by Ralph Cole, CFA

Executive Vice President

Week in Review

The S&P 500 was up nearly 1 percent again this week as economic data continues to confirm a growing economy. An underwhelming jobs report on Friday took yields on 10-year U.S. Treasuries to a new low on the year of 2.15 percent.

As was widely reported, President Trump announced his intention of the U.S. leaving the Paris Accord. Markets had no reaction to the news; however, we will continue to monitor the impact on the global markets.

Changing of the Guard

For the last several years it has felt like the U.S. economy was alone in pulling the global economy forward. While nearly all developed countries were employing extraordinary monetary easing, it seemed to only be working in the U.S. As our own Central Bank has begun tightening, it appears that other countries’ growth may be starting to accelerate, if only at the margin.

U.S. growth continues to muddle along at around a 2 percent rate. The Eurozone composite PMI hit a post-economic crisis high in May, and growth is improving in 2017. In April it was reported that Japan’s industrial production grew at its fastest pace in six years. This change at the margin has had a dramatic effect on interest rates here in the U.S. and on the dollar.

Interest rates rose in anticipation of Republican growth initiatives in the fourth quarter. As those policy discussions have been pushed out, rates here in the U.S. have fallen. As growth expectations here in the U.S. have fallen, and growth expectations in the rest of the world have picked up, it has led to a weakening dollar. The U.S. dollar is down a little over 5 percent versus other world currencies year-to-date. This has two major effects: one, it makes U.S. foreign profits more valuable. Two, it improves returns of international investments.

At the beginning of the year we were wary on how much further U.S. markets could run without the support of corporate earnings. The S&P 500 experienced virtually no earnings growth in 2015 or 2016, yet the market was up 13 percent. We felt that this disconnect was unsustainable. Earnings were strong in the first quarter, growing 14 percent year-over-year. With over 40 percent of multi-national profits sourced overseas, the weak dollar is another tailwind to earnings. This should provide additional support to stock prices in coming quarters.

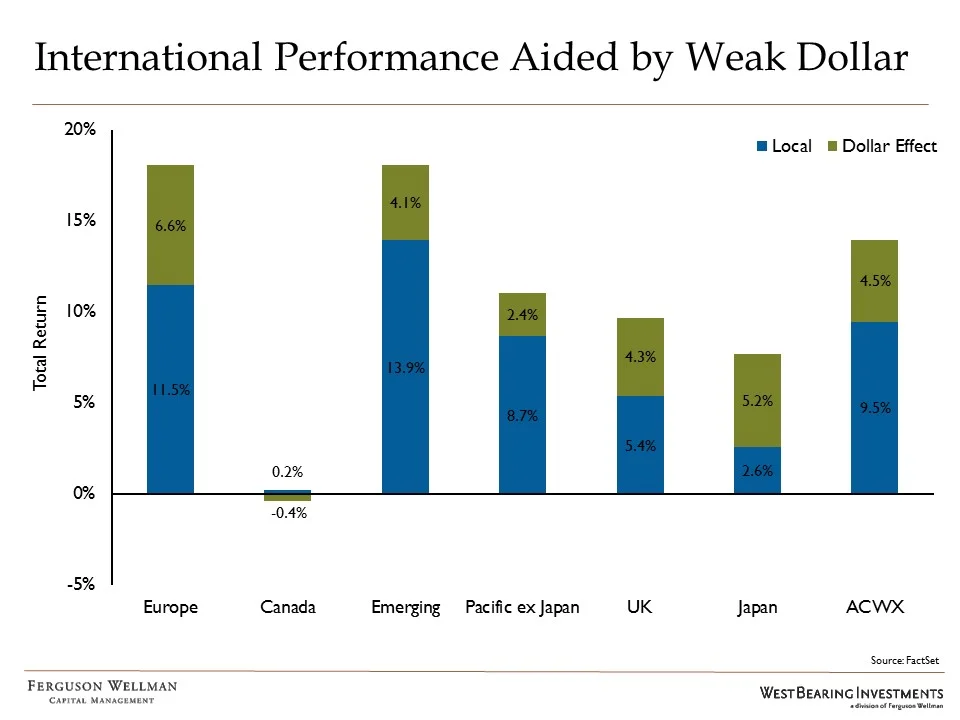

The weak dollar has also been a boon to U.S. investors allocated to international equities. While in local terms the ACWI ex U.S. has outpaced the S&P 500 by about 1 percent, stronger international currencies have added 4.5 percent to those returns.

Takeaways for the Week:

- Increased growth around the world will support a more sustainable global expansion

- The weak dollar has benefited U.S. investors allocated internationally