by Peter Jones, CFA

Senior Vice President

Equity Strategy and Portfolio Management

Inflation has been the most watched economic data point for the past two years. On Wednesday, we received inflation data for the month of April. The headline Consumer Price Index (CPI) increased by 0.4% compared to the prior month and 4.9% compared to the year-ago period. 4.9% compares to economist expectations for an increase of 5.0%, equal to the 5.0% increase seen in March. Although the downtick in inflation was very modest, it represents the tenth consecutive month that inflation has moderated. In other words, we are seeing continued progress towards the long-term target of 2% inflation.

Remarkably, inflation fell 4.2% from a rate of 9.1% last June, a 40-year high. Although investors and policymakers alike have been pleased with the progress towards normalization in inflation, there is still a vast gap to the 2% target. Unfortunately, the progress towards that goal has been slowing markedly in recent months and we continue to believe that the “easy” gains have already been made. The volatile categories of goods, food and energy have mostly normalized while the “sticky” service components remain stubbornly high.

While this week’s inflation data left something for both the bulls (inflation is coming down) and the bears (inflation is still too high), market participants continue to believe that the Federal Reserve will pause its tightening campaign in the coming months. Regardless of whether the Fed continues tightening, the absolute level of interest rates should continue to constrain economic growth. Moreover, Fed rate increases take roughly 12 months to impact the economy, and as such, the tightening of economic conditions will continue regardless of whether the Fed ceases with rate increases. Said differently, the rate increases between June of 2022 and last month have yet to be truly felt by most of the economy.

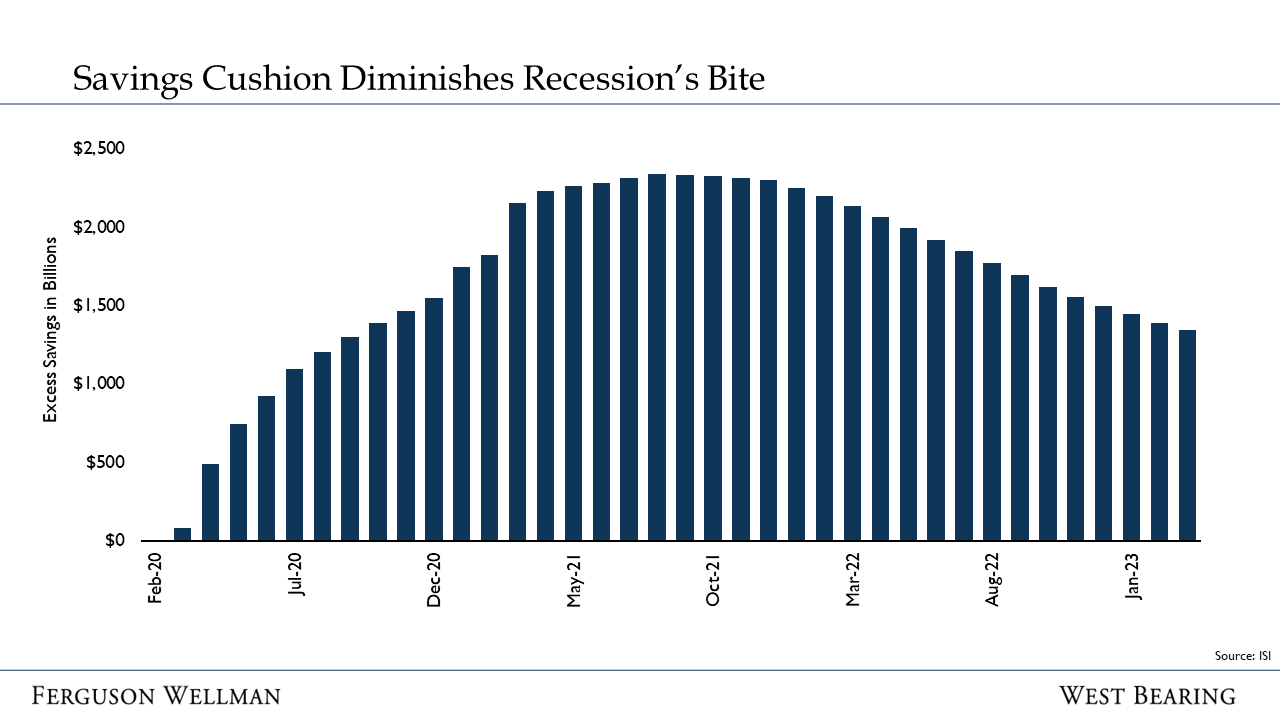

Naturally, this has led many forecasters to predict a recession within the next year. With the market still down about 15% from its peak, a good portion of any potential recession is reflected in stock prices. Our focus goes beyond whether we believe we will have a recession … our work also analyzes the severity of a potential recession. Stress in the housing market, a tenuous geopolitical environment, massive government debt and its ballooning interest rate burden are certainly concerning. On the other hand, the U.S. consumer remains in very good shape. Not only is unemployment at generational lows of 3.4%, but the consumer wallet provides a cushion to weather almost any coming economic storm. Savings accumulated during the pandemic and government intervention in the form of stimulus checks, debt forgiveness and PPP loans have left the consumer with about $1.5 trillion of cumulative excess savings (chart below). These extra savings should enable consumers to continue spending through a potential economic downturn. With consumer spending making up about 70% of the U.S. economy, this is critical in gauging the magnitude of a possible downturn.

Source: ISI

Takeaways for the Week:

Inflation continues to move lower … but remains much too high

The majority of Federal Reserve rate increases are yet to be felt by the economy

An extremely robust U.S. consumer should serve to dampen the impact of a potential economic downturn