by, Casia Chappell, CFP®, CPWA®

Vice President of Planning

The start of the new year brings to mind resolutions and goal setting, but when it comes to your finances it may seem hard to know if you're on track to meet your goals without a crystal ball or a time machine. Financial planning with Wealth Horizon™ provides clarity and a path to success. Given the unknowns and potential changes that can occur when making long-term projections, it is paramount to engage in planning on an ongoing basis to accommodate those variables and adjust if necessary. Wealth Horizon™ includes several tools that provide measurable data that, when reviewed together, can tell you if you are heading in the right direction.

Monte Carlo/Probability of Meeting Goals

The first of these tools is a Monte Carlo simulation which helps to illustrate the potential risks in an analysis when one of the components is an unknown variable. One unknown variable in planning is the investment return. When projecting financial goals over a period of time, such as 30 years of retirement, a Monte Carlo simulation will calculate the probability individuals will meet their goals, given their assets and income, while using varying investment returns each year to simulate the unpredictability of the market. The simulation runs 1,000 different projections, each with a different sequence of returns. In the example below, each line represents an individual projection. The projections in which the analysis meets all the stated goals are shown in green while the projections in which there are insufficient funds to meet all the stated goals prior to the end of the timeline are shown in red.

Simplified Analysis with Average Investment Returns

In addition to Monte Carlo, an average return projection shows how the portfolio is impacted when receiving the expected average rate of investment return, based on the asset allocation, each and every year of the analysis. While it is rational to expect a reasonable rate of return over a period of time, we know investments have risks and can be certain we will not achieve the average rate of return each year. Recognizing its limitations, we review this projection because it can offer insights into the sensitivity or durability of a plan to changes such as increased spending or lower market returns. For example, one limitation of a Monte Carlo simulation is the results become more drastic as the timeline increases, meaning the good projections look outstanding and the bad projections look severe. In some cases, the result of the Monte Carlo is below the acceptable range, while the result of the average return projection shows a sizeable estate at the end of a couple’s lifetime after meeting all their goals. The perspective gained from using both tools would suggest that these individuals may be on track to meet their goals, but careful monitoring is necessary to ensure their success as time goes on.

Timing Matters

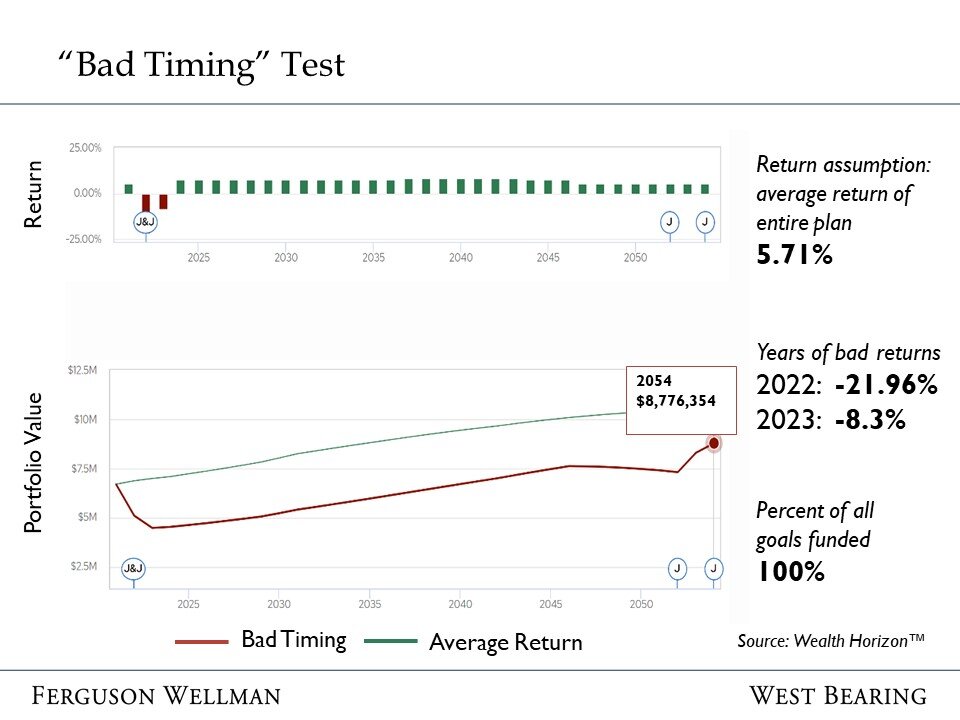

The “bad timing test” is an especially valuable tool for those whose goals includes portfolio withdrawals in the near term, such as retirement. This feature incorporates both the Monte Carlo simulation as well as the average return projection, but runs those calculations as if the portfolio were to experience negative volatility similar to the Great Recession during the first two years of retirement. The ”bad timing” refers to stress a portfolio experiences when there is a decline in value during the crucial first years. The simulation shows the disproportionate impact of relying on the portfolio for living expenses during an early market decline, due to the resulting loss of compounded portfolio returns.

These are some of the tools included in Wealth Horizon™ that provide quantitative data illustrating the end results of long-term projections. None of these calculations provides the whole picture, but when reviewed together, they can provide meaningful insight into your ability to achieve financial success, whatever your goals may be.

Most individuals do not have the time or interest to become students of planning, but everyone can benefit from the application of the tools. Your Ferguson Wellman and West Bearing teams are here to help you embark on a planning process to ensure you understand your financial circumstances, assist you in developing sustainable spending goals and know how your wealth is likely to evolve over time. Please reach out to your portfolio manager or client relationship associate for additional information or to get started with your personal Wealth Horizon™.

Ferguson Wellman and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.