by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

Flying High Again

Earlier this week Democratic presidential candidate Hillary Clinton announced several healthcare proposals. The focus was to propose policies that aim to keep the price of drugs down. This was on the heels of a specialty drug price for AIDS being raised over 5000 percent from $13.50/tablet to $750 that has since been reduced. However, these proposals highlight the concerns over drug pricing, specifically specialty pharma drugs.

Clinton’s plan would attempt to cap the prices paid for Medicare recipients, increasing drug re-importation, reducing the patent exclusivity for biologics and getting rid of the tax deduction for advertising spending. Although many of these proposals have been presented in some form in the past, headlines were not friendly to the healthcare sector. Since disclosing her proposals, the pharma and biotech industries have fallen over 3 percent. Names that have high priced biologics, such as Gilead Science for Hepatitis C, fell even more. Despite viewing this as an overreaction for a variety of reasons, due to the headline risk, we are not in a big hurry to put new money back to work in the sector.

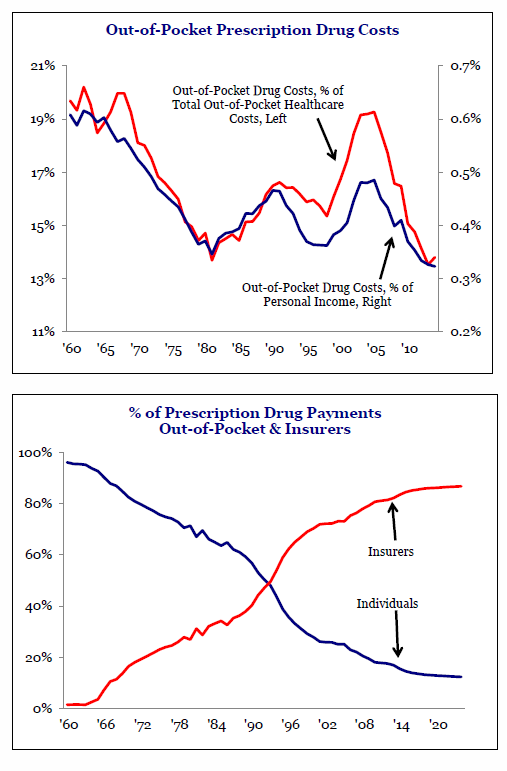

While drug costs are rising and patients are becoming more frustrated with this phenomenon, out-of-pocket costs are at historic lows for consumers. Drug payments are increasingly being paid out by the insurers (see charts).

Even if Clinton is elected president, expectations are for the House to remain to the right, thus making it very difficult for any of her proposals to be enacted. The Republicans may be willing to negotiate something on drug pricing but it will probably have to come with broader entitlement reform. Right now it is too early to tell but headlines may reign as we move into the election season.

While insurance providers are paying an ever increasing amount of drug costs they continue to be active in minimizing this expense and are increasingly considering the total cost of treatment. I was able to meet with a handful of insurance companies over the last week and discuss their focus on the total cost of care and preventative medicine. If a drug is very expensive and it can cure a disease that was previously just maintained, they will be inclined to pay for it (i.e., Hep C). Also, they are increasing their focus on compliance and general health with the belief that this will decrease healthcare costs over the life of the patient. The monitoring of vital statistics (blood pressure, cholesterol, weight, etc.) should lead to lower longer-term health spending.

We still believe the healthcare sector offers some great opportunities but headlines will keep volatility elevated.

Our Takeaways for the Week

- Drug pricing headlines will continue to add volatility to the sector

- Health insurers are increasingly focusing on the total cost of treatment to manage costs