by Shawn Narancich, CFA

Executive Vice President of Research

When Good News is Bad

Investors anticipating Federal Funds Rate cuts in the months ahead have become inversely sensitized to economic news supporting continued economic expansion. Last week’s surprisingly tepid payroll report and today’s reassuring read on U.S. retail sales resulted in opposing stock price reactions. Equities rallied last week on disappointing job growth and declined today as retail sales came in close to estimates for May while previous months’ numbers were upwardly revised. Broadcom’s earnings miss also weighed on stock prices to end the week, but the observation stands – investors at this point want to see weaker economic reports that they believe will incent the Fed to cut interest rates. As shown below, we do not foresee a recession in the foreseeable future, but rather anticipate a slowing of GDP growth beginning in the current quarter.

Source: FactSet

Leading Indicators

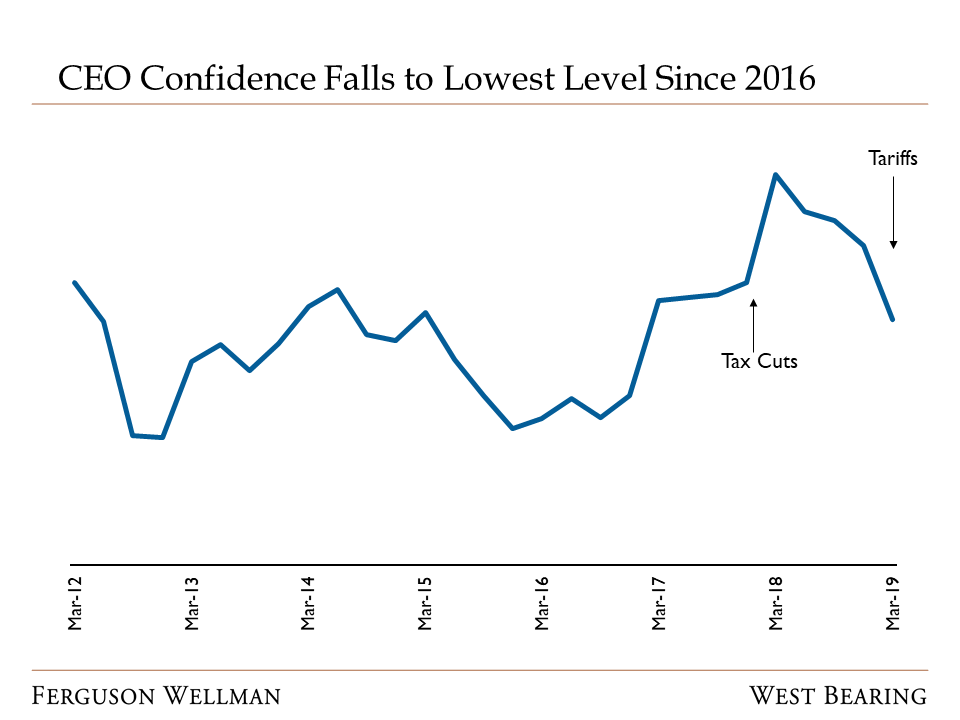

In a tight job market that has made hiring new employees a greater challenge, we are increasingly attuned to a data point that has risen for three consecutive weeks – jobless claims. We witnessed stagnant profit margins in first quarter earnings reports and believe that most of the mid-single digit profit growth anticipated this year will come from revenue gains. If profit margins were to fall under sustained pressure, companies would likely respond with job cuts. While we are not forecasting a turn in the labor markets anytime soon, jobless claims reported weekly have our attention as this data comes amid a trade war with China and falling levels of CEO confidence.

Source: Bloomberg

In an economy where employment is driven by the private sector, the sentiment of company leadership surrounding both the economy in general and their businesses specifically impacts investment and employment levels. In turn, healthy labor markets are key to sustaining the ongoing economic expansion because consumption expenditures account for two-thirds of the U.S. economy.

Week in Review and Our Takeaways

Anticipated interest rate cuts have caused investors to cheer weaker economic data

Stocks finished the week modestly higher ahead of the Fed meetings next week