by Timothy D. Carkin, CAIA, CMT

Senior Vice President

This week, Alphabet Inc., parent company to Google, became the fourth company to join the “trillion-dollar market value club,” that includes Apple, Microsoft, and Amazon. Besides the significance of their “trillion dollar” size, why do we care so much about the market value of these companies? Because the performance of these market value titans can have significant impact on the stock market, most notably the S&P 500.

The S&P 500, the index to which most domestic money managers benchmark, is market capitalization weighted (market capitalization = share price x number of shares outstanding). This means that the larger the company, the larger its impact on the index. For example, the largest five companies (the aforementioned four plus Facebook) now comprise more than 18 percent of the S&P 500. Five years ago, that number was only 12 percent, though it was constituted with a different set of companies. Back in 1999, the top five companies also comprised 18 percent of the S&P 500. But today, the largest five companies generate an impressive 12 percent of profits, while in 1999 they contributed only 7 percent. The largest companies today have stronger balance sheets and larger sales than they did 20 years ago.

Difference Between Big and Small

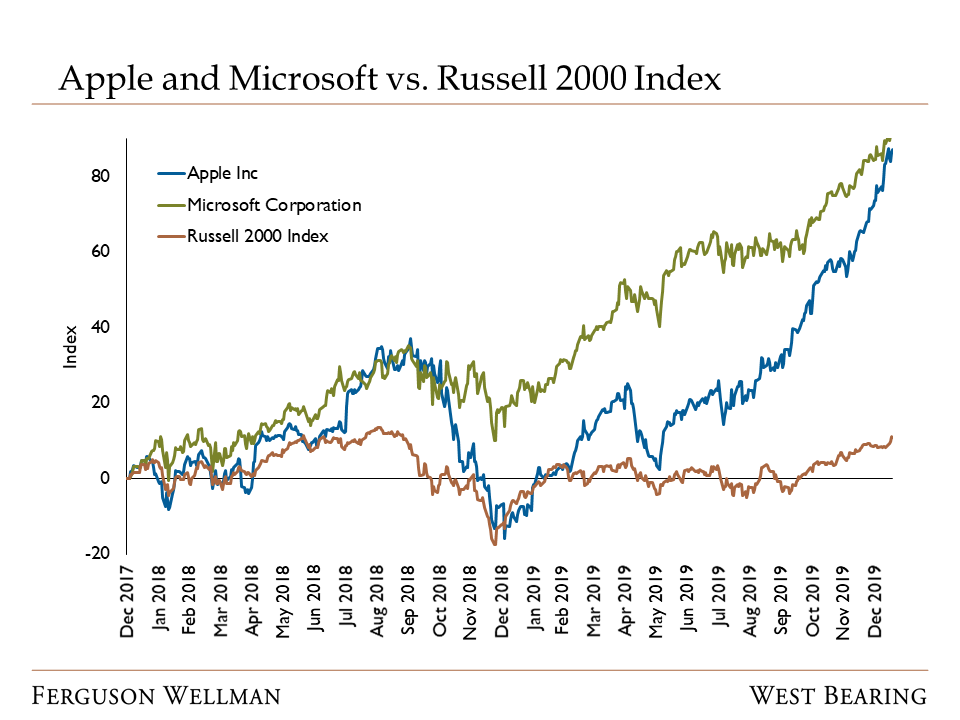

While a majority of 2019 headlines touted the amazing year in the equity markets, they were most likely referring to the S&P 500 or Dow Jones Industrial Average, as both indices are comprised of the largest stocks. On the other hand, small capitalization stocks were mostly left behind in the rally and subsequently left out of media broadcasts. As this bull market marches on, investors are continuing to seek out large, well-known, cash generating companies over those that are smaller and more speculative. Apple and Microsoft, charter members of the trillion-dollar club, are two such companies. The chart below illustrates the importance of these two stocks to current market success by highlighting their performance relative to small cap stocks. Most notably, Apple and Microsoft have now amassed market capitalizations of $1.4 trillion and $1.2 trillion, which combined are now as large as the entire small cap index.

This large cap bias will certainly reverse someday, but to quote a famous Wall Street axiom, for now “it doesn’t pay to fight the tape.”

Source: FactSet

Week in Review and Our Takeaways:

Equity markets set another high as Alphabet Inc. hits a trillion-dollar valuation

Continued strength in the largest stock names has been a key to market performance this year