by Joe Herrle, CFA

Vice President, Alternative Assets

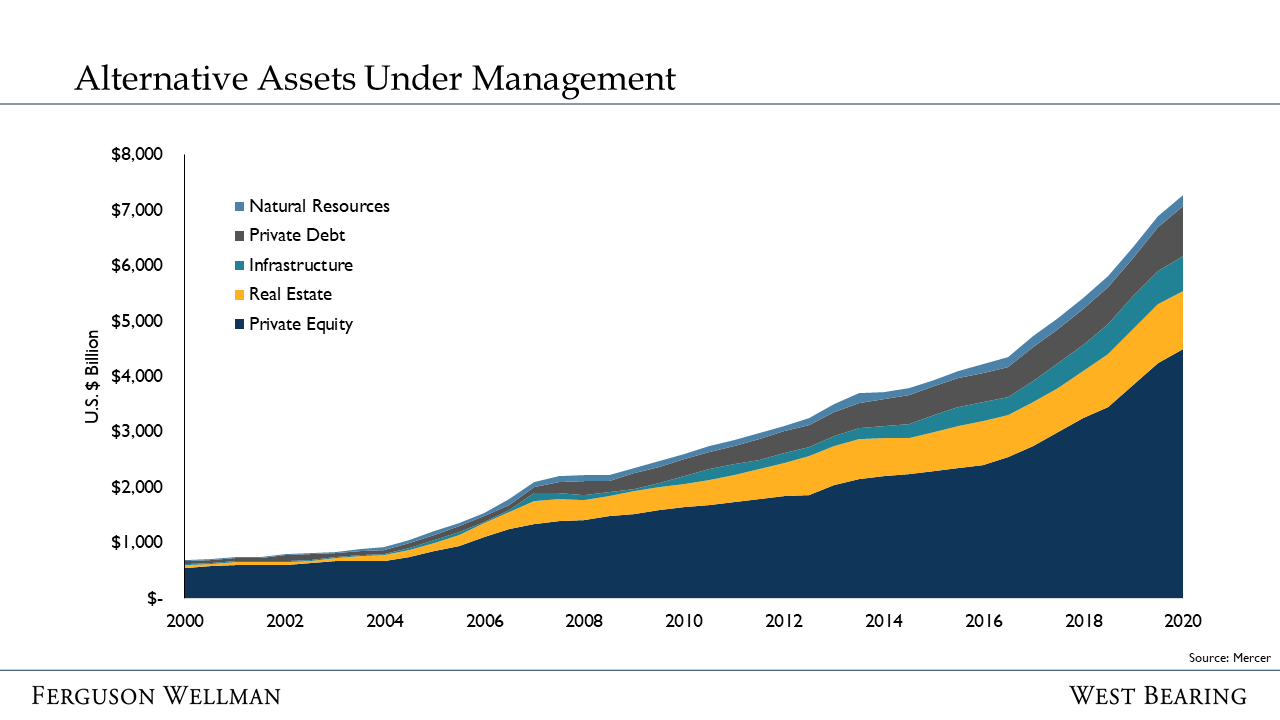

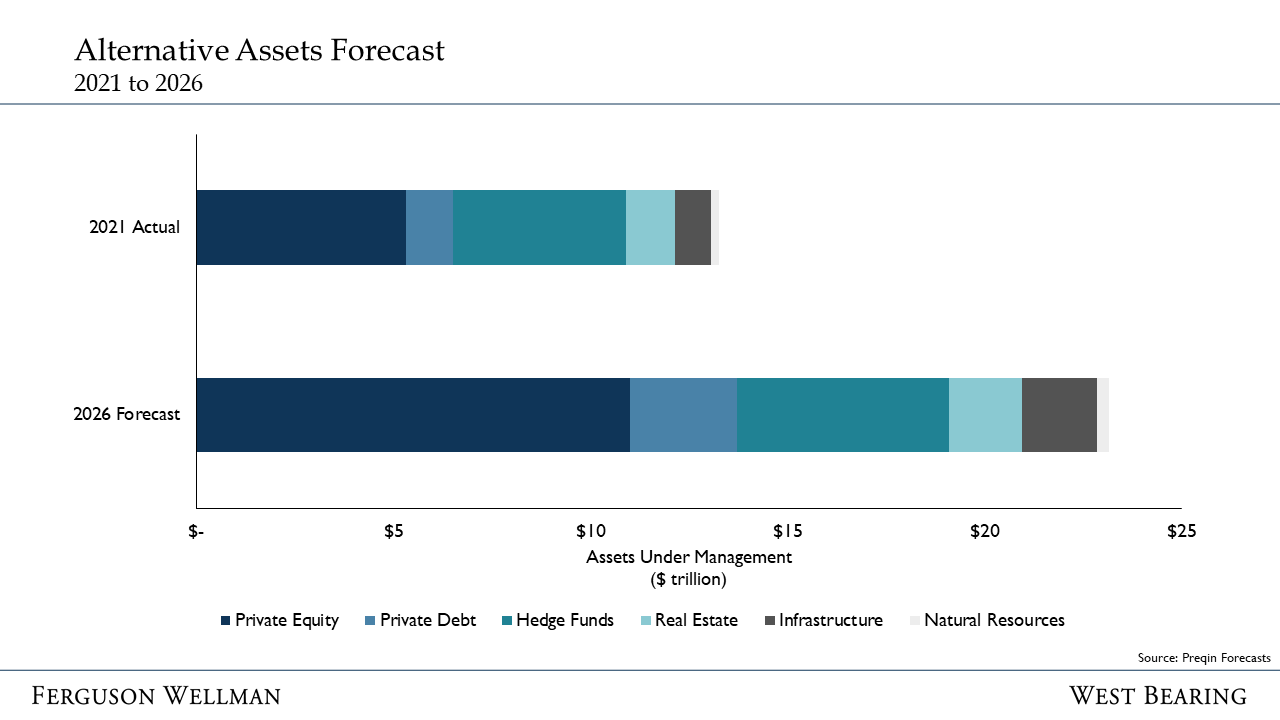

It would appear that the alternative investment industry has the complete focus of the SEC, and it is not hard to see why. Attracted by the high return potential and uncorrelated nature of many alternatives, sophisticated investors from significant pension plans, sovereign wealth funds, family offices and high-net-worth individuals have significantly increased allocations to the asset class over the last few decades. And in 2021, fundraising for alternative assets, including private equity, real assets and private credit, exceeded $1.1 trillion, and total assets under management in alternatives exceeded $9 trillion, according to Moody’s 2022 asset management outlook. And according to Preqin, alternative assets under management are expected to grow to $23.2 trillion in 2026.

Source: Mercer

Source: Preqin Forecasts

Beyond the sheer growth in size recently, alternative asset managers have also grown in their influence and reach. Alternative asset investors play an important role in capital allocation through their ability to lend money and extend credit, but they also influence the operations of major public companies and even impact public policy like climate change initiatives.

Simply put, the alternatives industry has become too big to ignore. This week the SEC proposed sweeping new transparency rules for the alternative investment industry that would require managers to disclose much of what the industry considers to be trade secrets. This comes on the tail of the SEC approving other transparency-related requirements in January of this year. Many alternative investments, like private equity, venture capital, and private real estate, are regulated less than mutual funds. Though they are exempt from reporting many items that a typical mutual fund would need to disclose, they have much tighter restrictions on who can invest. And, as the investor base grows significantly from individual investors as opposed to the historical base of institutional investors, it would appear the SEC wants to increase protections for this investor group.

The primary objective of the SEC is investor protection, no matter the type of investor, and they view these rules as a step in the right direction to protect owners of alternative assets. The new rules would increase transparency to investors about fees and expenses, compensation, preferential fee arrangements for certain investors and fund performance. Also, the SEC is proposing enhanced audit rules and regulations to help prevent conflicts of interest when making investments and certain types of fees. Whether these rules are put into practice or not, the main takeaway is that alternative asset managers have drawn the focus of the SEC, and the attention is not going away soon.

Takeaways for the Week

Inflation, measured by CPI, increased 7.5% year-over-year in January, the fastest rate since 1982

On Friday, the market erased gains made earlier in the week to finish down 1.85%

Alternative asset managers are growing their influence in areas beyond capital formation

Driven by regulatory changes, 2022 will likely be a year of change for the alternative asset class

The increased attention from the SEC is unlikely to have a major impact on the growth of the alternative asset class