by Jason Norris, CFA

Executive Vice President of Research

Week in Review

Trade concerns weighed on stocks this week resulting in a 1 percent decline for the S&P 500, and the Dow Jones Industrial Average falling close to 2 percent. Large-cap industrial stocks have taken the brunt of the pain due to their exposure to export markets, as well as increasing steel and aluminum costs due to recent tariffs. Small-cap stocks bucked the trend with the Russell 2000 posting a slight gain.

The Gift of the “Trade Rhetoric”

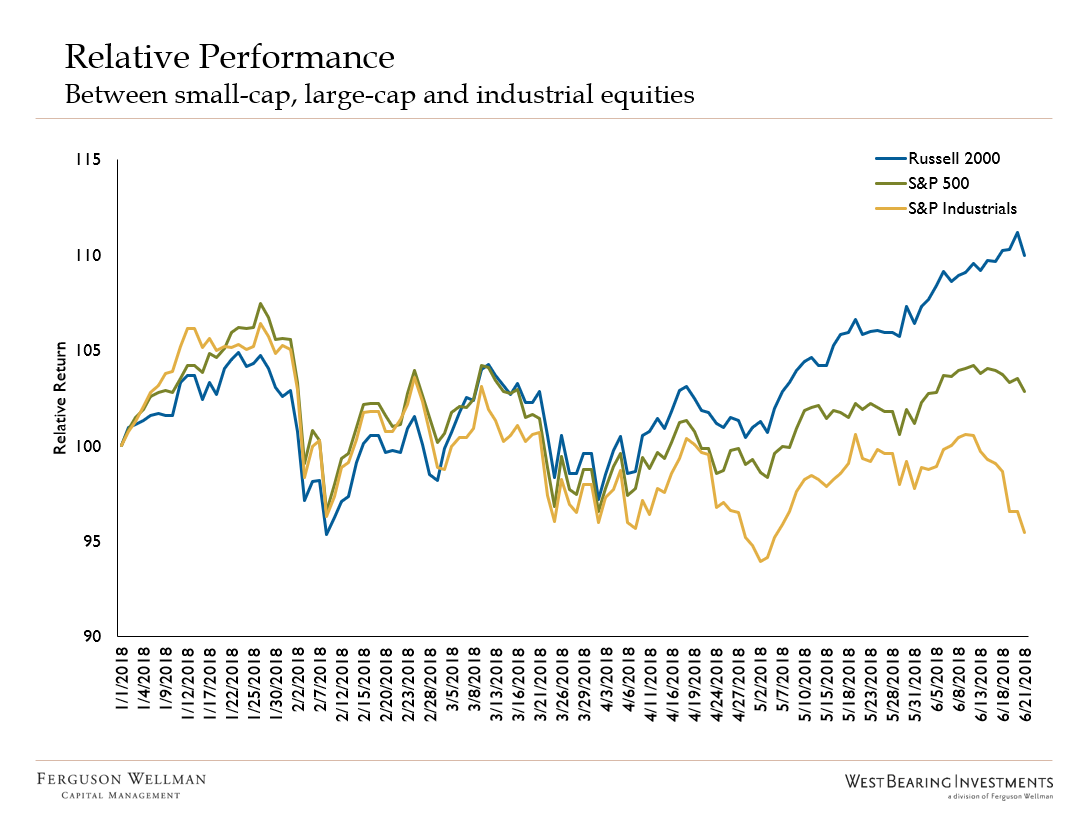

As trade rhetoric increases, certain sectors of the market disproportionately feel the effects. We started the year favoring the large-cap industrials equities sector due to their exposure to global economic growth. Examples of companies in this sector include Boeing, Honeywell, and United Technologies. Due to U.S.-imposed tariffs on aluminum and steel coupled with the fear of retaliation, these stocks have recently lagged meaningfully. The chart below shows the relative performance between the S&P 500 industrials sector, the S&P 500 and the Russell 2000 Index year-to-date.

Source: Factset

Up until April, the three groups of stocks were performing similarly. As the trade rhetoric increased, investors began to move money into small-cap stocks with the perceived notion that they have less foreign exposure and sold the Industrials, which in turn brought down the S&P 500. While there is a perceived view that small-cap stocks have minimal international exposure, this is not the case. In fact, 25 percent of the S&P 500 revenues are outside of the U.S. and the Russell 2000 has 20 percent*. Additionally, companies in both indices rely on a global supply chain, thus trade disputes will affect companies in both.

While small-cap stocks have recently been strong, we believe the magnitude of the recent outperformance is not warranted. It’s too early to sell the large-cap industrials and buy small-cap stocks and we are hopeful that the U.S., China and other trading partners come to a reasonable decision.

The Boy Who Cried “Tariff”

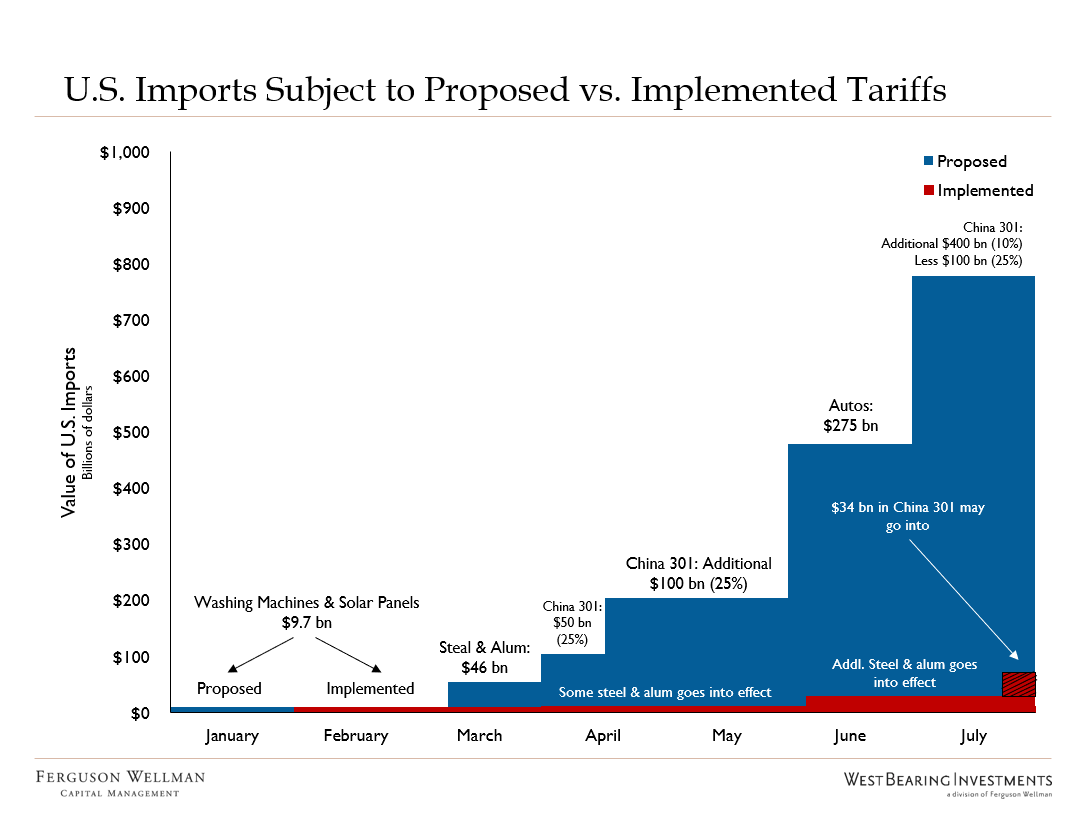

For perspective, while the Trump administration has announced billions of dollars’ worth of tariffs, but the vast majority have not yet taken effect. The chart below from Goldman Sachs highlights the proposed tariffs and what has been enacted.

Source: USITC, Goldman Sachs Global Investment Research

We have only seen major price increases on washing machines and Canadian lumber, both of which were affected by implemented tariffs. However, the prices on some goods have already been affected by the anticipation of tariff changes. For example, spot aluminum prices are up 10 percent in the U.S. since April and soybean prices are down 15 percent due to fears of Chinese retaliation.

In the long term, tit-for-tat actions on trade would result in increasing costs for U.S. consumers and less access for U.S. company exports. In fact, an increase in global tariffs is a net negative for all nations.

Takeaways for the Week

We wouldn’t be selling industrials in this uncertainty believing global growth will trump short-term rhetoric

A prolonged trade war will have negative effects on both U.S. consumers and U.S. companies, which will slow economic growth

*Citigroup research