by Jason Norris, CFA

Executive Vice President of Research

The Friday jobs report was slightly on the light side with December payrolls coming in at 156,000, which was 19,000 below economist’s estimates. Positively, the previous two months showed 19,000 in upward revisions. However, wages grew at their highest rate since June 2009, coming in at 2.9 percent year-over-year growth. One theme in the December report was that employers said that they are finding it more difficult to find workers. As the labor market has tightened, especially among skilled workers, employers have had to increase pay to find and retain the best talent. The continued improvement in wages pushed the 10-year Treasury yield up 0.07 percent to 2.42 percent. We believe this report reinforces the Federal Reserve view of two to three rate hikes in 2017.

Three large retailers did not see the consumers’ money this holiday season. Macy’s, Kohl's and Sears all reported a poor holiday season. On top of the poor sales, Macy’s announced they will be closing over 60 stores in 2017 and Sears will be closing 150. The shift in the retail market has been a slow train wreck with the main winner being Amazon, with secondary runner-ups in the likes of T.J. Maxx and Burlington. This table from Morgan Stanley highlights the shift in apparel sales over the last five years.

(AMZN-Amazon.com, WMT-Walmart, ROST-Ross Stores, TJX-T.J. Maxx, BURL-Burlington, TGT-Target, KSS-Kohls, M-Macys, JCP-JC Penny, SHLD-Sears Kmart)

Finally, credit default spreads (basically a security instrument on fixed income insurance) show a 45 percent likelihood that Sears defaults in the next two years.

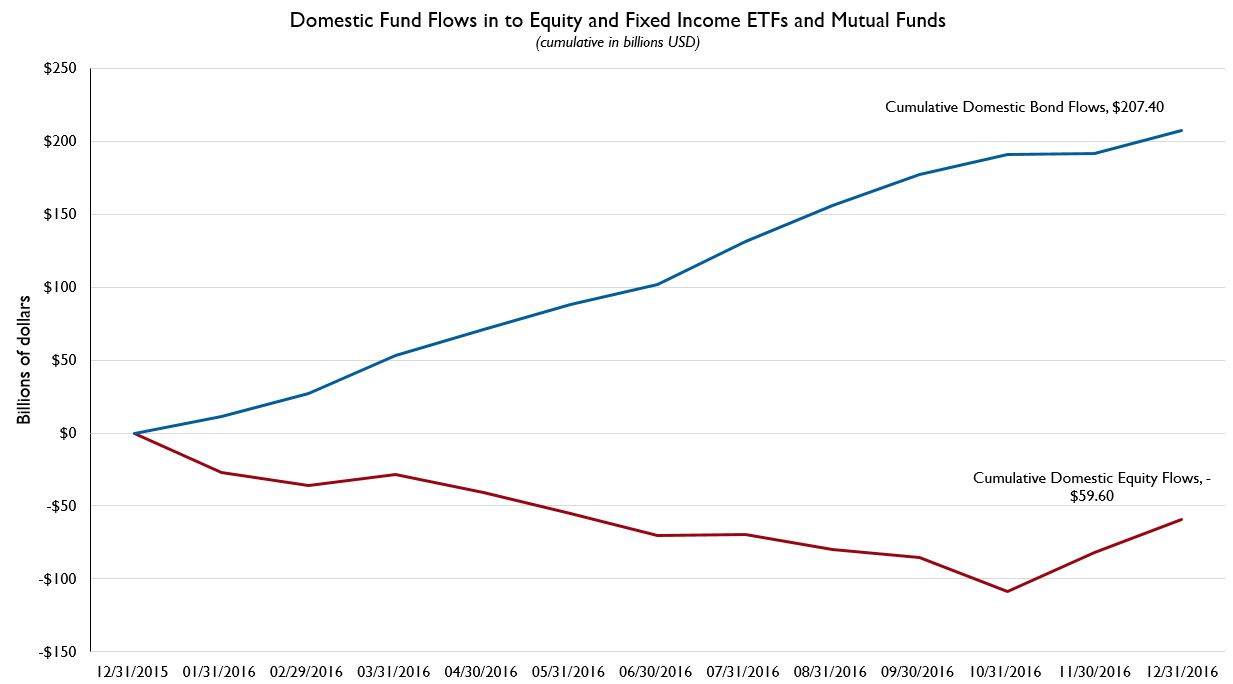

For the majority of 2016, the equity markets did not see any investor money. Through the first 10 months of 2016, investors sold over $108 billion in equity ETFs and mutual funds shifting it into low-yielding bond funds. However, as the chart below highlights, November and December saw a huge reversal as investors bought equities.

Source: ICI Research

We have been arguing for years that this nine-year bull market has been underowned and the end of 2016 highlighted that theory.

Our Takeaways for the Week

· The U.S. labor market continues to exhibit solid gains supporting higher interest rates

· The retail environment is going to look meaningfully different by the end of this decade