by Jason Norris, CFA

Principal

Equity Research and Portfolio Management

While we continue to see a daily deluge of headlines highlighting layoffs in the tech space, the rest of U.S. labor market appears fairly resilient. This morning, the Department of Labor released the monthly jobs report and what was quite unexpected was the gain of over 500,000 new jobs. This brought the unemployment rate down to 3.4%, the lowest since May of 1969. Although this could be viewed as a negative in the context of inflation as it may signal continued strength of the U.S. economy, it also appears that wage growth continues to moderate. The labor market is starting to see wage growth decelerate to roughly 4%, which is music to the Federal Reserve’s ears. More on this later…

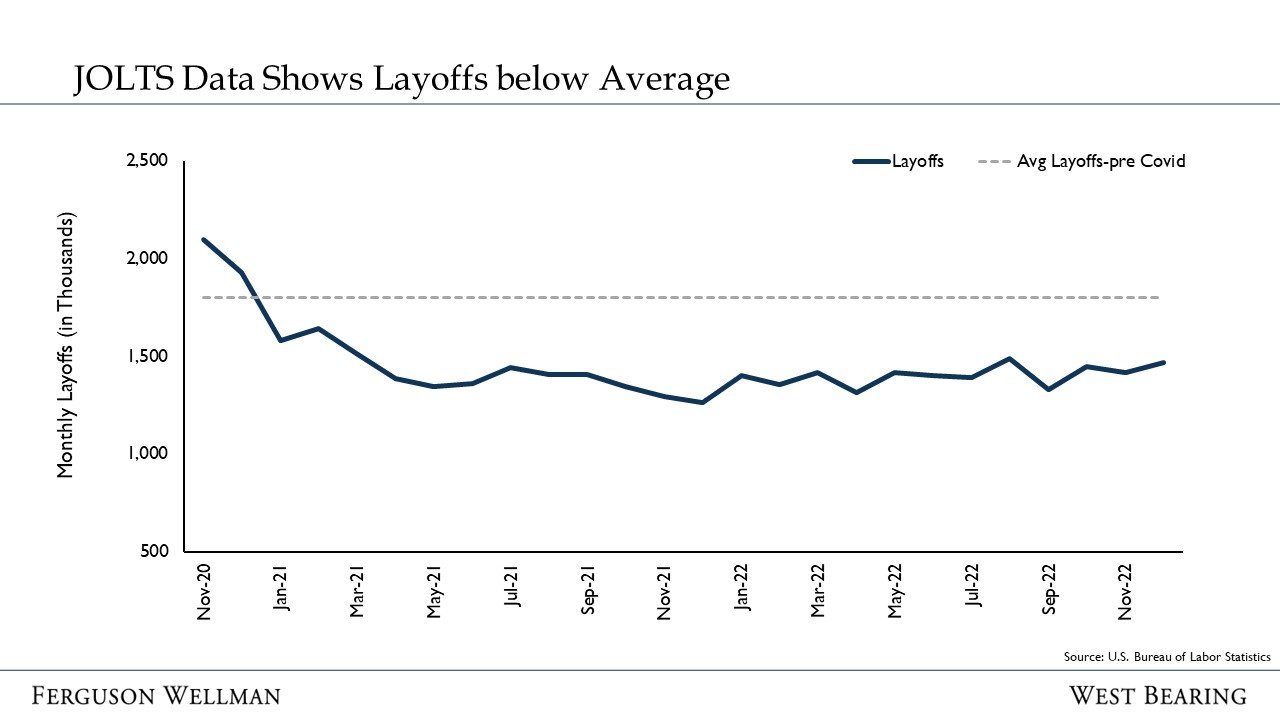

How does this news compare to all the company layoff announcements this quarter? These daily headlines can certainly affect the psyche, there is broader data indicating that these announcements are more “noise” than a signal about the state of the economy. Earlier this week the Bureau of Labor Statistics also released its Job Openings and Labor Turnover Survey (JOLTS), which details movement in the jobs market. While the headline number showed over 11 million job openings, what is often missed is the lack of people being let go from their positions. In the month of December, just under 1.5 million people were laid off from their jobs. While that may sound like a lot, the monthly average from 2012 to 2019 was 1.8 million, as seen in the chart below.

While the “headline” layoff numbers can cause some angst, the data is showing that the U.S. continues to be in a very tight labor market. This does not mean the economy will not continue to slow; however, with a resilient labor market, and easing wage pressures, the Federal Reserve may be engineering a “soft landing” rather than recession. Our 2023 Investment Outlook referenced a very mild recession, if any. The recent data continues to confirm that viewpoint.

When Doves Cry

Federal Reserve Chair Jerome Powell’s press conference earlier this week sent a strong signal that interest rate hikes are close to an end. While Chair Powell stated the Fed wasn’t planning to aggressively ease rate hikes after this cycle due to the tight labor market and other economic indicators … investors weren’t buying it. The key catalyst that led to the equity rally on Wednesday and Thursday was Powell’s comments that “disinflation” was here.

Therefore, as of today, investors anticipate one more rate increase in March and then a cut by December. The end is in sight.

Beginnings

With 2022 being one of the worst years for investors in both stocks and bonds, 2023 looks to be starting on the right foot. The S&P 500 finished the month of January up over 6%, led higher by the beaten down names of 2022; specifically technology communication stocks. Defensive areas of the market finished January with a negative sign.

Historically, January can be a bellwether for market performance for the year. Since 1950, when stocks finished the month of January higher, 86% of the time they continued to rally throughout the year. The average gain for the remaining 11 months is roughly 12%. This is 50% higher than the overall average return from February 1 to December 31.

While there is still uncertainty on the overall effects of higher interest rates on economic growth and corporate profits, the next few months will be very telling how much of a headwind companies and investors will be facing. History says that this year’s January strength is just a start to continued gains.

Takeaways for the Week

Corporate earnings continue to come in ahead of estimates; however, expectations for 2023 profits have been dampened due to a slowing economy

Stocks finished up roughly 2% as investors viewed recent economic and corporate data as a bullish signal