by Ralph Cole, CFA

Director, Equity Strategy and Portfolio Management

On Thursday, SunTrust Banks and BB&T Corporation announced the biggest bank merger in 10 years. The partnership will create a banking powerhouse in the Mid-Atlantic region and throughout the southeast United States. The current economic expansion has been notable from a slow growth standpoint and also for the lack of bank mergers and acquisitions (M&A). We want to address the reasons for the lack of activity this cycle and surmise what this merger might mean for future bank combinations.

M&A activity has been slower this cycle for several reasons: difficulty in getting approved by the Fed, difficulty in integrating other banks and a risk averse operating mindset post the financial crisis. Many new rules, regulations and reserve requirements have been enacted, with banks managing more than $50 billion in assets actually paying the Federal Reserve to supervise them. This has incentivized banks to stay under the $50 billion asset level or to grow much larger than $50 billion to spread costs over more assets. Also, if these banks didn’t see a high likelihood for M&A approval, they wouldn’t waste the energy and resources doing the due diligence, only to be denied by regulators.

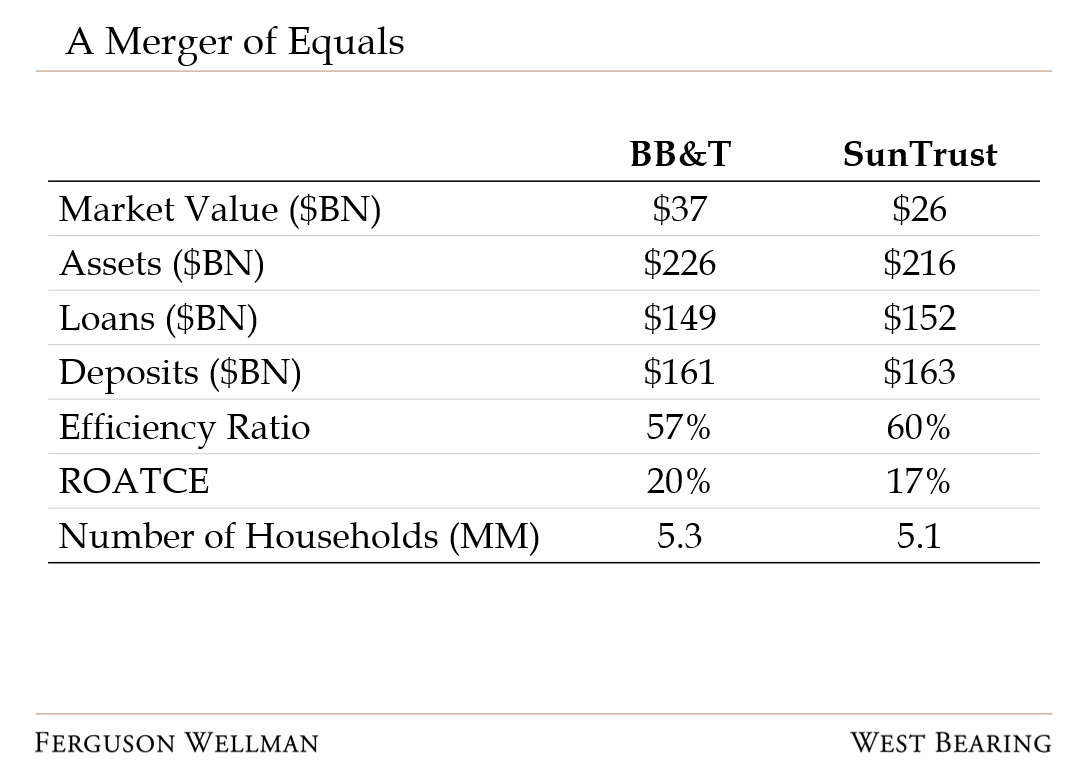

For all intents and purposes, the merger of SunTrust and BB&T is a merger of equals:

Source: BB&T Corporation

This merger is about gaining scale and cutting costs in a low-growth economic environment. Spreading out regulatory cost will be one benefit of the combination and another will be to spread out the massive technology investment necessary for the coming years to compete in an increasingly mobile banking environment. This same technology will make branches even more superfluous and this combination will allow the combined entity to reduce their branch footprint, thereby cutting costs.

These same benefits and costs are being faced by every bank in today’s market. They all see a need to invest in cybersecurity and mobile technology and they also must deal with increased reserve requirements. We would expect more mergers in the future to help compete in this changing environment, but we don’t expect a massive increase. There is still a massive amount of work involved in executing any acquisition and some banks may want to wait until after the next recession to start that process.

Week in Review and Our Takeaways:

Markets took a break this week after a massive run up in January and slowing growth and Chinese/U.S. trade negotiations weighed on stocks this week. The S&P 500 was down .5 percent for the week, while international stocks were down 1.5 percent with weakness in Europe and Japan

The BB&T/SunTrust merger is a blueprint for future M&A activity in the banking industry