by Shawn Narancich, CFA

Executive Vice President of Research

Week in Review

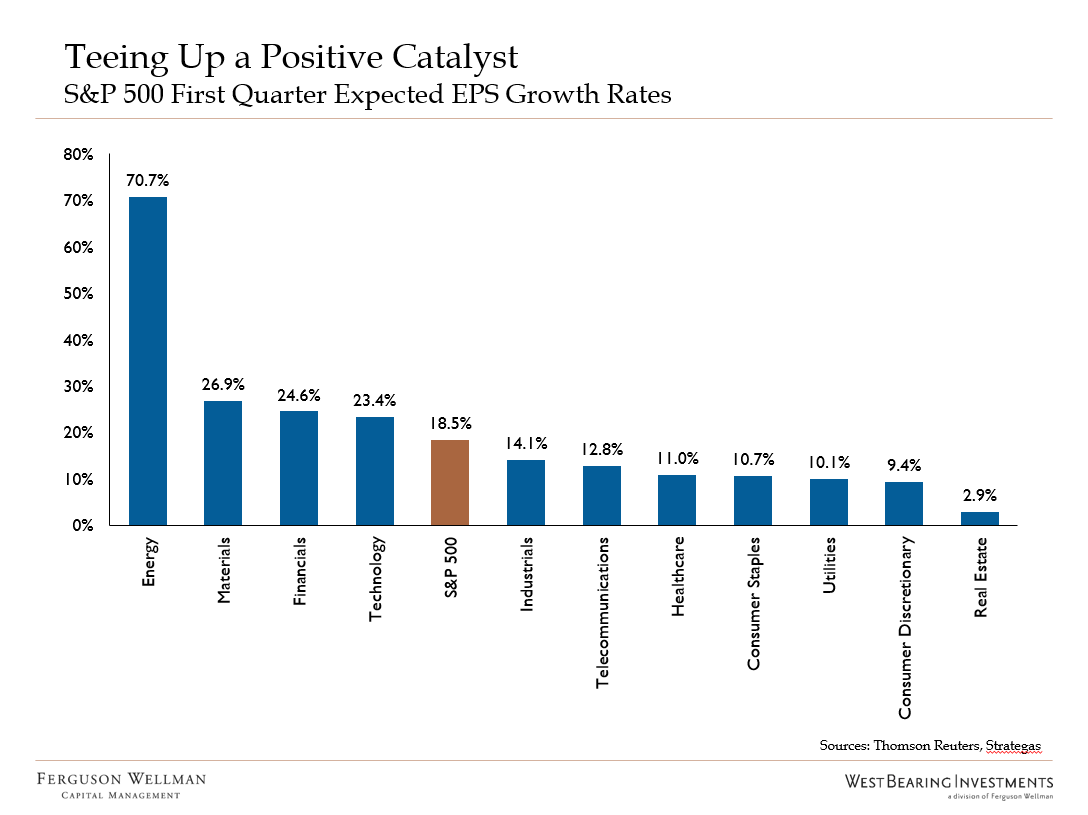

With this week’s latest rebound, the S&P 500 has now closed up or down more than 1 percent 27 times year-to-date ‒ this is more than three times the daily volatility that investors experienced in 2017. Accompanying higher stock prices, safe-haven bonds retreated modestly. While continuing uncertainty about trade policy and geopolitical risk are contributing factors to price swings, investors are now beginning to look forward to something more fundamental ‒ first quarter earnings. A shift in focus may be just what stocks need to break out of their recent trading range. As the chart below depicts, earnings for the S&P 500 are anticipated to rise to a “high-teens” percentage, with leadership from the commodity sectors, technology, and financials.

Sources: Thomson Reuters, Strategas

Banks in the Spotlight

True to form, the major banks kicked off earnings season this week, with Citigroup, JP Morgan and Wells Fargo all reporting today. JP Morgan’s results exceeded expectations, with 44 percent earnings growth benefitting from rising net interest income, lower than expected credit costs and favorable lending margins. On the other hand, Citi and Wells Fargo came up a bit short. Investor reaction to all three reports was downbeat, as 3 percent average declines for these blue-chip banks erased gains made earlier in the week. We will see a full array of money center and regional banks reporting results next week, headlined by Bank of America and Goldman Sachs.

Oil Back to Mid-Cycle Pricing

The tallest bar in the earnings chart above is energy, and for good reason. Oil markets have tightened like we predicted, with the oft-cited inventory overhang having now disappeared. With benchmark oil pricing at $67 to $72 per barrel, we look forward to producers and service companies across the energy business reporting what should be increasingly robust earnings.

Proving that it’s easier to model production volumes in Wall Street spreadsheets than to physically deliver oil to Houston, Texas, frack sand deliveries in the past several months have been delayed in the Permian Basin. This and a lack of pipeline capacity out of Canada are symptomatic of a North American oil industry increasingly challenged to deliver production growth. Logistical challenges reflect tight labor and equipment markets that we believe are underappreciated by investors.

While some worry about electric vehicles displacing oil demand and a seemingly endless supply of U.S. production capping oil prices, we see an oil market at risk of overtightening. Amid ongoing production declines in Mexico, China and Southeast Asia, Venezuelan oil production is in freefall. As for the production cutbacks successfully engineered by OPEC and Russia, our belief is that foregone volumes of oil will need to be eased back into production sometime later this year, lest inventories fall too far and oil prices spike. Against this backdrop, our clients are overweight energy companies set to benefit from increasingly robust oil prices and led by management teams with the operational acumen to navigate industry challenges.

Takeaways for the Week

- Equity volatility endures as investors begin to parse first quarter earnings

- Tighter oil markets have boosted prices to three-and-a-half-year highs