Matthew Sampson, CFP®

Vice President of Wealth Planning

If you are looking for ways to increase your tax-advantaged retirement savings, it may be worth exploring the concepts of the backdoor Roth, and the newly popular mega-backdoor Roth. If the circumstances fit and the rules are followed, both strategies allow individuals to save money for retirement without ever paying income taxes on the funds again. Yes, you read that right. Read on for an in-depth overview of the nuances of these strategies or contact your portfolio manager to determine if you might be eligible.

Navigating the plethora of options investors have in selecting retirement accounts can be a daunting task. This decision can become even more convoluted when determining whether to pay tax now (after-tax or Roth contribution) or upon withdrawal (pre-tax contribution). Making an after-tax contribution means you will have a tax-free distribution in retirement, assuming all requirements are met. The inverse is true for pre-tax contributions. Strategically funding the various retirement buckets available to you provides an excellent hedge against variability between current and future tax rates. As the saying goes, the IRS will always get their share, it is just a matter of … when. Understandably so, this decision tree can quickly become onerous for an investor. Add to the mix various eligibility requirements and you have quite the puzzle on your hands. Enter the backdoor entry points to tax-free retirement savings afforded by Roth plans.

The Roth IRA was introduced under the Taxpayer Relief Act of 1997 and is named for its chief legislative sponsor, Senator William Roth of Delaware. In exchange for giving up a current income-tax deduction potentially afforded by a traditional IRA, investors contributing to a Roth IRA do so with after-tax dollars. Assuming all distribution requirements are met, withdrawals of principal and capital appreciation from Roth IRAs are tax-free; a lucrative benefit to individuals building their retirement plans in the higher tax environment we are approaching. Unfortunately, the decision tree does not end there as direct contributions to Roth IRAs are subject to income eligibility requirements. For tax year 2021, single taxpayers with a modified adjusted gross income (MAGI) in excess of $140,000, and married taxpayers in excess of $208,000 are completely phased out from directly contributing to a Roth IRA.

Backdoor Roth

Enter the backdoor Roth. So long as you have earned income, there are no maximum income thresholds in order to contribute to a traditional IRA. Furthermore, if you are married and your spouse does not have earned income, you can make a spousal IRA contribution effectively doubling the amount. Contributions to traditional IRAs are either tax-deductible or non-deductible. The deductibility of a traditional IRA contribution is determined by two components: 1) Are you an active participant in an employer-sponsored retirement plan? 2) Does your MAGI exceed $76,000 as a single filer, or $125,000 as married filing jointly? If the answer to both of these questions is yes, you are not eligible to make a tax-deductible traditional IRA contribution. While on the surface this may not seem beneficial, it is the exact formula necessary to effectively deploy the backdoor Roth.

A non-deductible IRA contribution is made with after-tax dollars, meaning that the contribution has basis equal to its value. In this scenario, you can convert the after-tax contribution to Roth with no additional tax due, assuming there was no growth between contribution and conversion. There are a few key components to be cognizant of. If you have a pre-tax IRA account, you will need to be mindful of the IRA aggregation rules. Investors are prevented from cherry picking their non-deductible IRA contributions in a Roth conversion when they also have pre-tax IRA dollars. You will only be able to convert a portion of the after-tax amount. Fortunately, there are a few strategies around this. If you are still employed and your employer retirement plan allows for reverse rollovers (IRA to a qualified plan) then you can effectively sidestep the IRA aggregation rules. Qualified plans are not included in the IRA aggregation test. Secondly, if you have a smaller pre-tax IRA balance and would like to boost your Roth balances through the backdoor, it may be worthwhile converting the entire balance of your pre-tax IRA to Roth. This may seem obvious at this point, but if you are already retired and have a large pre-tax IRA the backdoor Roth strategy will be difficult to implement. Those who stand to benefit most are investors with the lion’s share of their retirement savings in qualified plans, and who earn more than the Roth IRA contribution limits.

Mega Backdoor Roth

The good news is an even more attractive opportunity exists for those able to make after-tax contributions to their 401(k) plans. This often-overlooked strategy is referred to as the “mega-backdoor Roth” due to the much larger amount investors can direct toward a Roth. For this strategy to work it is critical that your qualified plan allows after-tax contributions. Not all qualified plans allow after-tax contributions, but numbers are steadily climbing. According to Vanguard, about 40% of their 4.7 million 401(k) participants are eligible to make after-tax contributions. To illustrate the underutilized nature of the strategy, only 10% of the eligible participants have made after-tax contributions. Fidelity reports even higher eligibility for after-tax contributions at 90% of plan participants. [1]

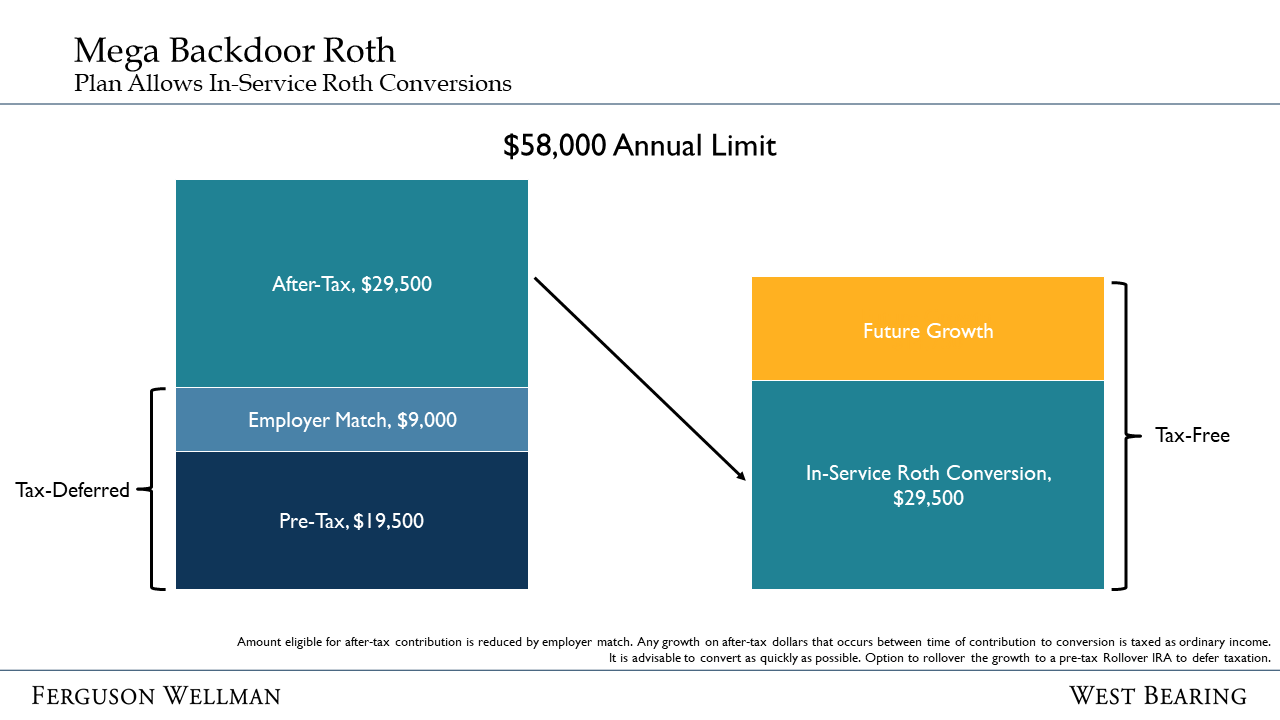

Now for the numbers. The maximum that can be contributed to a qualified plan in 2021 is $58,000. This comprises pre-tax or Roth contributions, employer match, employer profit-sharing contributions and after-tax contributions, if allowed. Below, we provide an illustration of the amount an investor could hypothetically contribute after-tax assuming they maximized their $19,500 401(k) contribution and received a $9,000 employer match.

For those looking for ways to super charge their retirement savings in a tax-free manner, this is a massive amount to contribute on an annual basis. It is important to note that the larger the employer match you receive, the lower the amount you can contribute after-tax. This is of course an excellent “conundrum” to find yourself in. From a logistical standpoint, once you make the after-tax contribution it is advisable to convert the dollars to Roth as quickly as possible. The main reason for this is to avoid any additional taxation on capital appreciation. If your after-tax contributions grow inside your employer plan prior to converting to Roth you will pay ordinary income tax on the gain. You do have the option of carving out the growth and rolling it to a pre-tax IRA, but the optimal solution is for the growth to occur completely inside the Roth.

The final component within the mega-backdoor Roth is how you go about converting the dollars to Roth. If your plan allows in-service Roth conversions, then it is likely easiest for you to convert the after-tax dollars within your plan. If your plan does not allow this, then your best bet is to perform an in-service rollover to a Roth IRA. Keep in mind though that most plans maintain an age requirement of 59.5 for existing employees to perform an in-service rollover, although some are now allowing plan participants under 59.5 to roll out only their after-tax dollars. As the mega-backdoor Roth grows in popularity, custodians are introducing features to simplify the process such as automatically converting after-tax contributions to Roth. A welcome addition to a sometimes onerous process.

At this point, you may be running some quick calculations to estimate the end-benefit the mega-backdoor strategy could provide to your portfolio. Let us quickly walk through a case study comparing saving in a taxable account versus a tax-free Roth account through utilization of the mega-backdoor. Since dollars going into a taxable account and a Roth are both after-tax, this exercise showcases the power of the tax shield afforded by the Roth. Below, we assume an investor contributes $29,500 annually for a period of 20 years and earns a modest pre-tax return of 5.79%. For the taxable account, we assume a Federal ordinary income tax rate of 37% and a Federal long-term capital gains rate of 23.8%. We omit state taxes from this calculation. In the final year of contribution (year 20) the taxable account has amassed a balance of $989,279 while the Roth has grown to $1,122,820. Due to the tax-sheltered nature of the Roth its value has grown to be 13.5% higher than the taxable account by year 20.

Source: Money Guide Elite

The story does not end there as the Roth continues to shine by providing tax-free qualified distributions in retirement. Finally, for those contemplating their estate planning objectives, Roth IRAs are amongst the most compelling wealth transfer vehicles as they are not exposed to required minimum distributions during your lifetime and maintain their tax-free status for a period of 10 years once inherited by your heirs.

In summary, for those looking to capitalize on building a tax-free bucket of assets, the backdoor and mega-backdoor Roth strategies offer incredible benefits to investors who are privy to the nuance and moving parts. Please reach out to your portfolio manager to further discuss this topic and your overall wealth management goals.

[1] Anne Tergesen, “A Little-Known ‘Back Door’ Trick for Boosting Your Rock Contributions,” Wall Street Journal, July 9, 2021.

Ferguson Wellman and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.