by Ralph Cole

Executive Vice President of Research

The Week in Review

It was another solid week in the markets. The S&P 500 was up almost 1 percent to record highs. Interest rates were relatively quiet with the 10-year Treasury finishing the week yielding 2.40 percent. Oil rallied modestly and is now up to $54.00 per barrel.

The Yin and Yang of It All

It is hard to reconcile the daily news flow with the new highs that we are seeing in the stock market. The angst felt by many over the new administration is juxtaposed to the booming confidence numbers that we are seeing … from everyday consumers to CEOs. To bring it to the view from our offices (literally), the ongoing remodel and construction of nearby hotels is set against weekly protests on our streets.

As investors, we are the bridge between the news and the markets for our clients. We must be laser-focused on what we think is really happening and cut through the amount of information that is thrown at all of us every day. Our job is to apply the long-term benefits of investing to client portfolios and be patient no matter what side of the political aisle our clients find themselves. In these times of mixed crosscurrents, we remain focused on the fundamentals of the economy and the markets, along with the risk and reward represented by each asset class.

Is the Earnings Recession Over?

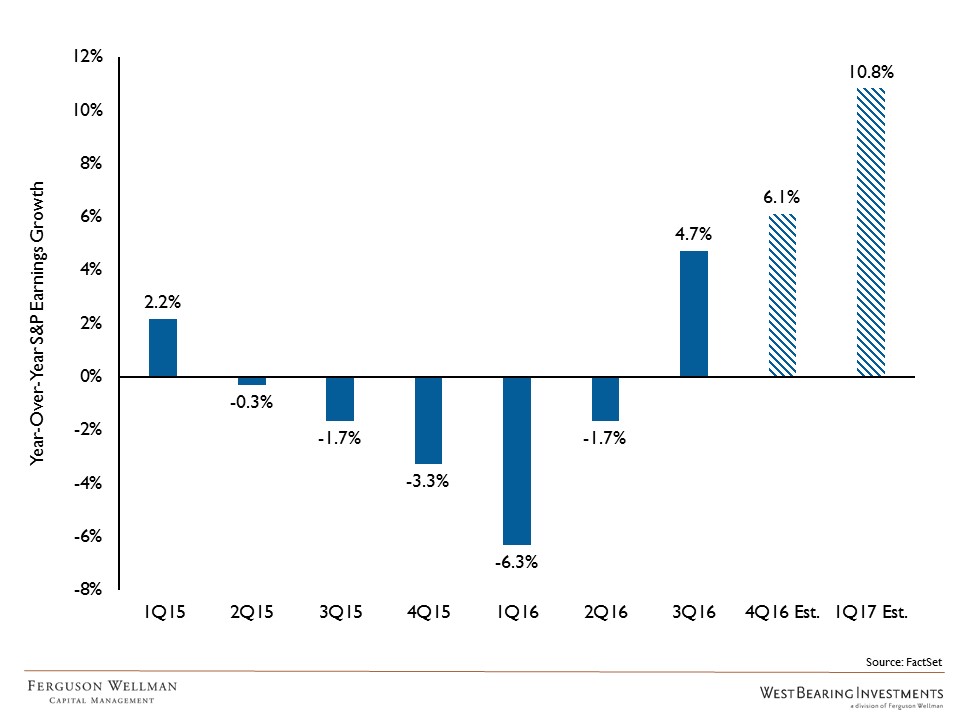

S&P 500 earnings have been in a holding pattern the past couple of years. Nearly all the returns for stocks in 2016 and 2017 can be explained by multiple expansion, meaning that investors have been willing to pay more and more for a dollar of earnings. If the market is going to move higher in 2017, we feel that earnings must begin growing this year. The chart below seems to show that the earnings recession is indeed over ending in the third quarter of last year.

Year-Over-Year Change in Quarterly Earnings for the S&P 500

Current estimates for S&P 500 earnings in 2017 are for 11 percent growth, which is likely too high from our vantage point. We believe that U.S. and global growth will continue to accelerate this year, which should deliver 5-to-7 percent earnings growth in 2017.

Our Takeaways for the Week

· Short-term noise can make long-term investing difficult

· The earnings recession for the S&P 500 is over