by Jason Norris, CFA

Executive Vice President of Research

Week in Review

Stocks finished the last week of December relatively flat resulting in a 20+ percent total return for the S&P 500 for 2017. Interest rates were steady with the yield on the 10-year U.S. Treasury ending the year at 2.41 percent, down slightly from a year ago.

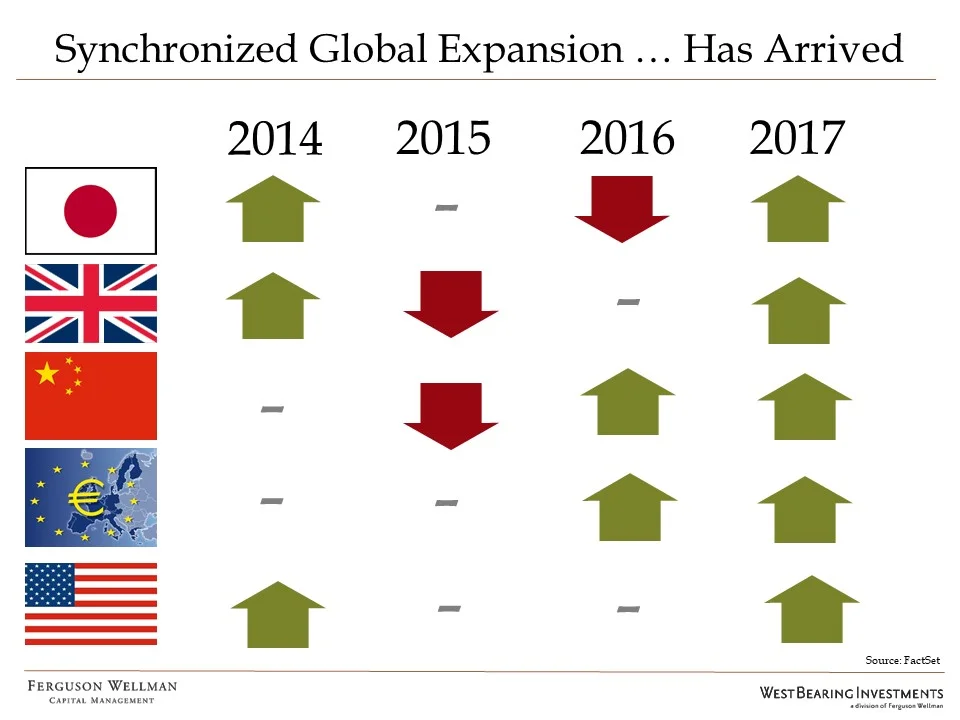

Can we get a repeat of 2017 in 2018? The economic data offers support. This week the Chicago Purchasing Manager’s Index (PMI) hit its highest level since 2011. While the national PMI will be released next week, this data reinforces our view that global economic growth will continue to accelerate. The chart below highlights the synchronized expansion we are experiencing.

This global growth should continue to support corporate earnings in 2018. However, we do anticipate volatility to increase as the Federal Reserve stays on their path of raising interest rates. This will actually be a return to the norm from a relatively stable 2017. A year ago, the last thing investors would have expected was stability; however, that is what we received in 2017. The CBOE Market Volatility Index (VIX) sits at historically low levels. Also, we have not seen a market correction of over 5 percent since June 2016. This is not the norm. Historically, the S&P 500 will fall over 10 percent in any given year. Therefore, when a correction occurs, investors must be mindful that this is common in history. What is important though is deciphering what the correction is signaling to investors. The chart below shows the average correction and recovery time in recessions and non-recessionary periods.

With healthy economic growth, we believe any correction that may occur in early 2018 would be short and shallow, rather than signaling a recession. Regardless, we are watching the Fed during this tightening cycle and what impact it may have on the economy in 2019.

At this time, we remain bullish on equities in 2018, but returns may be half of what we saw in 2017 as rising interest rates act as a headwind to robust earnings growth.

Come Bite the Apple

The highly anticipated launch of the Apple iPhone X may not live up to expectations. Data points out of Southeast Asia earlier this week signaled weaker than expected demand for the $1000+ smartphone. There has been a lot of hype in the media about some of the new features in the new iPhone; however, the price tag may be a bit too high to drive the demand a lot of investors were anticipating, especially in emerging markets. Apple will report earnings in late January and at that time we will know if these data points were accurate or just noise.

Takeaways for the Week

- U.S. economic growth remains strong

- Volatility remains extraordinarily low and a correction is overdue