by Blaine Dickason

Vice President, Trading and Fixed Income Portfolio Management

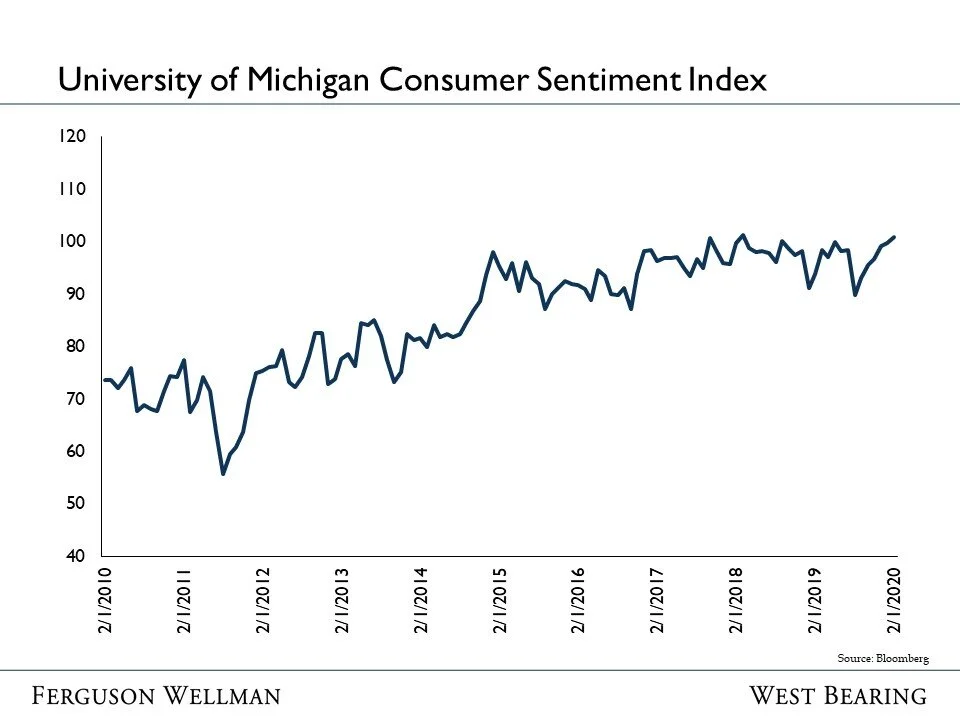

The U.S. consumer continues to be the sweetheart of the global economy. Personal consumption represents approximately 70 percent of U.S. GDP and this morning’s University of Michigan Consumer Sentiment Index release suggests the consumer remains both confident and resilient. Today’s report for the February period set a new 2-year high and just narrowly missed setting a post-financial crisis high for consumer confidence.

In another indicator of consumer strength, the National Retail Federation (NRF) recently released their estimates for spending this Valentine’s Day. They are projecting total holiday related expenditures of $27.4 billion, up a whopping 32 percent from last year’s record of $20.7 billion. Apparently, saying, ”I love you” has gotten significantly more expensive!

The primary reason the NRF highlighted this notable increase in spending is the strong financial position of the U.S. consumer. While intangible consumer survey data continues to indicate high confidence levels, the very tangible percent of income used to service household debt remains on a downtrend, freeing up dollars to be spent on additional consumer goods.

Another Refinance Boom?

“Do you want to refinance?” may not be the most romantic question you could ask your sweetheart while sitting at dinner this evening, however, from an economic standpoint, it could be the most meaningful.

According to Bankrate.com, the average 30-year fixed rate mortgage rate has trended down to 3.60 percent after a recent high of over 4.75 percent in the fourth quarter of 2018. By some mortgage industry estimates, there are currently over 10 million mortgages that are eligible to refinance based on both creditworthiness and the opportunity to improve their current rate by at least 0.75 percent. Refinancing by this pool of eligible borrowers has the potential to save over $260 per month per household and in aggregate would generate $3 billion per month in savings.

In addition to increasing disposable income, low mortgage rates also likely helped stimulate existing home sales since the fourth quarter of 2018. Besides the strong consumer, a resilient housing sector should also provide continued firepower for sustaining our record economic expansion.

Our Takeaways from the Week

This week’s sale of a new 30-year bond by the U.S. government resulted in a record low-coupon of 2.00 percent

Despite continued fear and uncertainty surrounding the coronavirus, the S&P 500 Index gained 1.58 percent for the week