Both fear and greed were on full display this week as the Federal Reserve raised the federal funds rate 50 basis points and announced that additional 50 basis point increases would be needed in the future. Fed Chairman Jerome Powell stated that the U.S. government would stop buying as many bonds on the open market in the coming months, effectively shrinking the Fed’s balance sheet and removing some liquidity from the system.

That message appeared to be well received Wednesday afternoon as the S&P 500 rallied 3% that day. Less than 24 hours later, though, the S&P 500 dropped more than 3.6%, without any major news to blame. The market appears to be caught in a classic tug-of-war between the “too hot” economy and the fear that the necessary Fed “cool off” might slow the economy too much, causing a recession. But to us, this is more reminiscent of a mid-cycle slowdown than a recession. A mid-cycle slowdown occurs when the economy slows down from strong growth to subpar or “dangerously close to zero” growth.

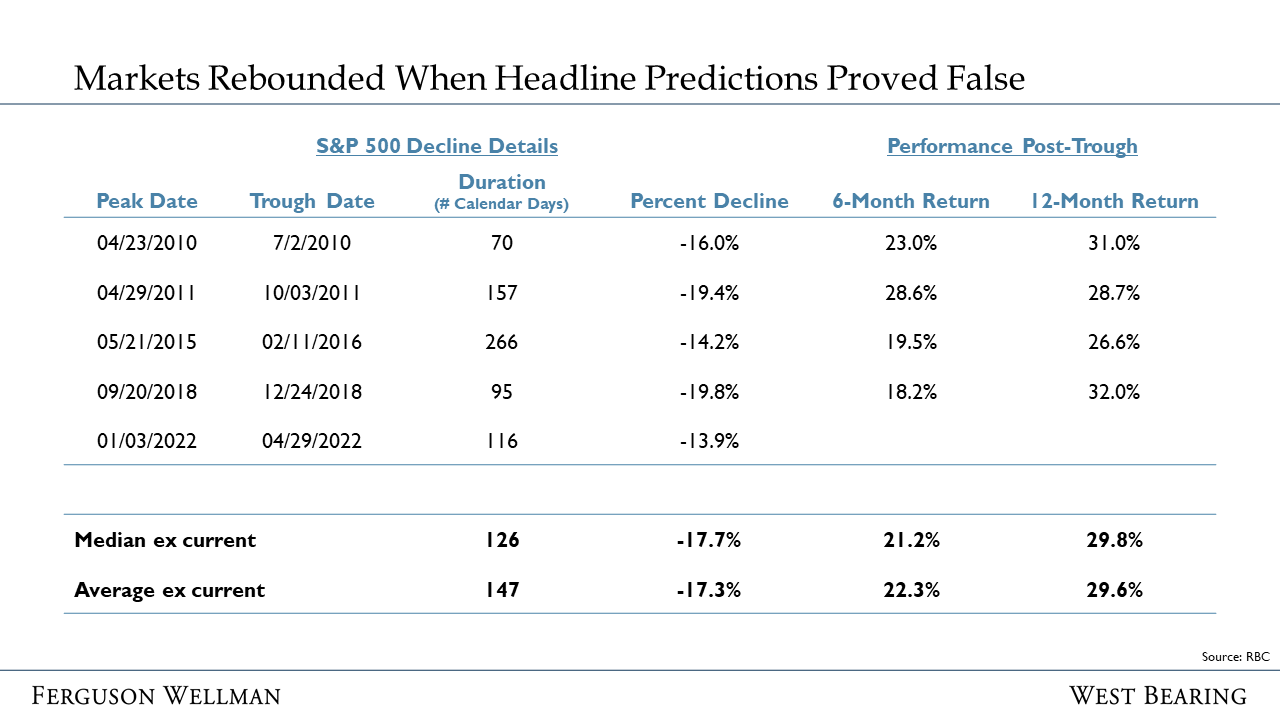

Several slowdowns occurred between the Great Financial Crisis and our most recent recession in 2020. During each slowdown, financial headlines often declared that the next recession was around the corner, however, those predictions didn’t materialize and the market rebounded as seen in the table below. It’s also important to note that even though we didn’t go into recession, this didn’t stop the stock market from dropping precipitously during those episodes.

Source: RBC

Who’s Buying Stocks Right Now?

“It is wise for investors to be fearful when others are greedy, and greedy when others are fearful.”

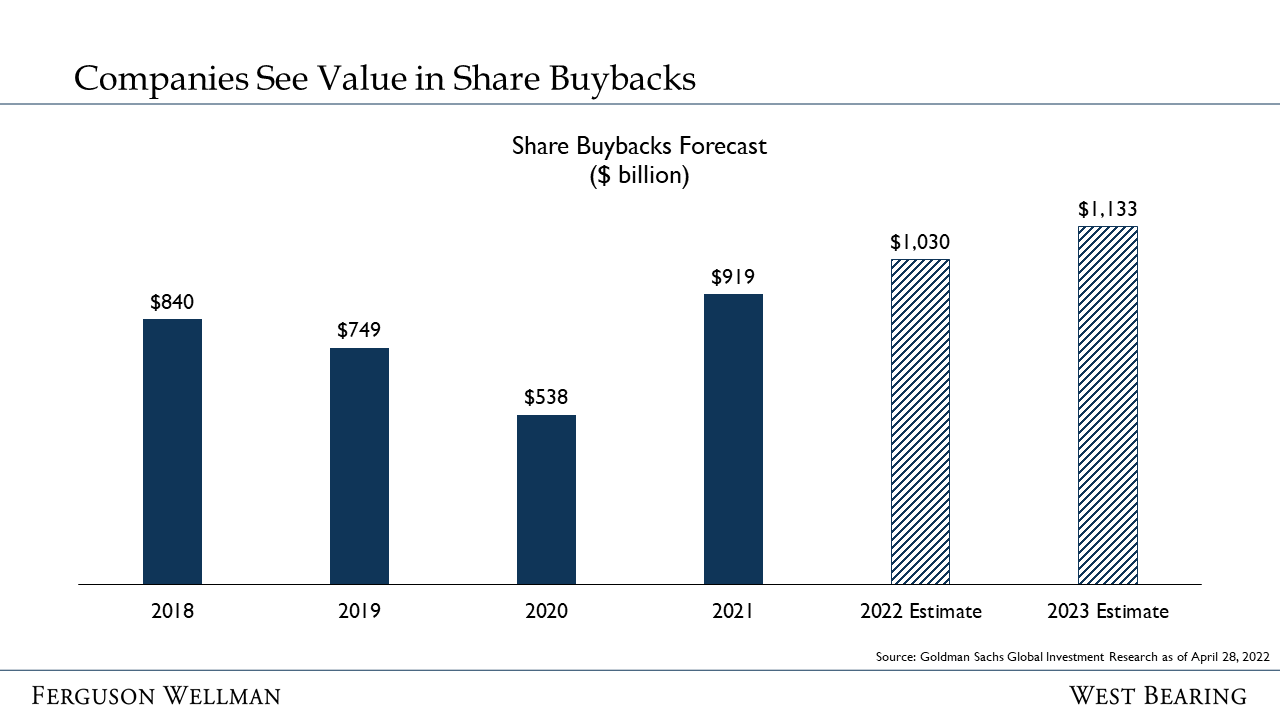

It was no surprise to us that Warren Buffett’s Berkshire Hathaway put to work $51 billion of the company’s $147 billion cash hoard in the first quarter of 2022. In a classic contrarian move as others were selling, Warren Buffet was finding value in the stock market. They also repurchased $3.2 billion of Berkshire Hathaway stock during the quarter, obviously seeing value in their own company. That is consistent with what we are hearing from other CEOs in this environment. With earnings hitting record levels, CEOs are using their cash to increase investments in automation, increase dividends and increase share repurchases. In fact, Goldman Sachs is projecting that companies will repurchase $1 trillion of their own stock in 2022, an increase of 12% over 2021.

Source: Goldman Sachs Global Investment Research

Week in Review and our Takeaways:

Investors are nervous that to fight inflation, the Federal Reserve will tighten monetary policy to the point of taking the U.S. economy into recession

Berkshire Hathaway is using this sell-off as an opportunity to snatch up great companies at solid valuations, and many companies are finding value in their own stock