by Brad Houle, CFA

Executive Vice President

First Quarter Earnings

It’s the tail-end of the first quarter of 2019 earnings reporting season and the results have been better than expected. While corporate earnings growth was up 22 percent in 2018 due in part to tax cuts, this year those same cuts will provide limited benefits and corporate earnings growth is expected to only be up around 5 percent for the full-year 2019. The fading tailwind of tax cut stimulus has left us with earnings that were expected to decline more than 4 percent for the first quarter of this year. As of this week, 72 percent of the S&P 500 companies have reported earnings; of the companies that have reported earnings, 73 percent have beat earnings expectations. For the quarter, earnings should decline less than 2 percent which is a good result in the context of 2018's unusually strong earnings growth.

Market Valuation

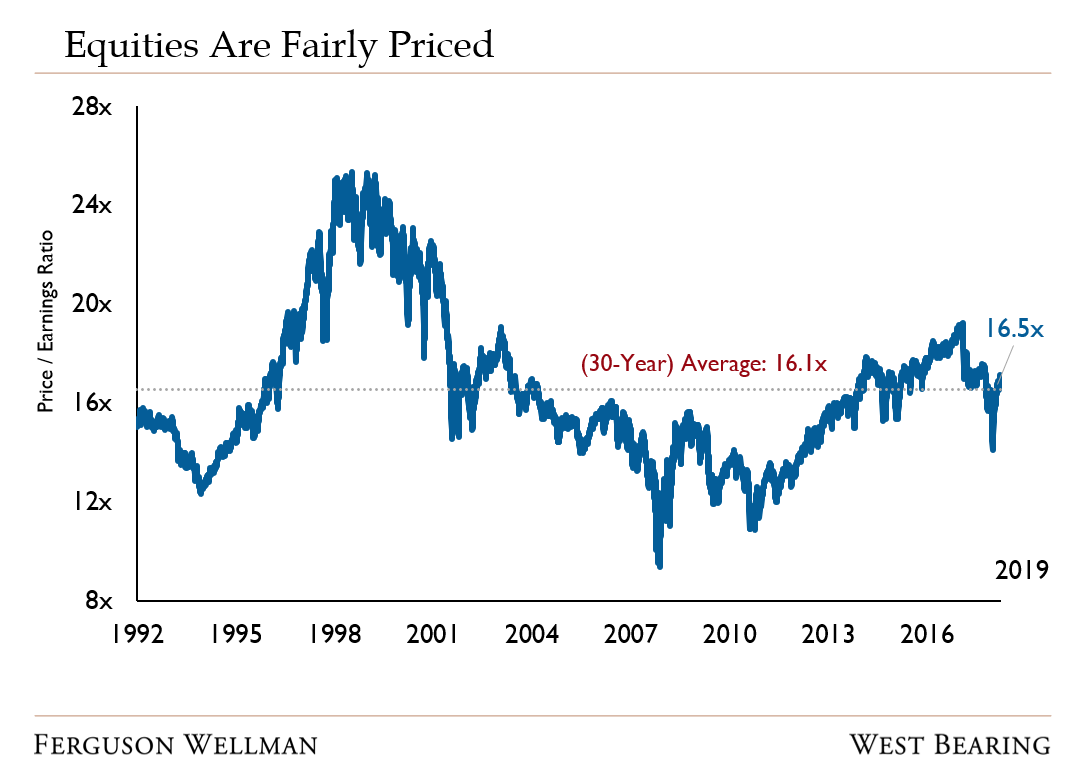

The valuation of the market as measured by the price-to-earnings ratio of the S&P 500 is close to the long-term average. Price-to-earnings ratio is the amount that investors will pay for a dollar of earnings. Since 1992, the S&P 500 has had an average price-to-earnings of 16 times.

Source: FactSet

Moving forward, the performance of the stock market will largely be driven by earnings growth. At this point in the economic cycle, we are unlikely to expect the price earnings multiple to expand. Investors generally will not pay more for a dollar of earnings in an environment where growth is slowing. The national income, or Gross Domestic Product (GDP), influences the growth in company revenues and earnings. For the first quarter, GDP growth was stronger than expected at 3.2 percent with a full year expectation of roughly 2 percent GDP growth. For 2018, GDP growth was 3 percent due in part to the tax cuts and resulting economic growth.

The Fed On Hold

On Wednesday this week, Federal Reserve Chairman Jerome Powell held a press conference following the Federal Reserve Open Market Committee meeting. He indicated that there is not a strong case for an interest rate move in either direction. The Federal Reserve changed its outlook earlier this year from increasing interest rates to avoid having the economy overheat to being on-hold. This change was in response to the slowing growth of the U.S. economy and inflation that has been below expectations. However, employment data for April released Friday was better than expected with 263,000 jobs created. The unemployment rate moved down to 3.6 percent, the lowest since 1969.

Week in Review and Our Takeaways:

Earnings for the first quarter of 2019 have come in better than expected

The valuation of the stock market is near its long-term average; it is not expensive

The U.S. economy is healthy and still growing, but at a slower rate. As a result, the Federal Reserve is on hold with respect to increasing interest rates