On Monday, we welcomed all employees back to our office after over two years of work-from-home. As most companies might agree, finding a balance between remote and in-office work has been a challenge. However, being at the office with the entire company has been gratifying. And like most companies, we’re not alone in celebrating “coming back” to work – this week, weekly unemployment claims hit its lowest level of 166,000 since the late 1960s. This timely data point shows that people are going back to work.

Back for More

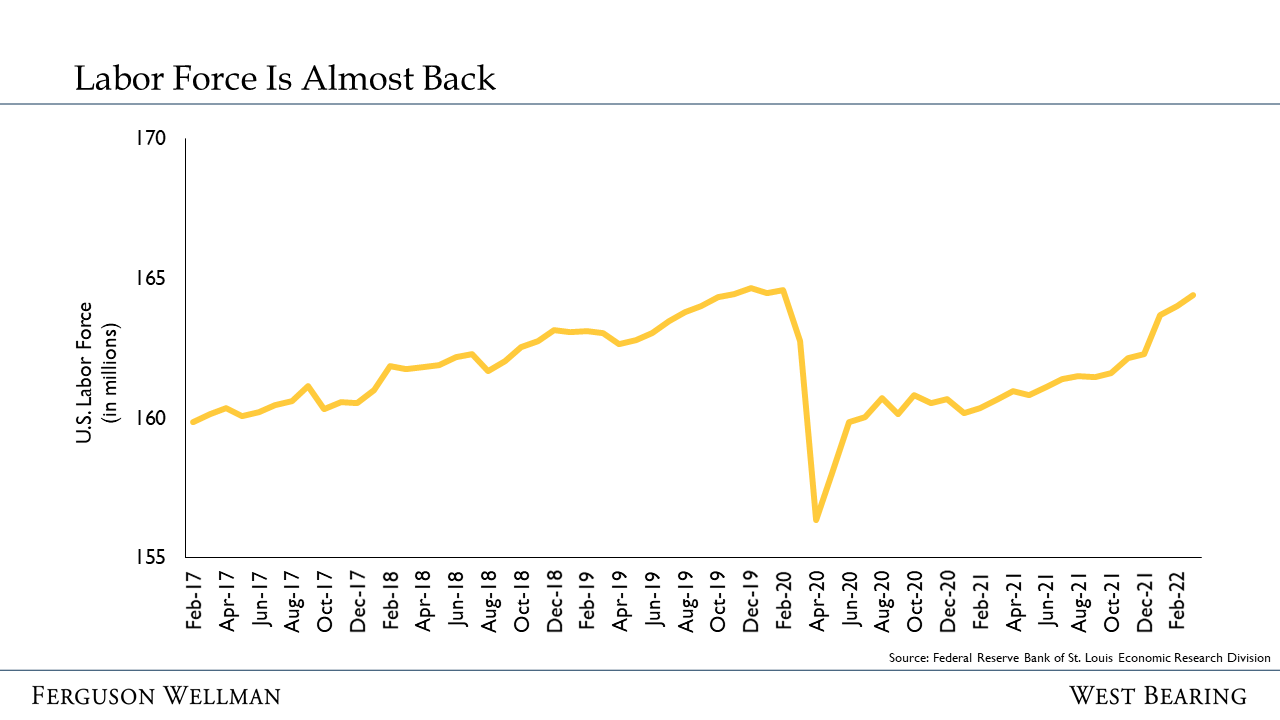

Since the economy began its recovery in the summer of 2020, the market has been in an unprecedented position: the demand for goods was high but labor supply was low. While there were a variety of reasons for this lack of labor participation, we are finally starting to see a change.

Before the pandemic, U.S. job openings were running between six and seven million. With the stimulus-driven recovery, consumer demand grew meaningfully. So much so, businesses couldn’t meet it with the existing workforce and job openings spiked to over 11 million.

Source: Federal Reserve Bank of St. Louis, Economic Research Division

However, unemployment has stabilized over the last several months. In fact, since the calendar moved to 2022, the Federal Reserve noted that job-listing website Indeed.com reported postings are down 10%. Throughout 2021, enhanced unemployment benefits, early retirements and concerns over health and childcare kept people from rejoining the workforce. For a brief period, stimulus checks provided a “safety net,” providing economic flexibility for those who received them and allowing them the ability to look for a better-paying job. Recently, as stimulus benefits have ended and health and childcare concerns have been reduced, participation in the work force has seen a steady increase. For the first nine months of 2021, the labor market only grew by 800,000; since September, three million have re-entered the workforce.

Source: Federal Reserve Bank of St. Louis, Economic Research Division

Most notably, women have been key drivers in the improvements made to the labor shortage. For the first nine months of 2021, women’s participation in the workforce had minimal growth. However, over the last six months, 1.1 million women have joined the workforce, reaching levels the U.S. economy has not seen since early 2020. This influx of labor is beginning to ease the strain of the worker shortage, helping to alleviate upward wage pressure, and in turn, inflation.

Source: Federal Reserve Bank of St. Louis, Economic Research Division

This data supports our view of an improving labor market for both workers and employers. Ultimately, the last several months have shown positive changes for the U.S. consumer and economy, leading us to believe there will not be a recession.

Our Takeaways for the Week

Stocks finished 1% lower in another volatile week as investors are still handicapping the effects of rising rates

10-year U.S. Treasury yields hit 2.72%, up 100 basis points from year-end, resulting in the worst bond market since the 1970s