by Ralph Cole, CFA

Director, Equity Strategy and Portfolio Management

Focusing on What Matters

It’s hard not to be a little discouraged each night when you watch the evening news. The laundry list of problems facing the markets can seem quite daunting: Fed tightening, slowing growth, dysfunction in Washington, D.C, tariffs, etc. We believe that these are real issues that certainly need to be addressed. When it comes down to it, we tend to be more focused on what business owners and consumers are doing with their money that makes our economy work. When there is confidence in the economy, companies invest in equipment, hire new people and spend money. Confidence tends to feed on itself in both a positive and negative direction.

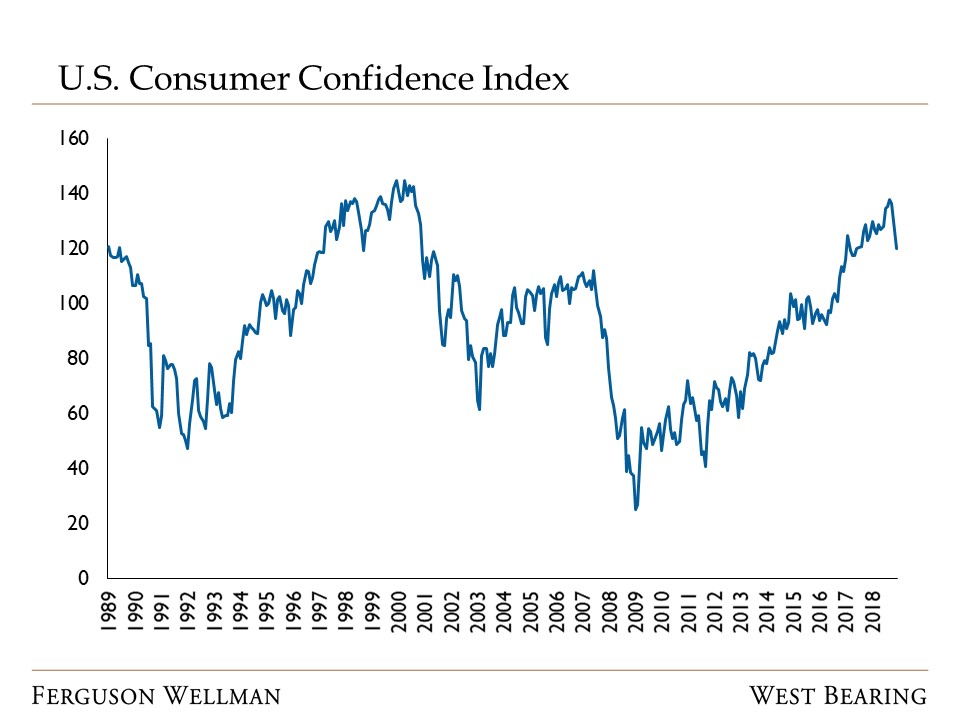

Consumer Confidence Dips

The Conference Board surveys consumers on a monthly basis to gain information on consumer attitudes and buying intentions. Consumer confidence has been steadily gaining ground since the financial crisis of 2008, hitting 20-year highs in November of last year. Since then, we’ve had a sharp selloff and rebound in equity markets as well as a government shutdown. These two events seem to have taken a toll on people’s psyche. While still at relatively high levels, this economic indicator bears watching because it tends to fall consistently prior to recession. According to our research partner, Strategas, consumer confidence peaks about 13 months on average before the start of a recession.

Source: FactSet

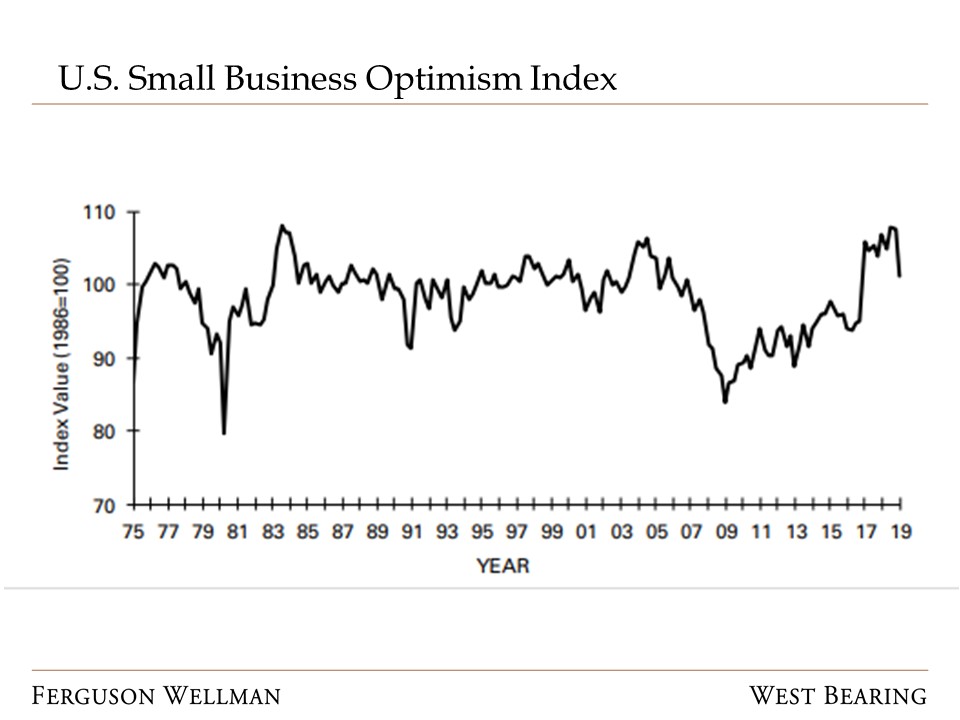

Small Businesses Drive Our Economy

For all the headlines that multinational corporations make, it’s the small businesses that really fuel our economy. According to the Small Business Administration, companies with less than 500 people account for 99.7 percent of all businesses in the U.S. and over 40 percent of the private workforce. They also generate 66 percent of new jobs annually. The Small Business Confidence Index was at an all-time high back in October of last year, but has fallen the last couple of months. Much like the consumer confidence index, small business confidence remains near all-time highs, but without a doubt, recent weakness is important to monitor.

Source: National Federation of Independent Businesses (NFIB)

Week in Review and Our Takeaways

Confidence levels remain near all-time highs, but recent weakness bears watching

Stocks finished the week on a positive note, up about a half-of-a-percent