by Ralph Cole, CFA

Director, Equity Strategy and Portfolio Management

All day and every day we are bombarded by economic, company and political news. And not just U.S. news, but global news as well. Even in normal times this can seem overwhelming, and especially so during a pandemic. We understand and feel it too. But as analysts and investors, we know to focus on underlying economic realities so we can see how they might impact our clients’ portfolios and their long-term plans.

As investors, we can see that the economy is slowly healing. People are starting to go back to work, albeit slower than we would like. Companies are beginning to see light at the end of the tunnel, although not as soon as they would like. Finally, scientists are continuing to make progress on vaccines and treatments, but they appear to be months from coming to fruition. As we all know, the healing process is not always a straight line and just like an injury or illness, the economy will have its own fits and starts along the way to recovery.

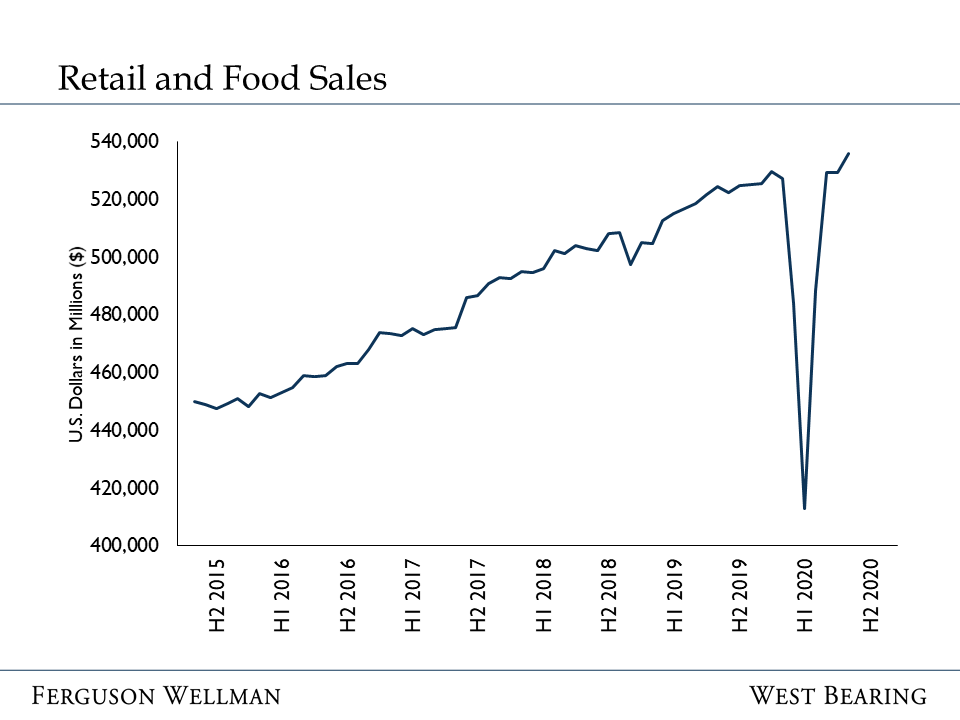

At Ferguson Wellman, we like to say, “never count out the U.S. consumer,” and this week’s retail sales numbers proved that statement true once again. Retail sales have rebounded to their highest level ever. While trapped at home during the pandemic, U.S. consumers have found ways to spend money at a surprising rate.

Source: Evercore ISI

This healing process is not confined to U.S. shores; it is also happening overseas in the manufacturing sector. Early in the pandemic, inventories grew as both businesses and consumers cut back spending. But with the start of re-openings around the world, those inventories have been drawn down and, depending on the product, may be backlogged several months. Manufacturers are starting back to work to fill that inventory hole and we are seeing that process unfold globally as factories start up once again. These events are illustrated in the chart below that shows the Purchasing Managers Indexes (PMI) for Manufacturing for some of the largest regions in the world. Any reading over 50 percent means that they are expanding, and as you can see, that is what they are all doing.

Source: FactSet

There are some important nuances in the chart above. First, you can see that China is ahead of the rest of the world in recovery. China, the first country to encounter COVID-19, reacted with strict lockdown methods, resulting in control of the spread of the virus and thus allowing their earlier recovery. Clearly, the rest of the world is several months behind, as evidenced by the steep drops further to the right of the chart. China’s PMI for Manufacturing, represented by the turquoise line above, while still expanding shows a leveling-off period that we may expect in other countries. This recovery will not be a straight-line and will be a slower process than many of us would like.

Takeaways for the Week:

Economic indicators show us that the global economy is healing

Being too close to any situation makes it very difficult to make long-term decisions. It is very important to step back and see the whole picture