by Peter Jones, CFA

Senior Vice President, Equity Research and Portfolio Management

U.S. markets have begun the third quarter with positive returns, erasing some of the losses that occurred in the first half of the year. Specifically, the market has recouped about one-fourth of the year-to-date loss in stock prices. It remains to be seen how long this rally will last, but there have been a couple of positive developments, despite a palpable slowing in economic growth.

First, there are signs that inflation is cooling. While inflation is still much too high, forward indicators point towards moderation. For example, average prices at the pump have now declined for 37 consecutive days. Copper prices have fallen below their January 1 levels. Anecdotally, it appears retailers have begun to discount inventory. Truck and rail companies are signaling that freight lanes are opening after more than a year of severe supply chain challenges.

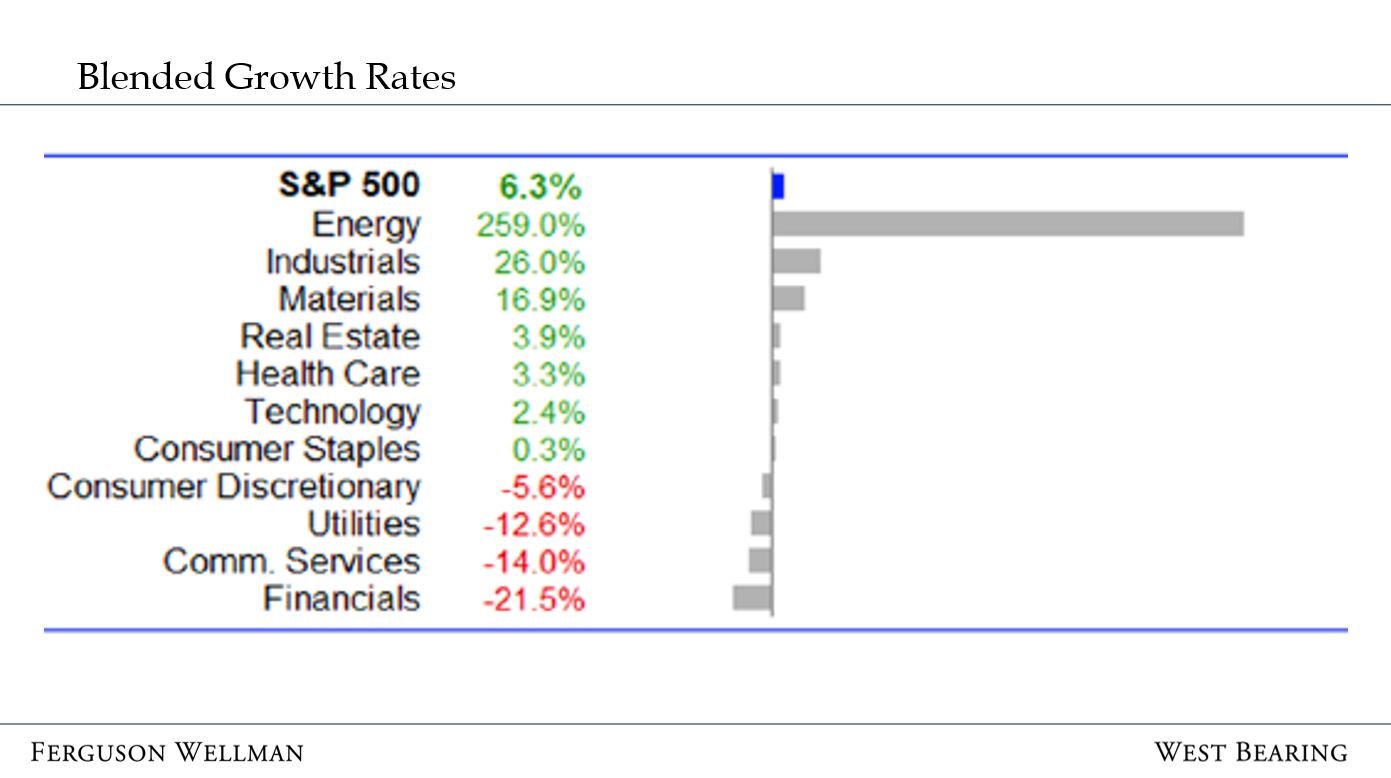

Next, corporate earnings for the second quarter began in earnest last week. With about 20% of the S&P 500 companies already having reported their earnings, results have come in better than expected. Specifically, of those that have reported, 78% have exceeded expectations with profit outperformance sitting at 5%. Given clear indications of a slowing economy and material headwinds to foreign sales from a stronger dollar, these upside surprises from corporations have been a welcome development. Corporate earnings growth has, unsurprisingly, been led by commodity and manufacturing companies. To that end, three energy companies have reported so far … with an average profit growth rate of 259%. Industrial companies have reported 26% profit growth and materials companies 17%. While we expect profit growth to moderate or even decline in the coming quarters, demand has clearly been strong for the first half of the year. While it is still early in the earnings season, blended profit growth currently sits at a solid 6.3% compared to the same period a year ago.

Source: Eikon

Perhaps most important has been the qualitative commentary from large domestic banks, indicating that the consumer remains in fantastic shape. Bank CEOs were in unison in their declaration that consumer health suggests that we are not in a recession. JP Morgan CEO Jamie Dimon commented that consumer spending, and the consumer’s ability to spend, remains robust. Citigroup CEO Jane Fraser remarked that it is an unusual environment where you have recessionary concern alongside a very strong consumer. Bank of America CEO Brian Moynihan said that, in fact, consumer credit quality has actually improved compared to the beginning of the year.

The U.S. consumer is the single most important variable when judging the health of the U.S. economy, as consumer spending accounts for roughly three quarters of domestic output. As such, so long as the consumer has a job, can continue spending and does not have significant leverage, the economy should be in good shape.

On the flip side, the stock market, consumer confidence, manufacturing surveys, inflation data and the European energy crisis all suggest a severe slowing in the economy, if not an outright recession. This begs the question … what would a near term recession look like? In our view, a near-term recession is likely to be benign. The reason? The consumer. As indicated in the chart below, aggregate checking and savings account levels sit at very high levels. Deferred spending during the pandemic, tremendous levels of government stimulus and a strong labor market have left consumer balance sheets in fantastic shape. Recessions are often severe when there is a credit crunch … consumers can’t pay their debt and stop spending, bank capital erodes with accelerating defaults on the loans they have extended. With unemployment at 3.6%, bank health proving resilient and consumers flush with cash, it is unlikely we will see a debt crisis this time around.

Source: Federal Reserve

To be clear, inflation is much too high and economic growth is slowing with corporate profits soon to follow. However, with the market down ~15% for the year and at one point down ~24%, arguably most, if not all, of the bad news is already reflected in stock prices. With that in mind, whether we have a recession in the U.S. over the next year or not, we are unlikely to reduce our allocation to equity asset classes.

Takeaways for the Week:

Leading indicators of inflation and the early part of second quarter earnings season have been encouraging

Consumer strength suggests that if the U.S. economy slips into recession, it is likely to be shallow

The stock market has already priced in a lot of bad news. As such, even if we have a recession, we would not advocate a change in asset allocation