by Blaine Dickason

Senior Vice President, Trading and Fixed Income Portfolio Management

The hotter-than-expected August Consumer Price Index (CPI) data released this week was a shock to financial markets, as other recent measures had suggested a moderation of inflationary pressures. While there is clear evidence that energy and gasoline costs have declined since earlier this summer, broad-based increases observed in major categories like food (14% of CPI) and shelter (32% of CPI) reinforce that significant and upward price momentum remains intact.

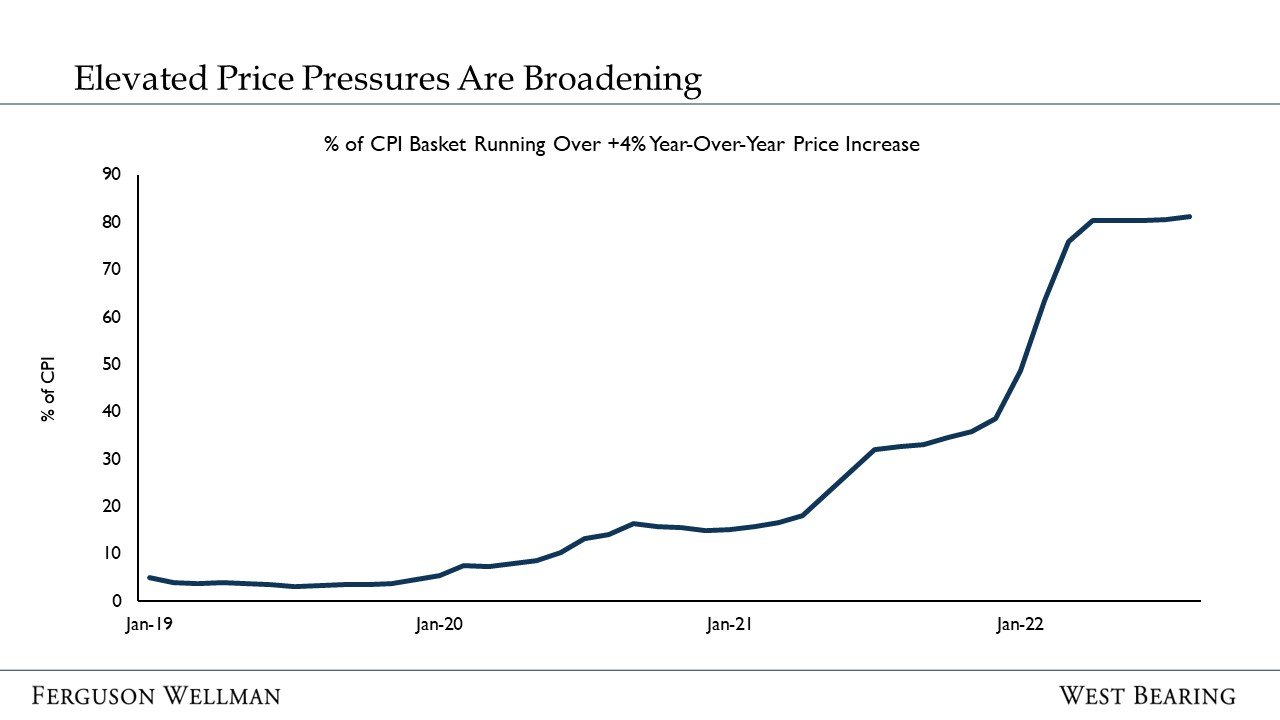

Early in this economic recovery, inflation was driven by a few idiosyncratic and pandemic-specific categories like used cars and car rentals. As the chart below indicates, over 80% of the composition of the consumer basket measured by CPI is now running at double the Federal Reserve’s 2% inflation target. This week’s report further confirmed that the Federal Reserve still has their work cut out for them.

Source: Federal Reserve

FOMC Meeting Next Week

Imagine applying the brakes in your car and it taking six to eighteen months to slow down. In 1961, Economist Milton Friedman identified the “long and variable” lags inherent to changing interest rates. This is the conundrum the Federal Reserve is currently facing as it judges the appropriate path for interest rates. Next week’s Federal Open Market Committee meeting will likely deliver another +0.75% hike in interest rates and be accompanied by projections for additional increases through the end of the year. As of this writing, markets are pricing in a policy rate of over 4% by year end compared to the current upper bound of 2.5%.

“While higher interest rates, slower growth and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.”

- Jerome Powell, August 26, 2022

Federal Reserve Chair Powell was correct in his prediction for pain delivered at Jackson Hole last month. Tuesday’s 4%+ decline in the S&P 500 index was a direct response to this week’s CPI report and the perception that a more aggressive response by the Fed will be forthcoming. The challenge for Chair Powell and the Federal Reserve this fall will be to deliver a response that neither overreacts to recent data nor underweights the lag times associated with their policy changes.

Takeaways for the Week

The estimate for the 2023 cost-of-living adjustment (COLA) for Social Security now stand at +8.7%, according to the non-partisan Senior Citizens League. The actual adjustment will be reported by the Social Security Administration on October 13, after the September CPI report

This week, Freddie Mac reported that the average 30-year fixed-rate mortgage exceeded 6.0% for the first time since 2008