by Timothy D. Carkin

Senior Vice President

This week, the U.S. Bureau of Labor and Statistics (BLS) released their monthly measurement of inflation: Consumer Price Index (CPI), annualized 2.7 percent, was down 0.2 percent from the month prior. Several clients have mentioned how inflation has impacted their lives to varying degrees; in order to understand these differences in experiences, it is important to consider how the BLS calculates their measurement.

The CPI is meant to be an estimate of the rise or fall in prices of consumer goods and services for primarily urban households. The BLS reviews more than 20 thousand companies and 80 thousand products and services. Because the BLS is unable to receive data on every product every month, they create categories of products and services, estimate the price change using a subset and apply it to the entire category. The BLS then weights each group by their relative importance or “wallet share” to a consumer. In short, the CPI is an estimate of an estimate of the average person’s spending.

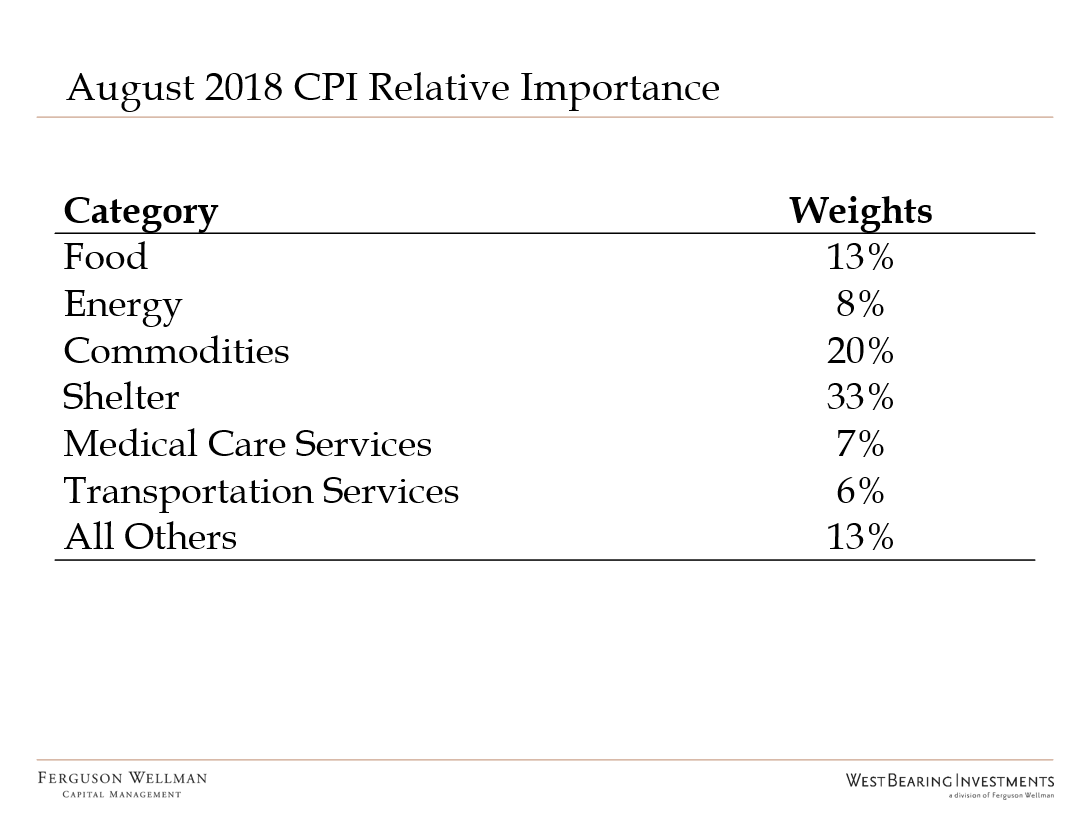

Above are the current weights the BLS applies to each category. Shelter, commodities (apparel, vehicles, etc.) comprise a large portion of the CPI. Knowing this, it is easier to see how people can experience inflation differently. For example, a family with four young children will see inflation in food and shelter (rent or mortgage) as those costs rise. Conversely, a retired couple with no mortgage and no children in the home may be insulated from the same rising costs but could still be impacted by the medical care service category.

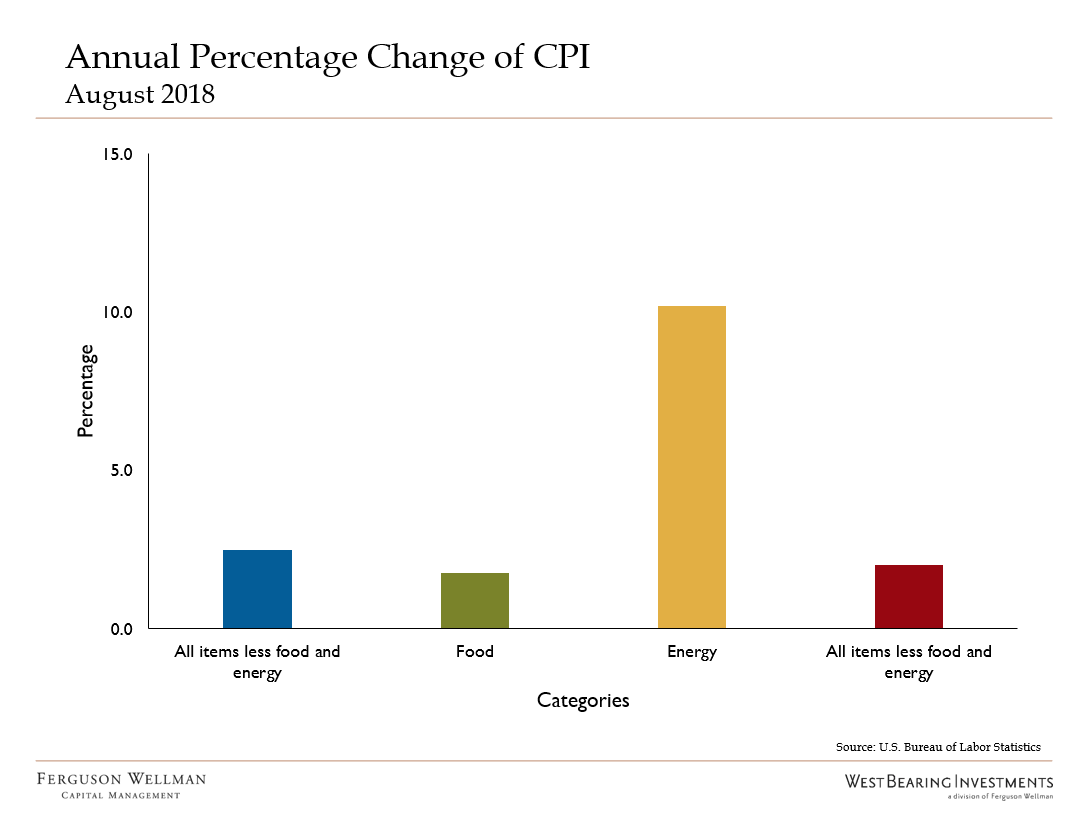

Several categories can exhibit more volatility than others and, because of this, you will occasionally see two CPI’s reported: Core CPI (CPI excluding food and energy) and Headline CPI (total CPI). The former is less volatile, so it is often used by economists. In addition, there is “chained” CPI which replaced a previous version used in calculations for social security and Medicare benefits. The government and businesses use chained CPI as a proxy for cost of living adjustments.

The September reading of the BLS CPI shows a moderation of year-over-year inflation rates for both the Core and Headline CPI. This reading is important to the Federal Reserve, which considers this data point when tightening or easing their inflation policy. It is unlikely that the Fed will alter their current course on rate increases based on September’s data. The annual percentage change of CPI can be seen below.

Source: U.S. Bureau of Labor Statistics

Week in Review

Investors bought the slight dip in stocks causing major indices to rise half a percent this week. In turn, the yield on the 10-year U.S. Treasury closed in on 3 percent, hitting 2.99 percent due to tariff worries. On Friday, retail sales came in lower than expected with a rise of just 0.1 percent but upward revisions to prior months mitigated much of the disappointment.

Takeaways for the Week:

CPI is an average of an average and people can experience inflation differently

Inflation has risen over the past year but moderated in September