by Alex Harding, CFA

Vice President, Equity Trading and Analysis

On Monday, Facebook experienced an outage across its platform of apps for nearly six hours, affecting billions of users. The network disruption reminds us how interwoven social media is into the fabric of the global economy and many of our personal lives. The company remained in the spotlight as a whistleblower testified before the Senate on Tuesday regarding allegations of misrepresentation and conflicts of interest. Despite the ‘glitchy’ start, the S&P 500 rallied to finish the week up 0.8% after Congress agreed to a short-term debt ceiling extension temporarily relieving investor concerns of a national default.

Jobs Data

Although the Facebook saga received more attention, what drove the markets this week was the deferral of the debt ceiling decision and the release of the monthly nonfarm payroll employment report. More commonly referred to as the jobs report, the economy added 194,000 workers to U.S. payrolls, missing the consensus estimate of 500,000 by a wide margin. While the headline number disappointed, the details within the report, such as 4.6% wage growth, upward revisions to prior months and seasonality effects causing government payrolls to be negative, gives us confidence the Fed has enough supporting data to begin gradually reducing its $120 billion monthly purchase of fixed income securities starting in November. The emergency program was created in the spring of 2020 to limit the economic damage caused by the pandemic. With the U.S. economy now exceeding pre-pandemic levels, a return to more normal policy seems justified.

Supply and Demand Imbalance

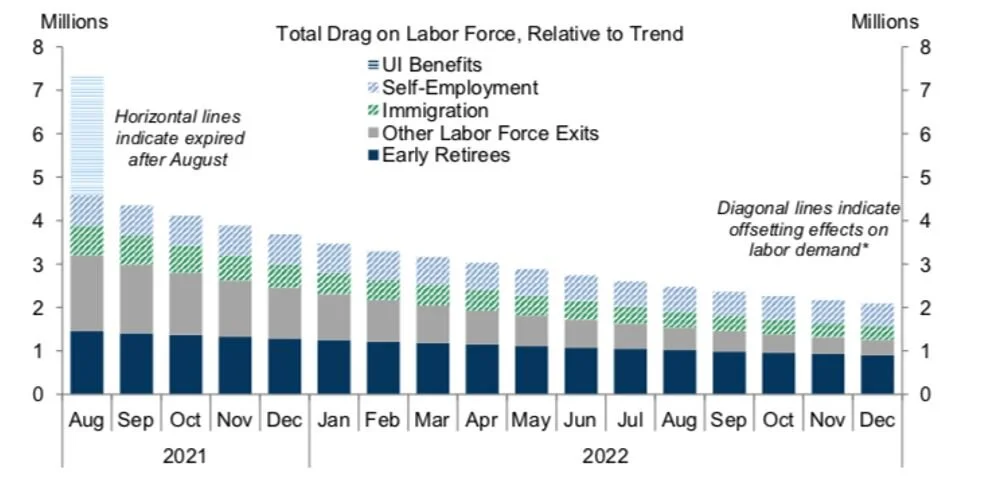

With the expiration of enhanced federal unemployment insurance benefits in September, the incentive to return to work has increased but does not explain the entire 7+ million shortage of workers. As shown in the chart below, many factors are playing into the U.S. labor supply issues. With home prices, equity markets and personal incomes at or near all-time highs, employees decided to retire early with few expected to re-enter the labor force. On the other hand, those with health concerns and/or limited childcare options (gray bar) will come back to the workforce as vaccine rates increase and students return to school. The final two categories, self-employment and immigration, have a demand offset but still played a role in the imbalance of supply. We will keep an interested eye on the self-employed category as workers weigh the security of corporate benefits against a more flexible work schedule and lifestyle freedom. The improvement in labor supply shortages will not be linear. But, given the fact most nonparticipants view their exit as temporary, we are confident 2022 will see a vast improvement and alleviate upward wage pressure.

Source: Goldman Sachs

Earnings Season

Banks such as JPMorgan and Bank of America kick off earnings season next week. Expectations for third quarter S&P 500 earnings growth is around 25% with the full year growth rate expected to be north of 45%. Looking ahead to 2022, we forecast mid-to-high single digit earnings growth supporting our current overweight to stocks.

Takeaways for the Week

It won’t be a straight line, but worker shortages will abate

Even with the weak jobs report, the 10-year U.S. Treasury yield rose 14 basis points this week to 1.6%