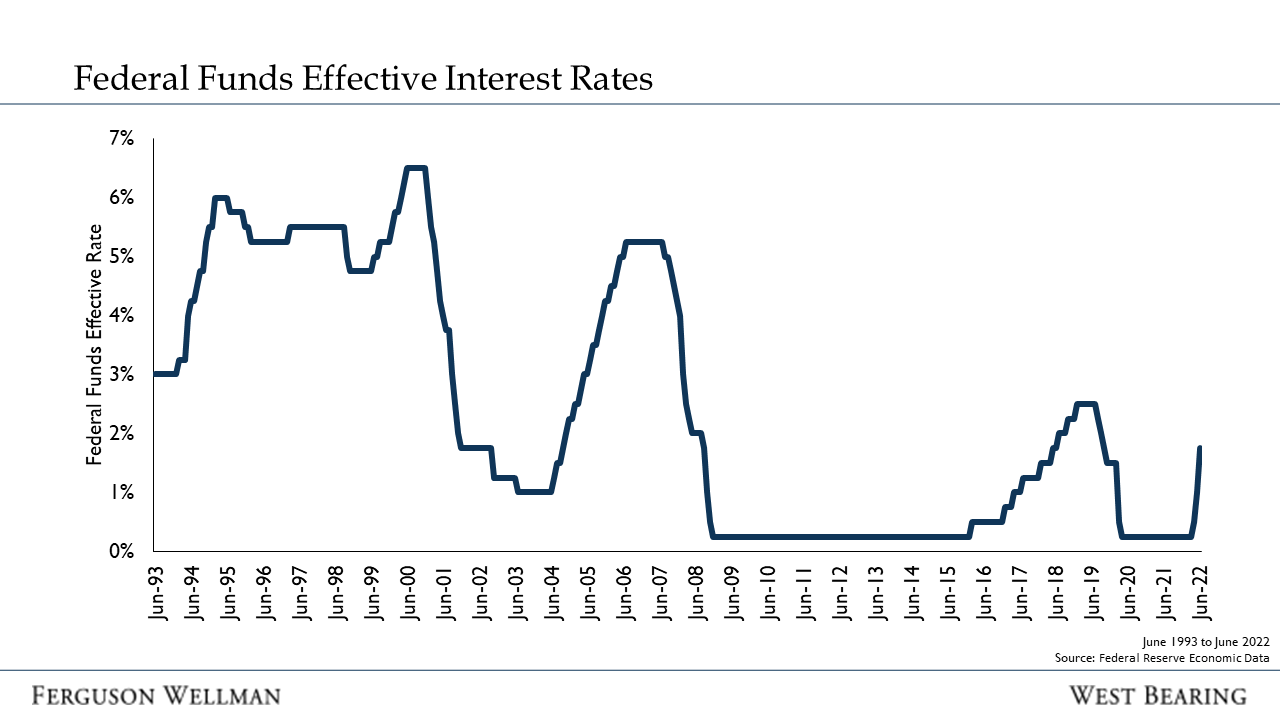

Earlier this week, the Federal Reserve raised its benchmark interest rate to 1.75%, an increase of 0.75% from the previous rate. This increase, the largest since 1994, was considered a possibility, albeit one the market hadn’t fully discounted. However, unlike 1994, interest rates have been rising throughout the year in anticipation of just such an event, resulting in minimal market movement.

In 1994, the Fed raised rates from 3.0% to 6.0% in a single year, creating a short and aggressive tightening cycle. That cycle, dubbed the “Great Bond Massacre,” caught investors off-guard. The yield on the bond index went from 5.8% to 8.2%, resulting in a 3%-to-4% loss in the bond market. Fortunately, this did not result in a recession, a common occurrence during rate hiking cycles. However, while equity investors experienced a small nominal return, the downside in 1994 was only 8%.

Source: Federal Reserve Economic Data

Today, the Federal Reserve is on the same pace as 1994. Federal Funds started the year at 0.25% and current rate expectations end the year around 3.0%. Unfortunately, this most recent rate increase will likely be more impactful than 28 years ago, as today’s bond investors are worse off due to significant price declines and the additional time needed for investors to recoup their losses.

In 1994, the yield on the U.S. Aggregate Bond Index (AGG), began the year at roughly 5.8% and by the end had increased to 8.2%. While the rate increase was a headwind, the high coupons the bonds were paying resulted in a quicker recovery period. For example, at the end of 1994, if there was no change in interest rates, your expected future return on bonds would be 8.2%. In 2022, the yield on the AGG began the year at 1.8% — today, it’s just under 4%. Therefore, if rates don’t increase, an investor’s expected return would be 4% per year. Unfortunately, losses in the bond market are close to 12% this year.

Chairman Jerome Powell stated that one area the Fed needed to focus on is the “too tight” job market, which is highlighted in the chart below. Fortunately, this wide spread between openings and seekers allows the Federal Reserve some flexibility to be aggressive with interest rates.

Source: Federal Reserve Economic Data

Takeaways for the Week

Stocks entered bear market territory falling 5%, down 22% for the year

While rates were volatile, the yield on the 10-year U.S. Treasury ended the week roughly unchanged at 3.2%

“This is a financial crisis [market] in search of a crisis.”