by Brad Houle, CFA

Executive Vice President

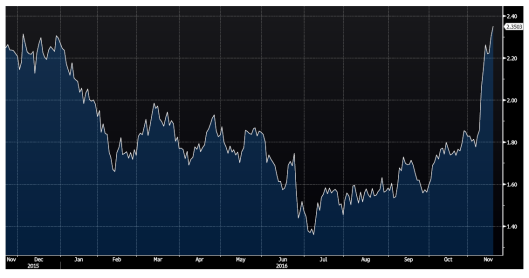

This week the markets continued to digest the election news in an attempt to understand how the changes in government will impact the economy and markets. Stocks were up a bit less than one percent this week and bond yields continued to grind higher with longer-term bonds up about .10 percent in yield.

Source: Bloomberg

Following the election last week the bond market has sold off, due to speculation about President-elect Trump’s economic policies possibly causing faster growth and higher inflation. Bond prices and yields move inversely to one another so when bond prices decline yields move up. Inflation is the enemy of the bond market, because bonds have fixed payments and if inflation increases unexpectedly it erodes the value of fixed bond payments.

Too much or too little inflation is a bad thing. Excess inflation, such as was experienced in the late 1970s in the United States, or hyperinflation that often occurs in developing nations can create an environment where costs spiral out of control. Conversely, deflation is also a negative scenario. In the case of deflation, prices continually drop and as a result consumption also drops as consumers wait for lower prices. Japan has suffered from this condition to some degree for the last decade and is attempting to climb out of deflation via aggressive economic stimulus.

When inflation expectations rise and bonds sell off the term “bond vigilantes” is often used in the media to describe the market activity. Essentially “bond vigilantes” describe investors that either refuse to buy bonds issued by a government or actively sell bonds issued by a government. At its extreme, it is a reaction by the investment community that it is displeased by the economic policies of a government. In the 1990s, the bond market aggressively sold off in reaction to some of President Bill Clinton’s domestic economic policies. He was even quoted as saying, “You mean to tell me that the success of the economic program and my reelection hinges on the Federal Reserve and a bunch of (expletive) bond traders?”

While interest rates have moved higher since the election and inflation expectations have moved higher slow growth still plagues much of the developed world. Low yields beyond the United States should keep our interest rates from climbing sharply. Interest rates have reacted in a similar fashion abroad and the silver lining of this change in interest rates is that there is now about $8.7 trillion in negative yielding debt in the world – down from $12 trillion earlier in the year. Governments abroad are realizing that low interest rates can only help so much and that negative interest rates actually hurt as opposed to help an economy.

The bond vigilantes at work today are fairly subdued compared to other times in history. Bond yields were moving higher prior to the election based upon the bond market anticipating the Federal Reserve moving short-term bond yields higher and a small tick-up in inflation. The move up in interest rates in response to the election has brought the U.S. 10-year Treasury close to where it began the year. How the new government’s policies actually impact the economy and interest rates remains to be seen.

Our Takeaway for the Week:

It is too soon to know what the longer-term impact will be with the change in political landscape. Markets have moved very fast in an attempt to anticipate what is unknowable at this point.