by Blaine Dickason

Senior Vice President Trading and Fixed Income Portfolio Management

For much of the prior decade, both savers and bond investors alike tolerated low yields and a modest total return. The Federal Reserve couldn’t achieve liftoff from their near-zero interest rate policy for over six years following the Great Financial Crisis. Their efforts to stimulate the U.S. economy with low rates and quantitative easing achieved about the same level of success as an attempt to ignite a pile of damp newspaper. Bonds’ greatest virtue during that decade may have been to provide a reliably unattractive foil for a strong stock market and expanding price-to-earnings multiples.

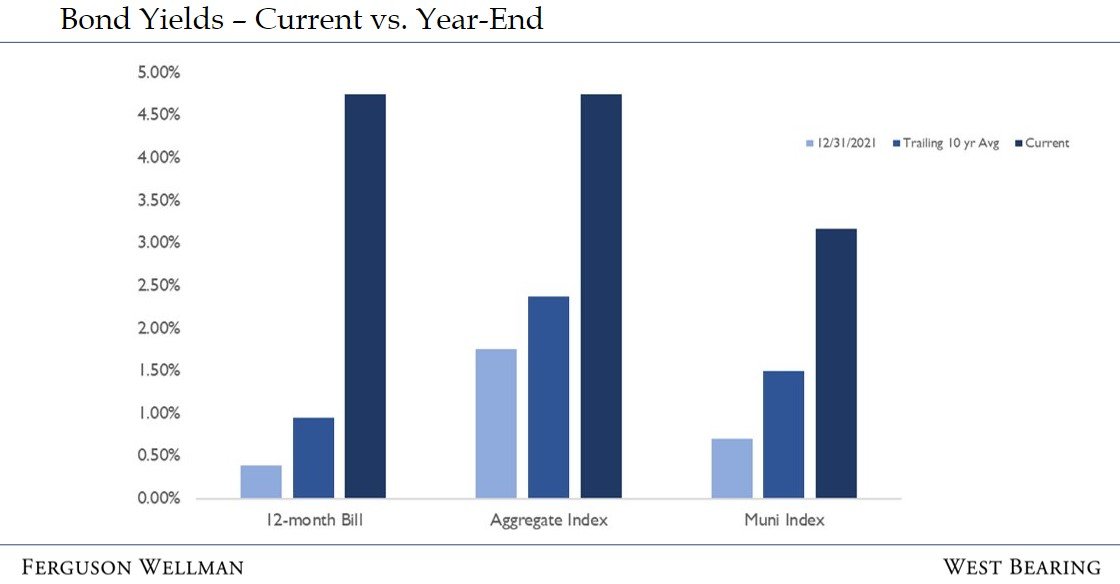

The early months of the pandemic reminded investors of the value of bonds. U.S. Treasuries added much needed ballast and positive performance to portfolios that otherwise suffered from risk-off financial markets. Those bond gains didn’t last long, with U.S. Treasuries quickly becoming the most expensive asset class available to investors. The benchmark 10-year U.S. Treasury offered a mere 0.5% of yield in August of 2020…and that was before inflation took its cut. The dramatic increase in yields and historically poor performance of bonds this year has once again returned relative value to this asset class. The table below highlights not only how much yields have increased this year, but also how much more attractive they are relative to their respective trailing 10-year averages.

Source: Bloomberg

The Federal Reserve has already raised rates by nearly 4% this year, as they deliberately attempt to slow the U.S. economy and put an end to the runaway inflation that we’ve all experienced. At their core, higher interest rates make the cost of money more expensive, which over time, should provide a headwind to aggregate demand across the U.S. economy, restore supply and demand equilibrium and help return inflation towards the Fed’s 2% target. As a result, bond yields have increased to levels not seen since at least 2008 and appear attractive regardless of whether you are an individual considering municipal bonds for your taxable accounts, an institution or non-profit purchasing taxable bonds on behalf of their stakeholders, or a corporate treasurer or controller optimizing their short-term cash management.

As we look ahead to 2023, bonds appear to be well positioned to once again provide both income and insurance in client portfolios. While it’s difficult to handicap the risk of future recessions, it’s important to note that historically, economic slowdowns have typically resulted in bond yields trending lower. In a declining yield environment, bond investors benefit not only from their original yield at purchase, but also from additional price appreciation … a dynamic that’s played out in each of the last four recessions dating back to 1990-1991. For more information on the relationship between bond yields and prices, please watch this excellent video on bond math by my colleague Brad Houle, CFA.

Until very recently, the generally low yields offered by bonds, as well as the relative attractiveness of other asset classes, led us to manage fixed income held in balanced accounts towards the lower end of client guideline ranges. While that positioning has been very appropriate so far this year, the sharp reset of bond yields to higher levels, coupled with the uncertainty associated with the Federal Reserve applying brakes to the economy, lead us to recognize that bonds appear well positioned once again to serve their traditional role of providing both income and safety to our clients.

Takeaways for the Week

Initial jobless claims reported at 240,000 this week hit a three-month high, and continuing claims reported at 1.55 million were the highest level since March of this year.

Mid-December will deliver the next read on inflation and interest rates, with the November Consumer Price Index (CPI) report being released on December 13, and the Federal Reserve’s next meeting and interest rate decision following on December 14.