by Timothy D. Carkin, CAIA, CMT

Senior Vice President

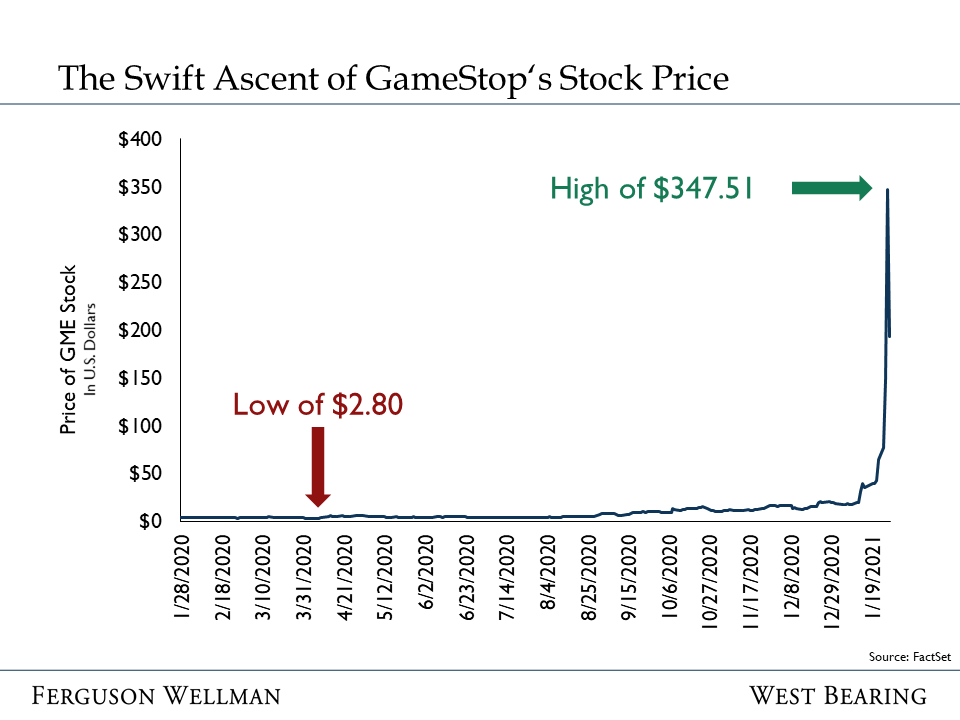

This week, the conversation around the virtual water cooler centered on the unexpected and meteoric rise of GameStop’s stock price. The movie-worthy combination of hedge funds, internet forums and a 2,700 percent stock price jump culminated in worldwide news headlines and questions from our clients. Most notably, clients are asking: What is going on with GameStop and how is this impacting the rest of the market?

What is behind GameStop’s sudden popularity?

As a result of the pandemic, brick-and-mortar stores have been hard hit by diminishing demand. One such “posterchild” was GameStop, a 36-year-old chain store that sells used video games primarily in malls or strip malls. Last year, the company’s stock price fell to a low of $2.80 in April, leading to a grim outlook for the chain’s future. That is, until Ryan Cohen, the founder of Chewy.com, infused the struggling company with an influx of cash. Cohen’s ambitious plan is to transition the company to online commerce and compete against industry behemoth Amazon.com.

Cohen’s influence led to a rally in the price of GameStop stock. However, large investors and hedge funds saw a potential for failure and bet against the new plan by shorting the stock. As a reminder, a “short” sale on a stock is a bet that the stock price will go down. In practice, the investor borrows stock from a lender and sells it again with the hope of buying it back at a lower price and thus returning it to the lender at a profit. However, if the price of the shorted stock increases past the initial borrowing price, then the short-seller owes the higher price, resulting in a loss.

For GameStop short-sellers, the short bet became so massively large that it eclipsed the free-floating shares, or the number of shares held by the public and not insiders. At the same time, some hedge fund managers took to sharing negative opinions towards GameStop in an effort to help decrease the stock price even further. While this tactic is ethically questionable, it is legal and not an unusual occurrence. However, what is different, and frankly extraordinary, has been the reactionary online response.

Users of the online forum Reddit and long-time fans of GameStop saw an opportunity in the large, short interest of these investors and hedge funds. Specifically, these users organized en masse to buy GameStop stock, resulting in a deluge of “buy” orders on Robinhood, an investing platform that has become a favorite of retail investors, and other trading platforms such as Charles Schwab, Fidelity, and TD Ameritrade. The large volume of purchases increased the stock price at such a fast rate, momentum traders took notice and began to purchase stock, too. Momentum traders will follow trends in the market; if a stock price is going up, they will buy it and if it is going down, they will sell it.

Source: FactSet

As the price continued to climb, those who were short the stock began to feel the pain of being on the wrong side of the trade. No longer could they buy back their shorted shares at a lower price. Acting to mitigate their losses, the short sellers fell into what’s known as a “short squeeze.” A short squeeze is when short sellers are forced to buys shares to “cover” their short position, driving the price even higher. As the price grew, more investors participated, and the price continued to climb. On Thursday, the price of the stock hit $492 and continues to be one of the most volatile stocks in the market.

The company’s ascent in stock prices ground to a halt on Thursday when Robinhood and other brokers added sudden curbs to prevent the buying of more shares. With their intervention, the stock price of GameStop fell 30 percent in a day. Other stocks that were experiencing increased stock prices, such as AMC Theaters, Blackberry and others were also negatively impacted. Understandably, these events have already triggered multiple lawsuits and calls for an investigation by the Securities and Exchange Commission.

Is GameStop responsible for the week’s market selloff?

While GameStop’s story and attention-grabbing headlines are adding to market uncertainty, there are numerous fundamental reasons for the recent sell off. For example, today, the People’s Bank of China injected 100 billion yuan following a meaningful reduction in liquidity last week. As a result, China’s short rates continue to surge. In addition, the Federal Reserve’s assets fell by 0.1 percent this month due to reduced buying. A shrinking Fed balance sheet is not positive for stocks. Lastly, U.S. Consumer spending fell by 0.2 percent, the second straight month largely due to a rise in coronavirus cases. While the news might focus on the GameStop fervor, it is important to keep a keen eye on the much broader economic landscape.

Buy, hold, or sell?

The fact that we at Ferguson Wellman have not participated in the manic trading in GameStop, AMC and others does not reflect a belief that there is not opportunity to make money in times of immense volatility. Rather, our lack of participation is a function of our investment discipline… a discipline in which we seek to identify attractively priced companies whose market value will ultimately be a reflection of the entities business fundamentals such as a stable and growing cash flow… and with an investment horizon that is typically measured in years, not hours.

While it is far too early to know with any certainty as to the potential legal and regulatory fallout of this chapter, Wall Street is no different than any other industry in that it is constantly evolving. To that end, perhaps the vulnerabilities and possible abuses exposed by this fascinating GameStop trading drama will ultimately lead to more transparent, fair and orderly capital markets.

Our Takeaways from the Week

GameStop has captivated the markets with its huge swings and volatility that will certainly continue into next week

With all the news focused on GameStop, the broader equity market has fallen more than 3 percent this week and bond rates are ticking back up