by Peter Jones, CFA

Vice President of Research

Since the Tax Cuts and Jobs Act was signed into law on December 22, 2017, pundits and economists have continued to debate if companies would increase their capital expenditures due to the 100-percent-expensing provision in the new tax code. Typically, a portion of company expenses are written-off and the balance depreciated over several years whereas the new code allows for the write-off of the entire expenditure in the year the outlay occurs. While the overall tax liability will remain the same, the front-end loaded tax shield gives businesses a higher rate of return on investment.

Like all expansionary fiscal policy, immediate expensing is thought to provide a boost to economic growth. In theory, individual tax cuts are thought to increase consumer spending whereas increased infrastructure and defense spending creates jobs, thereby leading to higher investment and consumer spending. However, various forms of fiscal stimulus provide differing multiplier effects on GDP. For example, tax cuts for the wealthy do not stimulate economic growth as much as tax cuts for the poor; lower income households have a higher propensity to consume and spend more of their tax savings. Further, tax cuts are thought to provide only a temporary boost to GDP, with less impact on long-term potential growth. Capital spending, however, has proven to have the highest multiplier on GDP.

Over the long term, GDP is a function of employment growth and productivity growth. Employment growth can fluctuate cyclically through changes in unemployment and participation rates, but longer-term growth rates are largely determined by demographics. This makes it difficult to alter the trajectory through fiscal policy. In contrast, productivity increases are brought about via technological innovation and increasing the capital base e.g., new equipment and structures. There is an abundance of data to support the notion that capital spending from businesses increases productivity and, therefore, long-term GDP. One of the primary reasons the current expansion has been weak is that companies have been hesitant to increase spending and alternatively have returned cash flows to shareholders in the form of dividends and share repurchases.

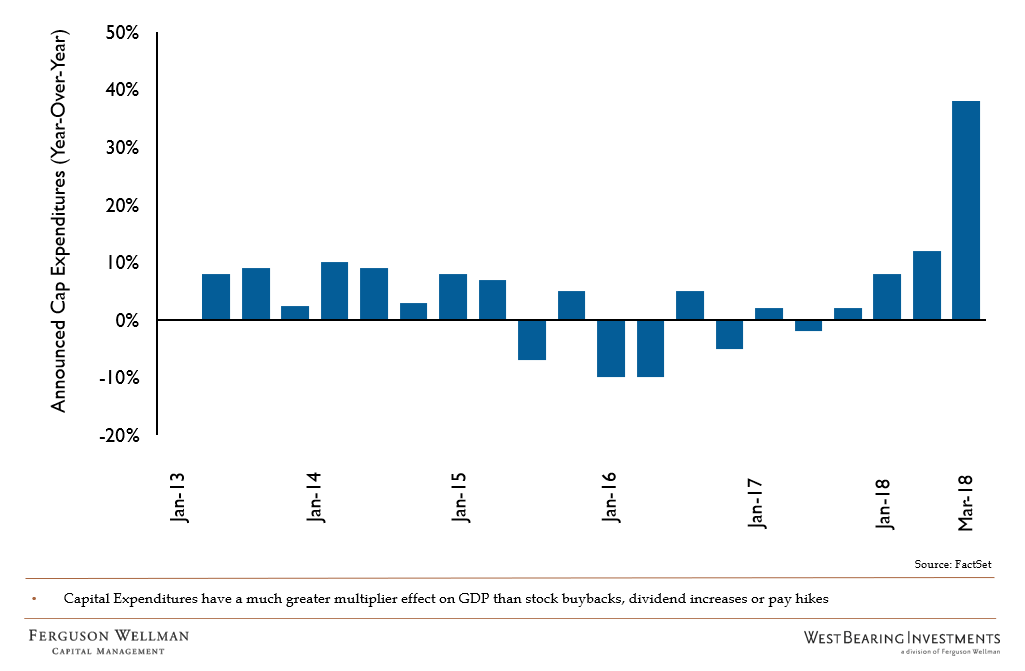

Although still early, there are signs that companies are indeed taking advantage of immediate expensing by increasing capital spending (chart below).

Source: FactSet

While we believe the jump in capital expenditures is partially induced by tax code incentives, we think there is significant pent-up demand for capital investment after an extended period of underinvestment. These two factors are working together to create a bounce in expenditures that we believe will continue for the rest of this year and into 2019.

To take advantage of the boost in business investment, we are overweight both the Industrial and Technology sectors, which benefit most from an uptick in spending. While the bet on industrial stocks has suffered in recent months due to fears around a trade war, we ultimately believe cooler heads will prevail and industrial companies will outperform as their earnings are slated to increase at a faster clip than the overall market.

Week in Review and Our Takeaways

- The S&P 500 increased for the third straight week and sits within 2.5 percent of the January highs

- It was a calm week in the bond markets with rates relatively unchanged

- We are expressing the view that capital spending will continue to increase by maintaining overweight positions to the Industrial and Technology sectors