by Brad Houle, CFA

Senior Vice President

by Brad Houle, CFA

Senior Vice President

In the not-so-distant past, Twitter was solely known as a bullhorn for celebrities, such as Paris Hilton, who would extol their wisdom – 140 characters at a time – to tens of millions of followers. Global events over the past year have catapulted Twitter into an unprecedented aspect of mainstream media – both as a lifesaving resource and a weapon for destructive pranks and rumors.

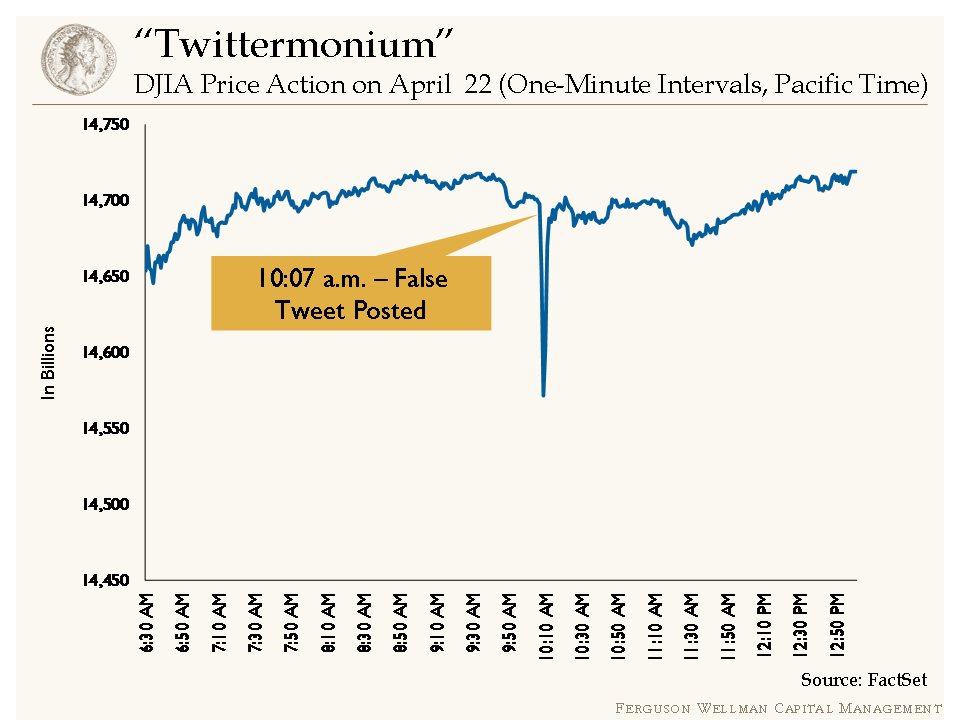

Last year, Twitter was part of electronic communication that facilitated the Arab Spring and just last week, it was used by police to inform Boston-area citizens of public safety issues following the marathon bombings. In addition, federal securities regulators have allowed the use of Twitter and Facebook as a means to disseminate potentially market-making news. On Tuesday, equity markets plunged 1 percent in three minutes due to an erroneous Associated Press tweet indicating that there were two explosions at the White House, causing injury to President Obama. The Associated Press quickly announced that their Twitter account had been hacked and the markets quickly recovered from its pandemonium. This incident exposes the razor’s edge that financial markets are on relative to news dissemination. Algorithmic and high-speed trading quickly takes over without any real evaluation of changing conditions.

Last year, Twitter was part of electronic communication that facilitated the Arab Spring and just last week, it was used by police to inform Boston-area citizens of public safety issues following the marathon bombings. In addition, federal securities regulators have allowed the use of Twitter and Facebook as a means to disseminate potentially market-making news. On Tuesday, equity markets plunged 1 percent in three minutes due to an erroneous Associated Press tweet indicating that there were two explosions at the White House, causing injury to President Obama. The Associated Press quickly announced that their Twitter account had been hacked and the markets quickly recovered from its pandemonium. This incident exposes the razor’s edge that financial markets are on relative to news dissemination. Algorithmic and high-speed trading quickly takes over without any real evaluation of changing conditions.

This incident is reminiscent of the flash crash that occurred nearly three years ago on May 6, 2010, when the Dow Jones Industrial Average (DJIA) fell almost 1,000 points intra-day and recovered most of its loss before the close. This “crash” was the result of selling pressure from quantitative investors, as well as high-frequency trading that fed on itself. Having only begun to recoup the losses of 2008, investor confidence in the markets was rattled by this volatility as there was a growing suspicion among investors that the “game was rigged.”

This lack of confidence in the equity markets can be observed in the difference between fund flows into both equity and fixed income mutual funds. From the market bottom in March of 2009 to the end of the first quarter of 2013, investors have plowed greater than $1 trillion into bond funds and withdrawn more than $500 million from equity funds. In the first quarter this year fund flows into equity funds have turned modestly positive. While market indexes flirt with all-time highs, retail investors are largely on the sidelines in bonds or cash.

This lack of confidence in the equity markets can be observed in the difference between fund flows into both equity and fixed income mutual funds. From the market bottom in March of 2009 to the end of the first quarter of 2013, investors have plowed greater than $1 trillion into bond funds and withdrawn more than $500 million from equity funds. In the first quarter this year fund flows into equity funds have turned modestly positive. While market indexes flirt with all-time highs, retail investors are largely on the sidelines in bonds or cash.

In other market-maker news, it was a busy week for earnings releases. With the earnings season nearly half over, the largest takeaway is that results are mixed at best. Earnings have generally exceeded expectations and revenue growth that has been largely disappointing.

Our Takeaways from the Week

- This is in an environment with low expectations where company guidance was cautious coming into the quarter

- Guidance for next quarter and the remainder of the year has also been weak