by Peter Jones, CFA

Vice President, Equity Research

This week, the Federal Reserve made big news when it reduced the federal funds rate by 0.25 percent, its second cut this year. While any Fed action always dominates the headlines, the interest rate reduction was expected and fully priced into the market. Having raised federal funds a quarter point just last December, it has been a rather dramatic change of monetary policy in which the Fed has now cut rates twice this year. While labor markets remain very strong, sluggish manufacturing activity, tepid economic growth overseas and lingering trade uncertainty have all contributed to this shift to easier monetary policy. Crucially, stubbornly low and below-target inflation has provided The Fed with a green light to cut interest rates without risk of igniting inflation. While this most recent move was widely expected, the path from here is much less clear. At present, the market is pricing another cut in December and one more in 2020. However, Fed projections suggest no change for the rest of the year or in 2020.

After three consecutive weeks of gains, the S&P 500 was roughly flat on the week and remains just shy of all-time highs achieved in late July. Many are amazed that with the Fed acknowledging a slower growth environment, trade wars and Brexit, that the market is up 22 percent this year and setting new highs. While we are not dismissing these risks, we continue to see justification for current equity prices.

First, corporate earnings have grown more than 35 percent since the end of 2016. Over the same period, the S&P 500 index is up 34 percent. Therefore, equity valuations are unchanged … despite such a strong run in the last couple of years. Over this same period, the 10-year U.S. Treasury bond yield has declined from 2.5 percent to 1.8 percent. Putting the two together, equity valuations have become even more attractive relative to bonds. Another reason equity markets remain at high levels is the global change in policy. As discussed, the Fed has begun cutting interest rates in effort to stimulate the economy. In addition, the European Union recently announced they will restart quantitative easing, an even more drastic measure to bolster economic growth. Furthermore, stimulus isn’t only coming from the monetary side as Germany is expected to approve a $50 billion spending package and just today, India announced a broad-based tax cut. In short, global policymakers are taking action to address slowing growth. It remains to be seen whether stimulative policy will succeed in improving growth, but easier policy has certainly helped boost equity prices.

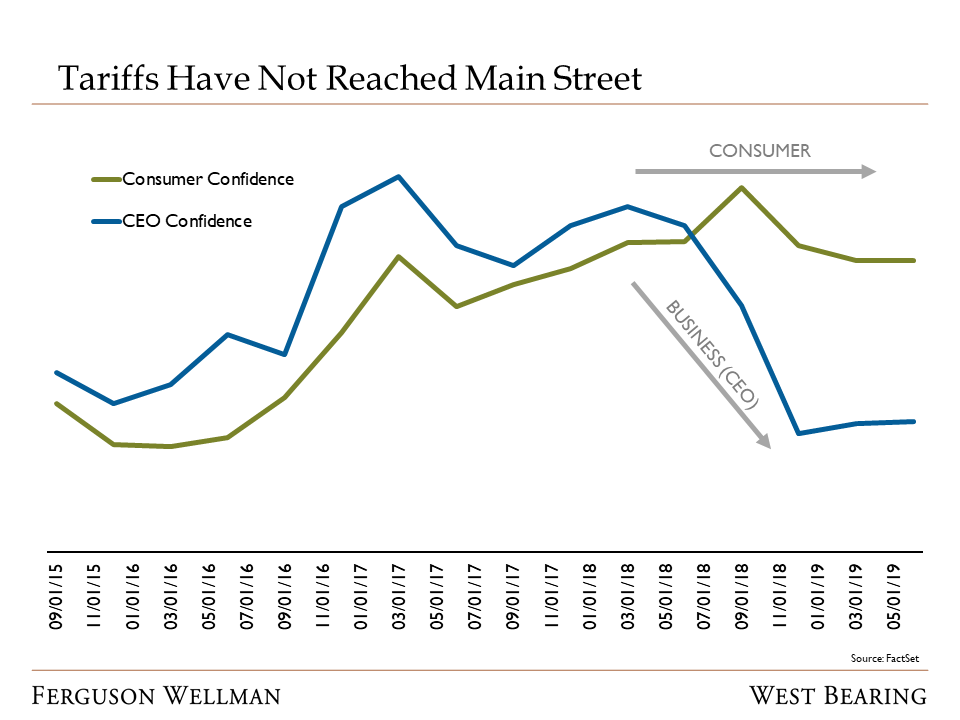

Valuation and policy are two reasons that returns have been so strong, but our view is that the healthy U.S. consumer is even more important. To that point, consumer spending makes up 70 percent of U.S. GDP. And for perspective, the U.S. consumer is larger than the entire Chinese economy. While tariffs have shaken the confidence of CEOs, and in turn pressuring business investment and manufacturing, the consumer continues to be optimistic, with confidence measures sitting near cycle highs.

Source: FactSet

For the consumer, having a job and a growing paycheck outstrips just about everything. Right now, unemployment of 3.7 percent is sitting near 50-year lows. Wages are growing 3.5 percent, the highest in a decade. Similarly, we have yet to see jobless claims, a leading indicator of recession, display any red flags. In addition, personal debt levels are very low. With labor markets robust and consumers confident, retail sales grew more than 3 percent last month. Bottom line, while the U.S. consumer remains healthy, risk of recession is incredibly low.

Week In Review and Our Takeaways

The Fed cut interest rates by 0.25 percent on Wednesday, a move that was broadly expected

Equities were flat on the week and remain near all-time highs

Accommodative global monetary and fiscal policies, coupled with relative valuation, are contributing to robust equity returns

So long as the U.S. consumer is healthy, recession risk is very low