by Blaine Dickason

Senior Vice President

Trading and Fixed Income Portfolio Management

This past week’s plethora of economic and market-moving data, especially regarding interest rates, has served to highlight the sometimes-conflicting forces at work in the U.S. economy. While the Federal Reserve maintained their interest rate policy at 22-year highs on Wednesday, we also learned the U.S. government’s budget deficit grew to nearly $2 trillion in their most recent fiscal year. One arm of the federal government is trying to slow the pace of economic growth to contain inflation, while the other is stimulating the economy by spending significantly more than the current tax dollars they receive. This is the equivalent of driving down the road pressing on both the brakes and the gas pedal simultaneously!

The U.S. Economy is Slowing After a Torrid Third Quarter

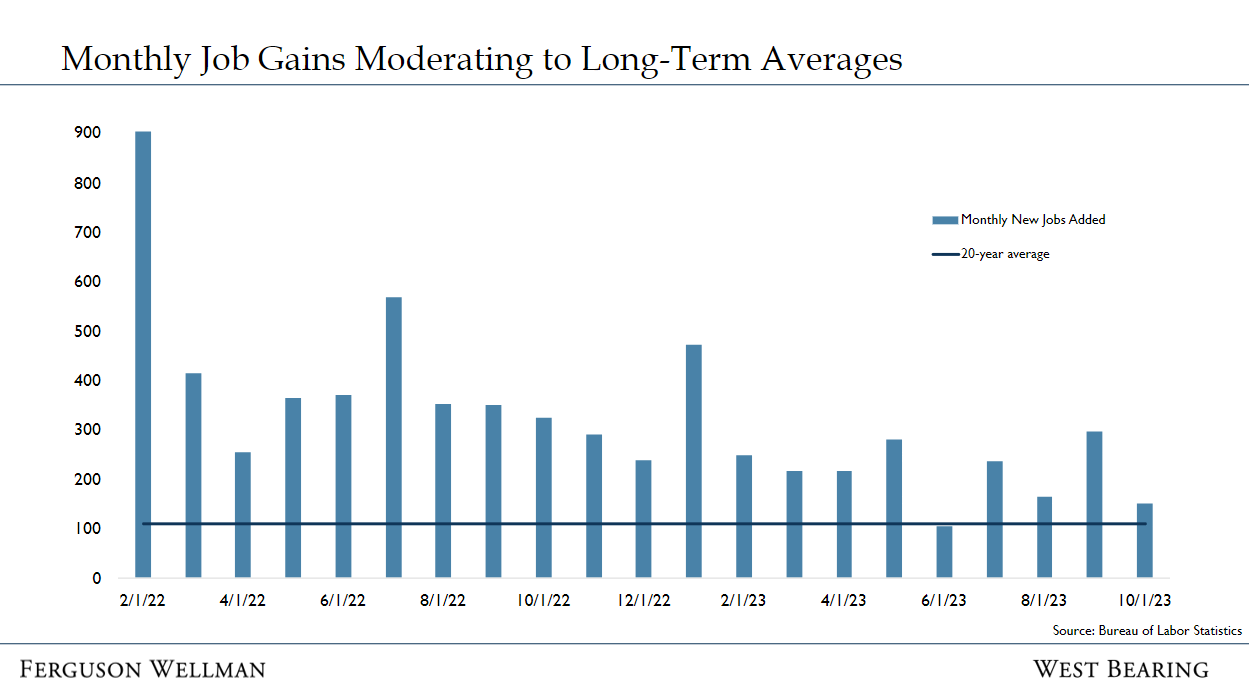

Last week we received confirmation of the economic strength seen this summer as third quarter GDP was +4.9% versus the prior year. This momentum was a major driver behind higher interest rates and bond market weakness as markets contended with the prospect of a ‘higher-for-longer’ interest rate policy from the Federal Reserve. A weaker report from the manufacturing sector this week, coupled with today’s below-expectation employment report of +150,000 jobs and a 3.9% unemployment rate, provided evidence of slowing momentum in the economy. Earlier this year, we highlighted that the labor market holds the answer to Fed policy. The chart below shows how the slowing of job growth is returning us to our long-term average. More significantly, it is likely a sign that the current restrictive interest rate environment may finally be bringing markets back to an equilibrium level consistent with the Federal Reserve’s 2% interest rate target.

Deficits Are Stimulus

This week, the U.S. Treasury announced that they anticipate borrowing nearly $1.6 trillion over the next six months - this exemplifies the level of fiscal stimulus still being administered to the U.S. economy. The current magnitude of deficit spending can be considered extraordinary for an economy considered to be at full employment. It is reasonable to presume that much of the restrictive policy from the Federal Reserve is directly countering the stimulative effects implicit to these elevated levels of borrowing and spending.

Stock and Bond Markets Embrace No More Hikes

We have expressed for several months that we believe the Federal Reserve is done with their rate hikes this cycle, and Fed Chair Jerome Powell’s press conference on Wednesday was embraced by financial markets for similar reasons. The significant resilience of the U.S. economy had admittedly flummoxed bond investors this year and steadily higher interest rates had put the U.S. bond market at risk for an unprecedented third consecutive year of negative returns.

Both stock and bond markets had negative performance in the third quarter as the prospect of higher-for-longer interest rates put pressure on market valuations. This week’s data releases, along with Fed Chair Powell’s commentary on the labor market and supply-side of the economy coming back into balance, suggest their current restrictive stance on interest rates may not need to continue at current levels. In other words, markets are picking up that the Fed may not need as much pressure on the ‘brakes’ of the U.S. economy and have rallied accordingly.

Takeaways for the Week

U.S. labor productivity grew at +4.7% in the third quarter, the highest levels since 2020, and well above the +1.6% trailing 20-year average.

Over 80% of the S&P 500 has now reported Q3 earnings. Reported sales growth of +1.8% and earnings growth of +2.5% have both been above expectations entering earnings season.