by Samantha Pahlow, CTFA, AWMA®

Senior Vice President

Portfolio and Wealth Management

The holiday season is just around the corner. As we approach this hectic time of year, we encourage you to pause and review your personal finances before we close the books on 2021.

There are many areas of planning that should be evaluated annually. This review also enables you to have your ducks in a row for 2022 so you can start the new year confident that you’ve availed yourself of smart planning opportunities and strategies.

This quarter, we sent our clients a robust Year-End Planning Guide** and also shared our webinar, “Certain Strategies for Uncertain Times,” and Wealth Management Insights publication. These resources covered topics of charitable giving, tax savvy planning, retirement and estate planning. Below, we have highlighted a few areas of planning that are particularly time-sensitive at year-end:

Charitable Giving – Early December

Cash donations are as easy as writing a check and postmarking it, or wiring funds; however, if you are making more tax savvy donations of stock, don’t forget to account for custodian and charity processing times. Charitable donations must be received by the charity by December 31 in order to qualify as a deduction in the current tax year.

Donations of securities between custodians (for example from a non-Schwab account to a Schwab Charitable donor-advised fund) can take between two-to-six weeks to process. Make sure you’ve determined the amount of your gift, identified stock(s), and started the paperwork with your portfolio manager by early December, to ensure your donation makes it into the 2021 tax year. For those with a Schwab Charitable donor-advised fund, this Year-End Contribution Guide provides critical deadline information based on the type of contribution you are making.

For individual retirement account (IRA) owners over age 70 ½ planning to make a qualified charitable distribution (QCD) of up to $100,000 from their IRA, processing times are shorter than donating stock, but we encourage you to start the process early and not risk processing delays.

Annual Estate Gifts – by December 31

For 2021, individuals can give away $15,000 per recipient without incurring federal gift tax or using up any portion of their lifetime transfer tax exclusion ($11.7 million per person in 2021). Together, spouses can give away $30,000 per recipient per year. These gifts need to be completed (deposited into the recipients account, cashed or securities transferred) by December 31 to qualify. Like charitable donations, we encourage you to put these plans in motion sooner rather than later.

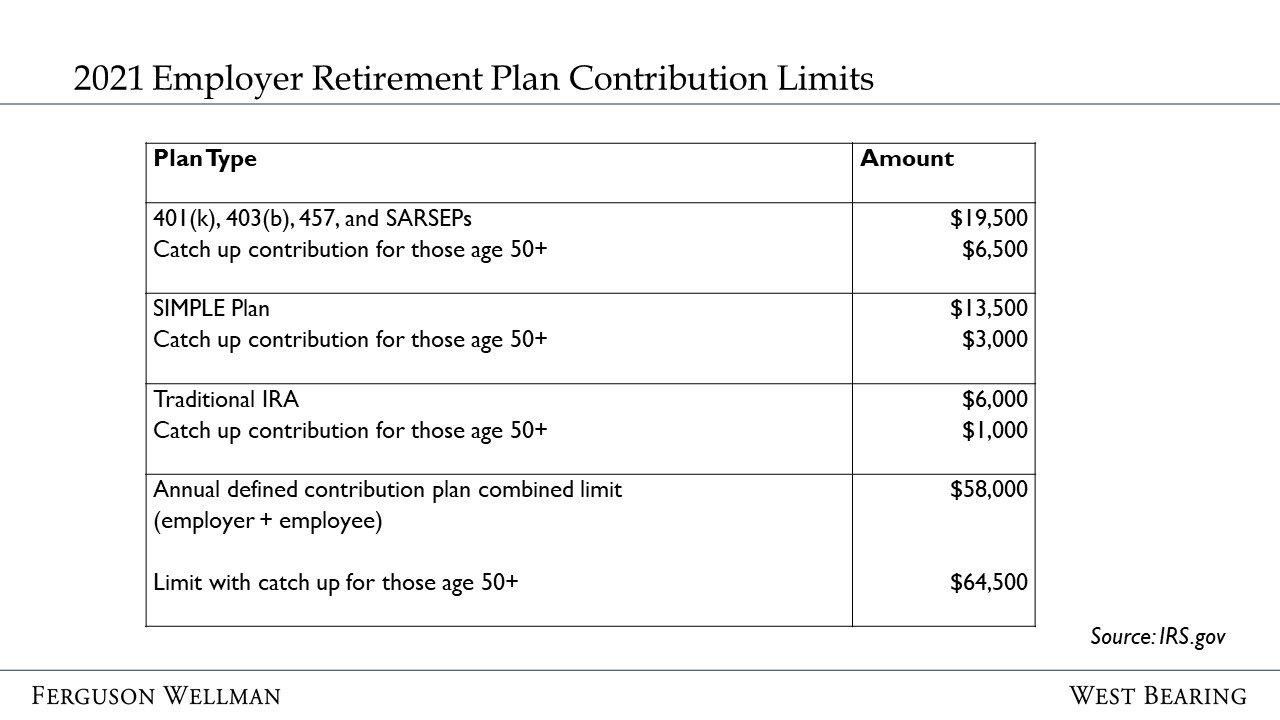

Employer Retirement Account Contributions – Last Paycheck

While contributions to traditional IRAs and Roth IRAs can be made up until April 15 of 2022, employee contributions to many employer-provided retirement plans, such as 401(k)s, 401(a)s, 403(b)s, and SIMPLE IRAs, must be made by December 31. Review your year-to-date contributions, and if you are falling short of the maximum allowed contribution, consider increasing your deferral out of your final paycheck. Also, for those whose employer plan allows them to make an after-tax contribution to their 401(k), see our article on the mega-backdoor Roth IRA strategy.

Estimated Tax Payments – Last Paycheck or IRA Distribution

If you make quarterly estimated tax payments, review your year-to-date payments to ensure you have at least paid enough to avoid penalties. Review with your tax preparer if you are unsure how much is required. If you have underpaid, consider withholding additional tax from your final paycheck in 2021 or taking a distribution that is 100% tax withholding from your IRA if you are over 72 years of age. Tax paid through withholding is treated as paid equally in each quarter and can help make up for a late or missed estimated tax payment and reduce penalties.

Additionally, keep in mind Congress is currently discussing changes to tax legislation. One item up for consideration is possibly removing the $10,000 cap on the deduction for state and local taxes. If this cap is successfully removed, you may benefit from paying your fourth quarter estimated tax payment after year-end, but before January 15.

Take Required Minimum Distributions from IRAs – by December 31

Make sure you’ve taken your required minimum distributions from retirement accounts for 2021 before December 31. Onerous penalties apply if this distribution is not taken in full by the end of the year.

Flexible Spending Accounts – by December 31

Flexible Spending Accounts (FSAs) do not roll over from year-to-year. Each plan is unique, but in most cases, they are a use-it-or-lose-it arrangement and qualified expenses have to be incurred by December 31. Make sure you know your plan rules and arrange for any final medical expenses needed to use up your remaining balance.

529 Education Plan Contributions – by December 31

529 plan contributions for the current year must be made by December 31. Remember that you can superfund a 529 plan by contributing five years' worth of annual exclusion gifts ($15,000 x 5 years = $75,000). If you have made other gifts to the same person or previously superfunded a 529 plan, be sure to talk with your tax advisor to confirm how much you can give this year. If you have previously superfunded a 529 plan, be sure to talk with your tax advisor to confirm how much you can give this year.

We hope this helps you focus and prioritize any remaining 2021 financial to-dos so you can put a nice big bow on 2021. If you have any questions or need help facilitating some of your year-end transactions, please contact your portfolio manager and client relationship associate.

**Contact your portfolio manager if you are a client who did not receive a copy of the Year-End Planning Guide. It was sent by email on November 9.

Ferguson Wellman and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.