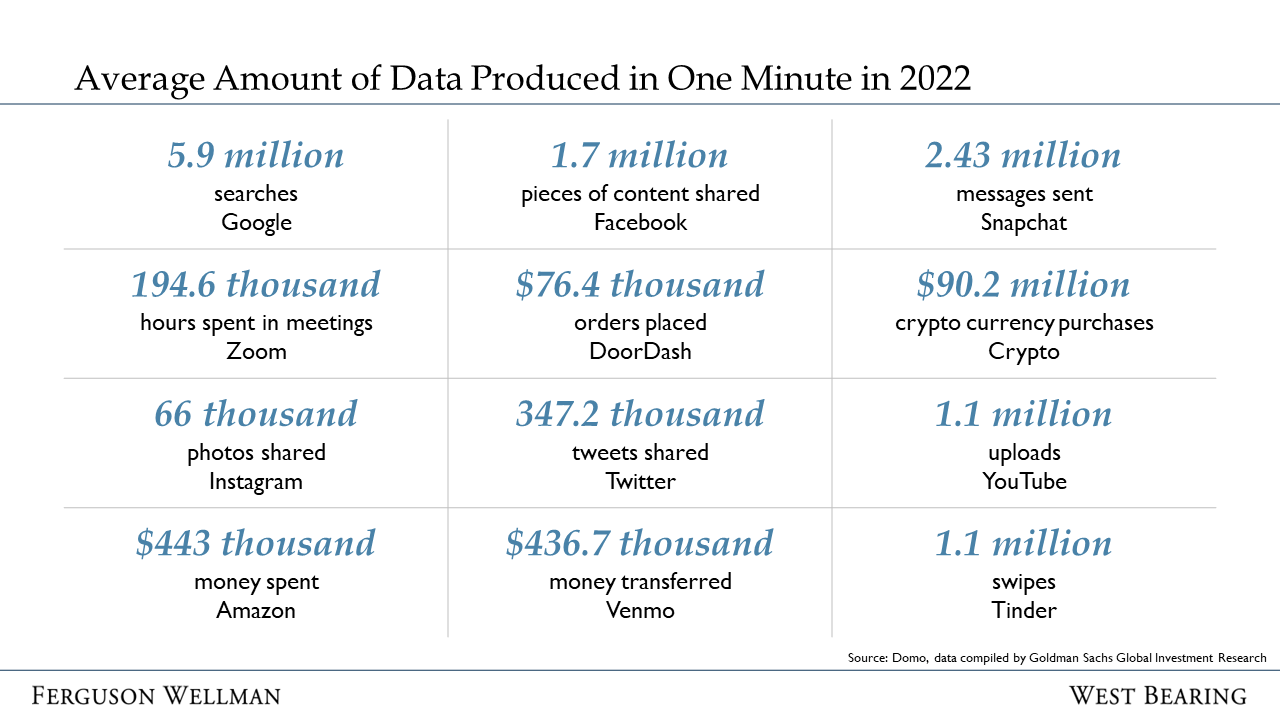

In 2018, OpenAI, the creator of ChatGPT, found that the amount of computational power used to train the largest AI models had doubled every 3.4 months since 2012. Think of the already massive amount of data the world creates (see figure below) and consider that AI will have a multiplier effect on the amount of data produced. Trying to predict how much more data will be produced in the future is difficult, but it's safe to say that it will be substantial.

For some time now, we have been investing in this theme of technology infrastructure through both our public equities and alternative assets. The advent of AI should accelerate the tailwinds driving returns in the sector. It is challenging to measure how much of an impact AI will have on society in the future. But it seems a sure bet that more data will be produced. And we can say with certainty: that more data will require more storage, data processing and networking equipment.

Takeaways for the Week:

The S&P 500 is off to its best start to a year since 1997. But the market rally has cooled off this week, with the index declining about 1.0%

The market is still driven mostly by just a handful of stocks, but there has been increasing participation in the rally as small-caps and mid-caps show signs of life. Broader participation in the rally would add legitimacy that we are in a true bull market

This week’s data showed that housing starts and building permits surged in May, despite higher interest rates, showing the financial resilience of consumers. But it also gives the Fed another reason to continue on their path of rate hikes