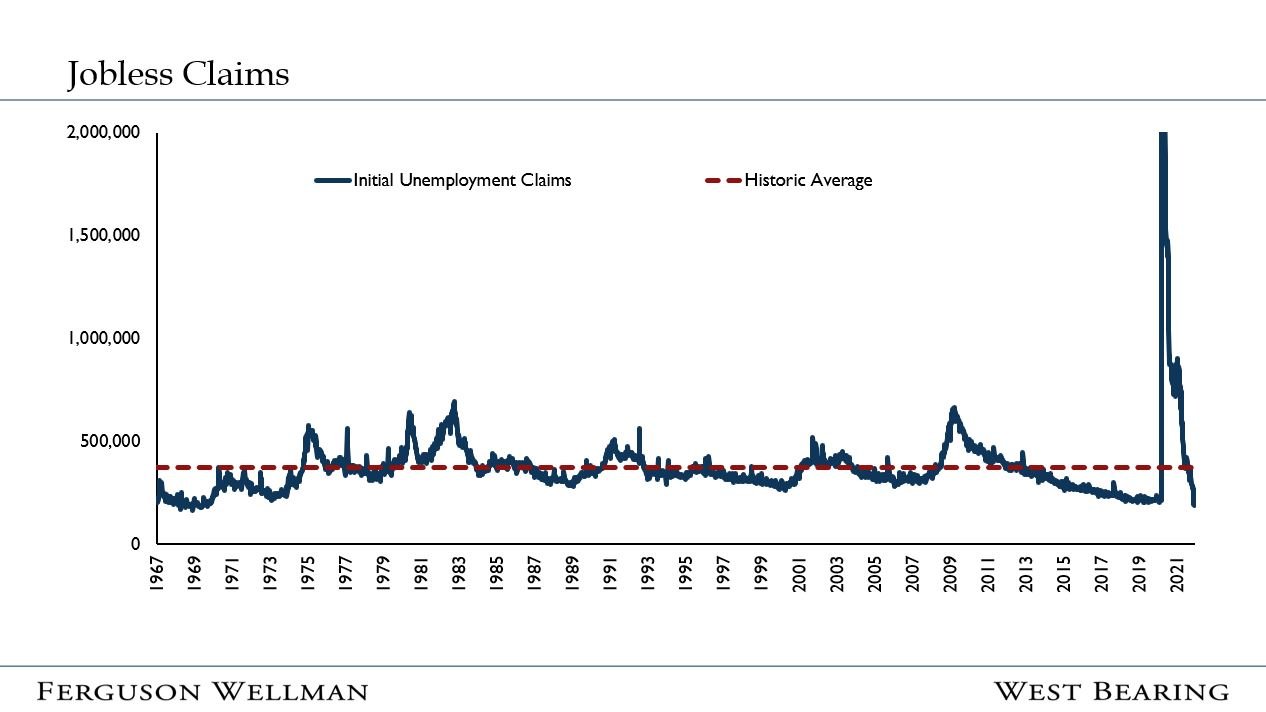

A key economic data point this week was a flashback to the 1960s with initial unemployment claims at 198,000, which are levels we haven't seen since that decade.

This level is almost half of the long-term average of 371,000. We are continuing to see a large worker shortage. There are currently over 11 million job openings; however, only 7 million people unemployed. The pandemic has led to a reduction in the labor force due to a variety of reasons. Labor participation in those over 55 has fallen over 2% over the last two years, primarily due to early retirement. We have also seen a lot of people transition to self-employment, termed the “Etsy Economy.” Finally, with continued uncertainty around health conditions and childcare, a lot of people are staying on the sidelines and not coming back to work. We had expected that once the enhanced unemployment benefits expired in September and kids went back to school, we would see an increase in labor participation; unfortunately, this has been slow to occur. This phenomenon may lead to higher wages as employers attempt to pull workers back into the job market.

Source: Federal Reserve Bank of St. Louis

It’s All Right

Should you sell stocks after a year like 2021? The answer is, it depends. The previous year’s returns have little effect on what’s to follow. When looking back at market returns since 1926, there have been 25 years when returns eclipsed 25%. What we saw the following year, for the most part, are still positive returns. Returns were positive 68% of the time, with an annual return of 11%. The overall average for that period is for stocks to rise 12% and delivering a positive year 74% of the time.

What this highlights is that equity returns, longer-term, are contingent on company fundamentals, which are a function of the economy. We believe global economic growth will show mid-single digit levels, resulting in high single digit profit growth. While we don’t expect similar returns in 2022 as 2021, we do believe we will still see positive returns. Therefore, being overweight equities relative to bonds continues to make sense.

If This Is It

Santa Claus did come to town in December; stocks finished the week rising 1% capping off a 29% year for the S&P 500. Bonds delivered their 14th bear market in 96 years, however, the downside was only 2%. Asset allocation was key in 2021 and being overweight U.S. stocks and underweight bonds was the winning call in 2021, and we have reason to believe it will be again in 2022.

Takeaways for the Week

We will be holding our annual investment outlook virtually on January 20, stay tuned for the invitation and opportunity to register

We hope you have a Happy and Safe New Year