by Jason Norris, CFA

Executive Vice President

Humans Being

While retail investors continue to be focused on negative media headlines, stocks continue to climb the “wall of worry.” Since March 31, the S&P 500 has rallied over 33 percent while investors sold domestic equity Exchange Traded Funds and Mutual Funds to the tune of $189 billion as seen in the chart below. This includes $40 billion that investors pulled out of equities in the first two weeks of October.

Sources: ICI, FactSet

Over the last several months, we have highlighted that stocks can perform well in the face of bad economic data; however, they can exhibit short-term volatility as the economy strives to gain its footing. Focusing on the long-term growth prospects is key. As Warren Buffet once quoted his mentor, Benjamin Graham, as saying, “In the short-run, the market is a voting machine . . . but in the long-run, the market is a weighing machine.” While it is easy to get caught up in the short-term noise, focusing to long-term economic fundamentals is key when investing in equities.

House of Pain

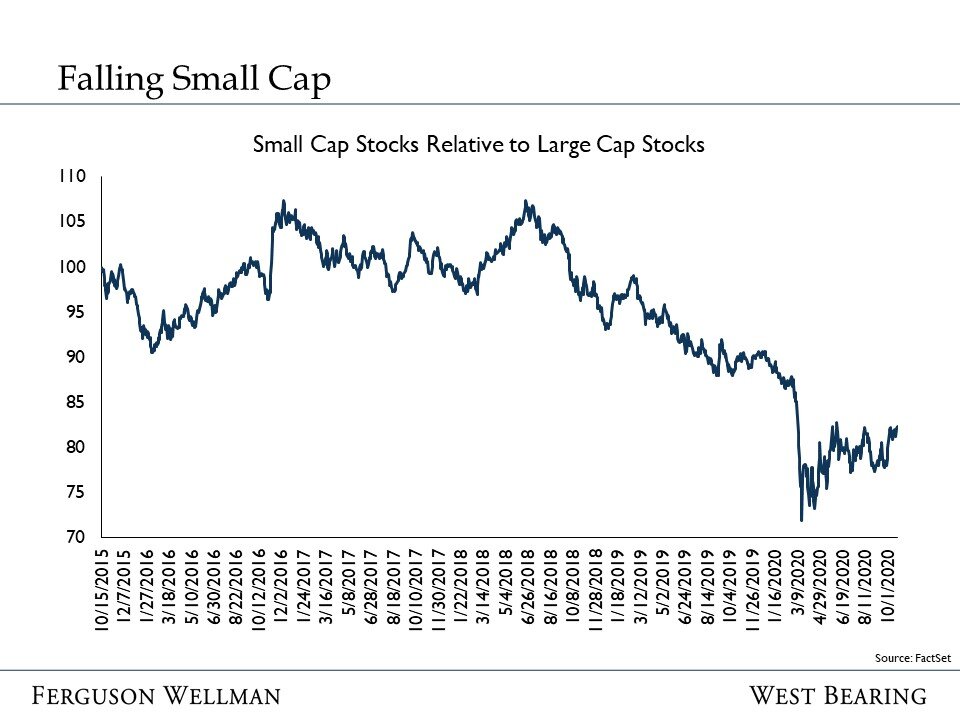

While investors in large cap stocks, specifically growth stocks, are now earning a positive return for 2020, those focused on the small cap (small cap stocks are commonly defined as companies with a market value less than $2.0 billion) space have had no such luck. When looking at long-term performance, small cap stocks historically exhibit higher returns than their large cap peers. However, this is usually accompanied with higher volatility. This is why most diversified portfolios will have an allocation to small stocks.

Looking at the chart below, it has been a tough couple years for the small cap space with the S&P 500 meaningfully outperforming the Russell 2000.

Source: FactSet

For the last several years, we have been underweight small cap stocks due to where we were in the economic cycle — historically, small cap stocks do better in the early stages of an economic recovery. However, since we believed the recession would be short-lived, we began adding to small caps in April of this year. We have seen some pickup in relative performance, specifically recently. We believe it’s too early to move to an overweight, but as economic growth continues to improve, small cap stocks should continue to perform well.

Good Enough

Earnings kicked off this week and results have exceeded expectations. 27 percent of the S&P 500 have reported and over 80 percent of those companies beat estimates. Also, the results are 18 percent higher than expectations. Profit growth for the third quarter is expected to remain negative, down 17 percent. However, it is an improvement on the 31 percent decline we saw last quarter.

Week in Review and Takeaways:

Concerns surrounding COVID-19 have risen as cases have increased. But, we believe that global economies will not shut down like they did earlier this year as treatments and recoveries have improved meaningfully

Stocks delivered mixed returns this week with the S&P 500 falling roughly 1 percent, while the Russell 2000 eked out a small gain.