2013 Annual Report

Deidra Krys-Rusoff Quoted in Bloomberg Business News

Bloomberg Business Week Detroit Pension Proposal Would Shut Out New Hires

September 27, 2013

By Corey Williams

Hoping to stanch some of the red ink flowing from Detroit, its emergency manager is riling the workforce with a proposal to close the city's pension plans to new employees by the end of the year and move the city to a 401(k)-style system that has become the norm in the private sector.

Detroit's underfunded obligations of about $3.5 billion for pensions and $5.7 billion for retiree health coverage are part of the city's $18 billion debt load and a major reason emergency manager Kevyn Orr filed for bankruptcy protection in July.

Now, he wants to end pensions for new employees and freeze benefits to about 18,000 members. Non-taxable annuity savings will be closed to new employees and no future contributions would be accepted after Orr's proposed Dec. 31 "freeze date."

Non-vested active system members also will be frozen out by Dec. 31.

"They took my wages and now they're trying to take my pension," said Mike Mulholland, vice president of American Federation of State, City and Municipal Employees. "All of our people are saying 'what are they doing to us?'

"We've already given concession after concession, and now to be asked to give up more and be put in a defined contribution plan ... they want to force us to take something where we have no security when we retire."

Orr's pension plan has to be approved by Michigan Treasurer Andy Dillon and is one of the strongest challenges to unions in the one-time organized labor stronghold.

It also is likely to continue the parade of court challenges by union leaders who say changes to pensions and bargained health care benefits violate Michigan's Constitution.

But Orr counters that federal bankruptcy law trumps state law.

James McTevia, a Detroit-area turnaround expert, said he is not aware of a previous ruling on the matter, but adds it's clear what Orr is trying to do.

"He is following the natural process for a reorganization," said McTevia, of McTevia and Associates. "That sets up a mechanism to make changes to the entity's debt structure. If the city doesn't have the money to pay (into the pensions), what difference does the law make? If the city can't do it, it can't do it. That contract has to be rejected and another contract has to be entered into."

A draft of the pension proposal was given last week to the General Retirement System, which represents about 20,500 active and retired city workers. AFSCME Council 25 spokesman Ed McNeil said unions have not received the draft.

In it, the city also would contribute five percent of the base pay of non-uniformed workers to the 401-type pension plan.

Overtime, bonuses and longevity pay will not be factored into compensation as they have been in the past. The city will make no contributions to a deferred compensation plan in which participant contributions and earnings on retirement money are tax-deferred.

A separate plan for police and fire retirees still is being worked on and has not been presented to that pension system, said Bill Nowling, a spokesman for Orr.

"But it will be similar" to the General Retirement System plan, Nowling said.

The police and fire system has nearly 12,700 members.

The pension systems, city unions and individual retirees are fighting Orr in bankruptcy court. They don't believe he has proved Detroit is insolvent and complain that he hasn't bargained in good faith.

Mary Estell, a retired Department of Public Works employee, receives a pension of about $2,300 per month after 32 years with the city. She realizes the likelihood of getting more is unlikely.

"At this point, there is nothing we can do," Estell said of Orr's pension plan. "The city doesn't have any money, so we won't get any increase. If the bankruptcy doesn't go through, then maybe there's a chance we will get an increase in the future."

Orr's plan does not say how much would be saved, according to a draft of the proposal.

A spokeswoman for the pension system says officials still are studying the plan. "It really just caught us completely off guard," said Tina Bassett. "It was the first time we saw it."

But any changes could take as long as two decades to make a dent in how Detroit's long-term debt is structured, according to Michael Sweet, a bankruptcy attorney with Fox-Rothschild.

Moving from a defined benefit to a defined contribution plan "isn't going to change the savings tomorrow," Sweet said.

"Kevyn Orr is working on all sorts of different things. One is to address the short term issues and deal with the longer term imbalance of the budget."

Private companies long ago starting shedding plans that relied heavily on employer contributions in favor of those where workers decide how much of their pay they want socked away. As cities and states continue to buckle under the pension and health care liabilities, elected leaders are pushing for similar changes.

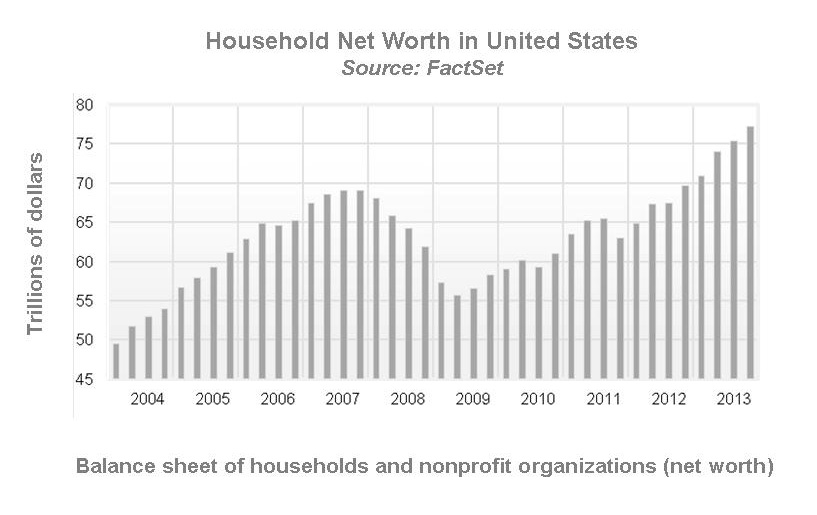

"Something has to be done because the pensions are extremely expensive and with the aging demographic, those costs just keep going up," said Deidra Krys-Rusoff, a portfolio manager with Ferguson Wellman, an Oregon-based capital management firm.

Christmas Comes Early … and Late

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Melt with You

It feels like the market is melting up these days as stocks continued their year-long rise during the shortened holiday week. Investors continue to be heartened by positive economic data signaling stronger growth as we enter 2014. Durable goods orders were up 3.5 percent in November with automobiles, airplanes and refrigerators helping drive end demand. Also, new home sales remain robust with record-setting sale prices. Both of these data points hit on some important topics for our 2014 Investment Outlook. Specifically, we think demand for capital equipment will finally accelerate in 2014 due to underinvestment and substantial cash balances on corporate and consumer balance sheets. Furthermore, consumers are increasing their spending as a result of the “wealth effect” that has been fueled by increased home and stock prices.

Crosstown Traffic

Our investment team has been writing for some time about the shift to online shopping and this trend came to a head this week for Amazon and UPS. For those of us who like to start shopping closer to Christmas, Amazon Prime© seems like the perfect solution. For an annual fee of $79.00, Amazon provides two-day free shipping on most merchandise. We don’t think anyone is surprised to learn that we live in an era of procrastinating techno-geeks who wait until the last minute to ship gifts. This time, the sheer volume of orders overwhelmed both Amazon and UPS. Though UPS has not stated how many packages were affected, the number seems to be in the hundreds of thousands. While both Amazon and UPS are doing what they can to satisfy customers, the real story is the volume shift to cyberspace. Amazon signed up over 1 million additional Prime© customers in the third week of Christmas alone. This is a nice development for Amazon because these shoppers tend to spend twice as much in a given year as those who don’t have Amazon Prime©.

Our Takeaways for the Week

- Christmas week was just another reason for investors to keep bidding up stock prices

- Interest rates continue to move slowly higher on Fed taper talk

The Birth of the Fed

Posted by Lori Flexer, CFA

Executive Vice President

Posted by Lori Flexer, CFA

Executive Vice President

100 years ago today, the Federal Reserve was formed. NPR's Planet Money shares the fascinating beginnings of this important institution. Click here for the full story.

Note: Clicking on this link will take you to a third-party website. The information provided by this site is not endorsed or guaranteed by Ferguson Wellman. Disclosures

Early Christmas Gifts

by Shawn Narancich, CFA

Executive Vice President of Research

by Shawn Narancich, CFA

Executive Vice President of Research

Early Christmas Gifts

In what turned out to be a surprisingly action-packed week before Christmas, the markets finally shook off the shackles of worry concerning what would happen when the Fed began tapering its program of quantitative easing (QE). Bernanke proved that he’s no lame duck chairman and investors learned that stocks can still go up despite a slightly less accommodative Fed. In reducing monthly purchases of Treasury and mortgage-backed bonds by $10 billion per month, our central bank is acknowledging a slowly improving labor market and an expanding economy that is being boosted by several key drivers: a renaissance in U.S. energy production and manufacturing and, increasingly, the wealth effect of rising house and stock prices that is giving a nice lift to consumer spending. Looking ahead, we expect incoming Fed Chair Janet Yellen to continue what Bernanke started. Our view is that further reductions to QE will be commensurate with continued improvement in labor markets, subject as always to the Fed’s other key mandate—keeping inflation low.

Always a Bear Market Somewhere

In stark contrast to stock prices that are once again setting new highs, gold prices have fallen substantially. After attracting increasing amounts of attention as a hedge against monetary dislocation and unchecked growth in the money supply, gold is increasingly being abandoned by investors now more attracted to robust stock market returns and, for those with a lower risk tolerance, bonds that are now offering real rates of return. From its high in August 2011, gold is now down 36 percent. It may be pretty to look at, but with the Fed now in the early stages of unwinding QE, it has lost its shine.

Blue Burner

Sticking to the commodity theme, one key source of energy whose price is going the opposite direction is natural gas. Much maligned by investors because of its seeming ubiquity, the front-month contract is up 31 percent since August. Cold weather has boosted the demand for natural gas, one of the nation’s most common sources of home heating. Weather vicissitudes aside, we like the longer-term demand case for the cleaner burning fuel to take market share of electricity generation from its dirtier cousin coal. Will gas currently priced for $4.40 per-million-BTUs go to $5.50? In the short-term, probably not, because the prolific shale fields in Pennsylvania, Wyoming and Texas will induce considerably more production if prices continue to rise.

Nevertheless, key suppliers can make a lot of money with natural gas prices in the $4.00 to $5.00 range. More importantly, our economy should increasingly benefit from using low cost natural gas and natural gas liquids to generate cheaper power and manufacture plastics. In the latter case, low cost ethane, propane and butane feedstocks are displacing oil-based naptha, incenting major chemical companies like Dow and the petrochemical arm of Shell to locate plastic manufacturing facilities stateside. The beneficial result for America is new jobs, additional exports, and healthier levels of GDP growth.

In this festive season, we wish all our friends and clients a Merry Christmas and a very happy and healthy new year.

Our Takeaways from the Week

- Investors took the start of Fed tapering in stride, as stocks rallied to new highs

- A continued flow of encouraging economic data points to faster GDP growth in 2014

Oregon Jewish Life Magazine Writes Article About West Bearing Investments

Josh Frankel Takes West Bearing by the Horns Oregon Jewish Life Magazine

By Deborah Moon

December 2013

Since 1975 Ferguson Wellman Capital Management has managed investment accounts for clients who have portfolios of at least $2 million, a level that has caused them to turn away many prospective clients and then compete for those same investors a few years down the road.

Now Josh Frankel has joined the firm to lead West Bearing Investments; this new division of Ferguson Wellman caters to clients with $750,000 or more in their investment portfolios. By Sept. 30, the new firm had $25 million in assets under management – a goal they didn’t foresee reaching until the end of the year.

“We are a boutique agency with $3.6 billion in assets under management,” says Mary A. Faulkner, Ferguson Wellman vice president in charge of communications. She says the firm decided on a growth strategy to enable them to start relationships with clients earlier in their investment journey.

Josh says he grew up in a traditional Jewish family in a large Jewish community in Los Angeles before attending the University of Oregon, where he was a field goal kicker for the Ducks and discovered Hillel. “For the next several years, folks at Hillel were a big part of my Jewish experience in college and are still some of my greatest friends today,” he says. Now he is the board president of the Greater Portland Hillel. Josh has also served on numerous boards and committees in the Jewish community including B’nai B’rith Camp, Oregon Jewish Community Foundation, Cedar Sinai Park and Mittleman Jewish Community Center. He co-chaired the Jewish Federation of Greater Portland campaign kickoff event in 2011. Since Ferguson Wellman encourages all employees to take leadership roles on boards they feel passionate about, it’s not surprising that Josh met some of his future co-workers while serving on a board.

“They called me in May to talk about this new venture,” says Josh. “I’m such a community-driven person that working for a local, employee-owned company seems too good to be true.” About 90% of employees are stakeholders in the firm, which may help account for the fact that no portfolio manager has left the firm in the past 24 years. “He interviewed with about 18 people,” says Faulkner. “He was one of our first unanimous hires. … We wanted someone who understood our culture. Of all those we interviewed, Josh asked the most questions about the client experience, and that really stood out for us.”

Ferguson Wellman CEO Jim Rudd agrees. “Josh fits hand in glove with the professional people we have in the company. He has clients’ best interests first and foremost. And he has a network … Josh Frankel’s name is well known,” says Rudd. West Bearing, like Ferguson Wellman, will focus on long-term relationships with clients. “Consistency, reliability and continuity are more than words, they are our bedrock,” says Rudd. After he was hired as senior vice president and portfolio manager in July, Josh recruited Jorge Chavarria, with whom he had worked at Merrill Lynch, to join him at West Bearing. The two serve as portfolio managers who can draw on the full resources of Ferguson Wellman. “We never wanted West Bearing to feel like Ferguson Wellman Lite,” says Faulkner, who added the division was created to serve new clients. “We have some clients who have drawn down their assets (in retirement). We won’t move them over to West Bearing. This is to start new relationships.”

She adds that West Bearing will have access to all of Ferguson Wellman’s analysts and other resources. “It’s all under one roof. This is his team he is working with,” she says. And it is an impressive team. This year Forbes named Ferguson Wellman Capital Management 40th in the “RIA Giants” category of the Top Fifty Wealth Managers list. The data for the rankings are provided by Registered Investment Advisors Database and are based on the total discretionary assets under management.

“My goal is to help people understand their goals, put together a game plan and monitor that plan over time,” says Josh. Faulkner says she is also impressed by Josh’s devotion to his family. “His spouse is a doctor, so Josh has equal responsibility.” In 2008 Josh and his wife, Amy, moved to Portland for Amy’s residency at OHSU. Dr. Amy Swerdlin Frankel is a board-certified dermatologist with the Providence Medical Group. Their son, Ethan, is 14 months old. Josh says their dog Rocky, a Labradoodle, bears a striking resemblance to West Bearing’s logo – an American bison. The division’s name and logo were chosen to serve as an inspiration for West Bearing. The company literature explains: “Most animals in the West attempt to outrun inclement weather, prolonging their exposure to the elements and weakening their condition. Bison instinctively turn to face the storm. By bearing west, they successfully find the quickest path to clear skies.

Ferguson Wellman Capital Management Recognized as One of Portland Business Journal’s Most Admired Companies

Ferguson Wellman Capital Management is pleased to announce that the firm has been named by the Portland Business Journal as one of the Most Admired Companies. Of the 10 financial services companies listed, the firm was ranked third, with Umpqua Bank being first place. There were a total of 151 companies nominated in the financial services category. Ferguson Wellman was also voted 18th across all categories. This is the ninth consecutive year that the company has made this exclusive list. The list is compiled by surveying over 3,000 CEOs across the state of Oregon and southwest Washington. The CEOs were asked to select two companies they most admired in eight industries. They were also asked to rate the two companies they selected in each category on the following attributes: (1) innovation (2) quality of services or products (3) community involvement and (4) quality of management and (5) branding and marketing.

“We were honored to have been selected, along with many other companies that we respect and admire throughout the state,” said Steve Holwerda, CFA, chief operating officer and principal.

Founded in 1975, Ferguson Wellman Capital Management is a privately owned investment advisory firm, established in the Pacific Northwest. With more than 600 clients, the firm manages $3.6 billion in assets that comprise union and corporate retirement plans; endowments and foundations; and individuals. (as of 9/30/13)

Black Friday Magic

by Jason Norris, CFA

Senior Vice President of Research

by Jason Norris, CFA

Senior Vice President of Research

Good Mourning Black Friday, Welcome Cyber Monday

Black Friday shopping numbers were not much to write home about, but it is uncertain if it is the state of the consumer or the “expansion” of Thanksgiving weekend specials to the day of turkey day or even before. Thirty-three percent of “Black Friday” shopping occurred on Thursday, up from 13 percent in 2011. Over the entire weekend, traffic remained healthy; however, sales were a bit below expectations (up 2.3 percent) and would have been negative if not for 15 percent growth in online sales over the weekend. The weakness was most notable in the Northeast.

The other phenomenon is the growth of Cyber Monday. Online sales that day (the Monday following Thanksgiving weekend) were up over 19 percent and are projected to be up 15 percent this holiday season. Online sales will account for 14 percent of the $600 billion expected to be spent this season. While Amazon.com continues to be the main beneficiary of this trend, valuation metrics can’t get us excited about the stock, but as consumers we continue to benefit.

Learning to Fly

Speaking of Amazon, its CEO Jeff Bezos was interviewed on 60 Minutes and pulled off a great publicity stunt to keep the e-commerce retailer in the news all week. If you haven’t already heard, Mr. Bezos announced that Amazon was looking at using unmanned drones to deliver packages. While Amazon has a reputation of being a visionary and willing to invest in growth, the near-term applications of this announcement seem more or less PR rather than delivery. We just hope it doesn’t get to the point where our kids can’t enjoy the snow during the holidays because they will have to be avoiding all the Amazon package deliveries from the sky.

Detroit Rock City

Looks like we are witnessing a slow motion car accident with the approval of a federal bankruptcy filing by the city of Detroit. Deidra Krys-Rusoff, Ferguson Wellman’s municipal bond analyst and portfolio manager, believes that with U.S. Bankruptcy Judge Steven Rhodes ruling that Detroit is eligible to file for bankruptcy protection it may permit them to emerge from $18 billion of debt. This ruling grants the city the power to establish a financial plan which will allow the city to provide public services while meeting adjusted debt obligations. Judge Rhodes also ruled that pensions may be adjusted under federal bankruptcy, despite the fact that Michigan’s constitution does not allow for cuts to established pension obligations. This ruling may permit the trimming of pensions and retirement benefits, taking away the “protected” status usually afforded to the plans and placing them on an equal platform to other creditors (such as bondholders). We expect unions to fully challenge this decision, and the local union has already filed an appeal.

We believe that this event is isolated and should not have an overarching effect on the muni market. Any way you look at it though, this may end the same way as the 1976 classic song at some parties.

Stagefright

This week was the 17th anniversary of FED Chairman Greenspan’s “irrational exuberance” speech, and investors are anxious for what to expect in 2014 after a 25 percent+ move in equities this year. While this week we have seen some weakness in stocks as rates have risen, we still don’t foresee a major sell off. Putting history in context, in the bull market run from 1990 through 1996, equities DID NOT have a 10 percent correction, and we didn’t peak until March 2000. We are not saying that history will repeat itself, but with the U.S. economy improving and inflation remaining tepid, we would be buyers of equities on any major pullback.

Our Takeaways for the Week:

- Even though stocks have run, we are still constructive on equities

- Any weakness in the municipal bond market should be seen as a buying opportunity for quality muni bonds.

West Bearing Investments Continues to Thrive

West Bearing Investments Continues to Thrive

Ferguson Wellman Capital Management is pleased to share the growth of West Bearing Investments, a division of Ferguson Wellman. After only five months in operation, West Bearing has reached the 2013 target for assets under management with $25 million. Many sources for these clients have been referrals from Ferguson Wellman clients and employees, accountants, attorneys and referrals from our friends at Charles Schwab and Umpqua Private Bank.

West Bearing Investments quietly launched in July 2013 after a year of internal exploration of a new growth strategy. The division was formally announced in the fall of 2013. West Bearing Investments was inspired by the opportunity to broaden client relationships and help individuals and institutions navigate through many important planning and financial decisions earlier. West Bearing serves clients with a minimum of $750,000 in investable assets and benefits from the investment principles, structure and expertise of Ferguson Wellman.

The West Bearing team is led by Josh Frankel, CRPC©, senior vice president. Frankel brings a range of professional experiences that enable him to provide a high level of client service and guidance on investment management and planning. Also part of the West Bearing team is Jorge Chavarria, who has over 10 years of client service experience in the financial industry and proactively guides clients and their portfolio managers toward best practices that foster strong relationships.

Founded in 1975, Ferguson Wellman Capital Management is a privately owned investment advisory firm, established in the Pacific Northwest. With more than 600 clients, the firm manages $3.6 billion in assets that comprise union and corporate retirement plans; endowments and foundations; and individuals. Minimum account size: $2 million. (as of 9/30/13)

Giving Thanks

by Shawn Narancich, CFA

Senior Vice President of Research

by Shawn Narancich, CFA

Senior Vice President of Research

Early Christmas Gifts

Another week, another record close. With both the S&P 500 Index and Dow Industrials breaking into new record territory, equity investors have much to be thankful for as they celebrated the Thanksgiving holiday and began to ponder full year returns that are shaping up to be the best in fifteen years. Trading volumes slowed to a crawl in typical holiday week fashion, with fewer investors around to digest a relatively light slate of news flow.

A Quiet Time

Those manning their desks were left to digest new housing data that showed a drop-off in October pending home sales juxtaposed against another strong Case-Schiller report, which showed house prices nationally up over 13 percent in September. For us, the tie-breaker was new residential housing permits for October, which rose 6.6 percent sequentially, to annualized levels exceeding one million units. While new apartment complexes drove the gains, permitting for single-family homes also rose, an encouraging development given the political upheaval that occurred last month. Housing has been a key driver of the U.S. expansion to date, and remains vital to our expectations for economic growth next year. In turn, interest rates on the 10-year Treasury are a key input to setting mortgage rates. As such, the Fed is paying close attention to them as it considers its next move. Tapering QE too soon or too quickly could spook bond investors, causing prices to fall and mortgage rates to rise. With housing data more mixed recently, this is the type of outcome the Fed is attempting to avoid, and a key reason why we think policy makers will err on the dovish side.

Black Friday (Thursday?)

Whether Santa Claus will deliver a Christmas bounty or a lump of coal to retailers is yet to be seen, but judging by the overflowing crowds seen at key shopping venues like Wal-Mart and Best Buy, shoppers’ enthusiasm for a deal is as strong as ever, incenting some to venture out as early as Thanksgiving Day. Estimates for holiday sales growth seem to be settling out around the 3-4 percent level, but the question as always for retailing investors is the price at which those sales transact. In addition to the level of sales growth, investors will attempt to discern the profitability of those sales, and the underlying gross margin data does not typically arrive until retailers report their financial results in late February. As indicated in last week’s web log, we believe the best success will be had by those focused on either the high-end or low-end, with general merchandisers like Kohl’s and Target caught betwixt and between.

That said, we bid our readers happy shopping on this Black Friday, so named for the day’s typically heavy selling pace that can swing retailers from losses to profits for the year. Moreover, we wish our clients and friends a peaceful and most enjoyable holiday season!

Our Takeaways from the Week

- Amid low trading volumes, stocks scaled new heights in a holiday shortened week

- Retailers are in the spotlight as the Christmas selling season begins

Gaining Elevation

by Shawn Narancich, CFA

Senior Vice President of Research

by Shawn Narancich, CFA

Senior Vice President of Research

Dow 16,000

A slow growth, low inflation environment that continues to enable highly accommodative monetary policy remains a recipe for stock market success. With year-to-date gains now topping 25 percent on the S&P 500, the venerable Dow surpassed another 1,000 point threshold as key equity benchmarks forge further into record territory. With retailers book-ending third quarter earnings season this week, investor attention is being redirected back to the global economy, where key U.S. reports continue to indicate the possibility but not likely the probability that the Fed will begin tapering its program of quantitative easing before year-end. Domestic inflation decelerated for the third consecutive month in October, to an annual rate of 1.0 percent not seen since deflation beset the economy in 2009. With next to no wage pressure and a domestic energy boom keeping natural gas and oil prices well contained, incoming Fed Chair Janet Yellen can afford to be patient. Will Ben Bernanke presiding over his next-to-last FOMC meeting next month steal her thunder? Barring a surprisingly strong November jobs report, probably not. Those betting on an early taper would point to last month’s better than expected payroll gains and this week’s surprisingly strong retail sales report, in which strong auto sales, restaurant spending, and furniture sales drove better-than-expected 3.9 percent growth.

Crystal Clear

While retail sales were surprisingly robust in an October disadvantaged by the partial government shutdown, investors are clearly witnessing a case in which a rising tide is not lifting all boats. In the plus column is Home Depot, which posted U.S. same-store sales exceeding 8 percent for its fiscal third quarter. For a retailer with $80 billion of yearly sales, such growth is impressive and speaks to where consumers are spending – on durable goods like washing machines and new carpet for a typical house that now has home equity. Where consumers are not spending as much is in categories like apparel and center aisle grocery, negatively impacting the likes of Target and packaged food companies Campbell Soup and JM Smucker. In contrast to another beat-and-raise quarter from Depot, each of the aforementioned fell short of investor expectations, with the stocks being summarily punished.

Winners and Losers

In an environment of muted wage gains and still elevated unemployment, consumers are increasingly price sensitive, but in contrast to past economic cycles, technology has enabled them to be smarter shoppers. Armed with smart phones able to compare prices across retailers and internet sites at the touch of an app, bricks-and-mortar retailers like Best Buy are having to offer price matching (think deals on Amazon) to keep up with online competitors. While Best Buy’s stock has performed spectacularly this year (up 231 percent year to date), it suffered a setback earlier this week because same-store sales missed expectations and the company warned of a heavily promotional holiday season.

Our final observation from the land of retail would be the high-end, low-end dichotomy. We expect the Nordstroms and Louis Vuittons of the world to post much healthier Christmas sales than general merchandisers like Wal-Mart, Target, and Kohl’s, reflecting lower rates of unemployment for college educated, upper income shoppers and record stock prices that are having a beneficial impact on higher-end spending.

Our Takeaways from the Week

- Stocks are setting new highs amid a benign economic backdrop

- Retailers concluded the third quarter earnings season, reporting mixed results

Ferguson Wellman's Tim Carkin Celebrates 10 Years

Ferguson Wellman Capital Management is happy to announce that Timothy D. Carkin, CAIA, CMT, has reached the important milestone of his 10th anniversary milestone at the firm. Carkin heads our trading and operations departments and is a member of the investment team. He also serves as an analyst for our firm’s alternative investments team and Strategic Opportunities investment strategy.

Carkin began as a trading associate but has had several promotions during his tenure at Ferguson Wellman. He consistently presents ideas for more efficient processes and best practices. Carkin holds the firm’s record for most “You Made It Happen” awards, a yearly internal recognition of employees that best embody the firm’s core values.

Carkin also represents Ferguson Wellman well throughout the community. He is involved with the City of Sherwood Budget Committee, Educational Recreation Adventures organization and the Oregon Council on Economic Education.

Ch-ch-ch-ch-changes

by Ralph Cole, CFA

Senior Vice President of Research

by Ralph Cole, CFA

Senior Vice President of Research

If the hearings yesterday on Capitol Hill are any indication, Janet Yellen should have smooth sailing to her confirmation as our next Federal Reserve Chairman. She was clear and concise in her answers, and conveyed a clear understanding of the job at hand. She gave the capital markets confidence that there would be no unsettling changes to current policy, while comforting legislators' concerns by stating the Federal Reserve’s oversight of banks would become a higher priority during her tenure. After reading her testimony, we believe that further improvement in employment will lead to tapering sometime in the first quarter of next year.

Not So Fast My Friend

A contrite President Obama stood in front of reporters yesterday and admitted that the administration had fumbled the roll out of “Obamacare” (the Affordable Care Act). Because of ongoing website problems individuals have found it nearly impossible to sign up for coverage online. In response, the administration has relaxed some deadlines, which will simply delay the implementation of the Affordable Care Act. As such, we are maintaining our current strategy for the healthcare sector, which focuses on companies that benefit from an increased volume in healthcare services, because with more people covered by insurance, more services will be used.

Tiny Bubbles?

As of this writing, the S&P 500 index and S&P earnings stand at all-time highs. When Janet Yellen was asked during her testimony about bubbles in the stock market, she asserted that on most valuation metrics, the stock market is far from bubble territory. That said, the zero interest rate policy that the Fed is currently maintaining may ultimately cause a bubble. The last two recessions were caused by the dot-com bubble and the real estate bubble. As investors, it is important that we keep a vigilant watch for the next potential bubble… At this point we don’t see one on the horizon.

Takeaways for the week

- Janet Yellen will almost certainly be confirmed as the first female Federal Reserve Chair

- While stocks continue to set new highs, valuations remain reasonable

Shifting the Gears of Focus

by Shawn Narancich, CFA

Senior Vice President of Research

by Shawn Narancich, CFA

Senior Vice President of Research

Super Mario?

As the sun begins to set on third quarter earnings season, investors are increasingly turning their attention back to the broader economy. With regard to key data, this week provided plenty to ponder. Mario Draghi’s surprising decision to cut short-term rates in Europe speaks to the European Central Bank’s concern about last week’s surprisingly low inflation reading, which has spawned talk about potential deflation on the Continent. And while the U.S. administration may not like the fact that Germany generates half its GDP from exports, the likes of BMW and Siemens must have been raising a toast to the resulting drop in the euro, which promises to make German exports that much more competitive. Only time will tell if more aggressive actions might be necessary in Europe, but from a monetary policy standpoint, the ECB retains more dry powder (reducing the rate that the central bank pays on excess bank reserves, quantitative easing, etc) than its U.S. counterpart, which has already spared no dollar in an attempt to stimulate the economy.

Less than Meets the Eye

As the Fed ponders its next move, investors got their first dose of the third quarter GDP data, which showed that the U.S. economy grew at a surprisingly robust 2.8 percent rate. Peeling back the onion, the underlying detail paints a less rosy picture—consumption spending up a lackluster 1.5 percent and reduced levels of capital spending more indicative of an economy growing at a slower pace. After subtracting a build-up of business inventories, real final sales rose by that not-so-magical number of 2 percent that investors have grown increasingly accustomed to seeing from the U.S. economy.

Taper Talk

Juxtaposed against the uninspiring GDP data was Friday’s payroll report which was surprisingly robust. Despite the early October government shutdown, the economy added a net 204,000 jobs to nonfarm payrolls during the month, boosted by hiring in the manufacturing sector and better hiring trends in retail, leisure and hospitality. The response from financial markets was mostly predictable, as bonds fell, gold declined and the dollar strengthened—all in anticipation of the Fed tapering its program of quantitative easing sooner than otherwise expected. What is encouraging to us was the reaction by equity investors, who bid stocks higher to close the week. As we have indicated in past commentary, when the Fed does begin to taper, it will be for the right reasons.

Our Takeaways from the Week

- With nearly 90 percent of large U.S. companies having reported, an acceptable third quarter earnings season is drawing to a close

- Despite added volatility, stocks remain well bid in a rising interest rate environment

Jason D. Norris, CFA, Quoted in Barron's Magazine

Raking in Returns By Jack Willoughby

October 19, 2013

America’s money managers expect stocks to rise 7% from now through the middle of next year. They like Europe, tech shares and real estate, not bonds. Memo to Ben: It’s time to taper.

Whew! It's back to business in Washington after a 16-day government shutdown. And it's back to business on Wall Street—the business of buying stocks, that is.

Markets cheered the news last week that Congress had finally come to its senses, or what passes for the same, in reaching a deal to lift the U.S. debt ceiling and send government workers back to their posts. The Dow rallied 1.4% on Wednesday, and 1% on the week, to 15,399, and the Standard & Poor's 500 rose 2.4%, to a new high of 1744.

America's money managers had a strong hunch things would work out on Capitol Hill, at least for now, and they told us so in their largely upbeat responses to our fall Big Money poll. Sixty-eight percent of participants, representing a cross section of the nation's professional investors, declared themselves bullish or very bullish about the stock market's prospects through the middle of next year, evidence that they see no lasting damage from Washington's latest drama.

"The government shutdown is near-term noise for investors," said Jason Norris, senior vice president of research at Portland, Ore.–based Ferguson Wellman Capital Management, in the days before the deal was announced. "A few months from now, we'll be looking back at what could well be a good buying opportunity. We like that there are a lot of skeptics out there. It means the stock trade isn't crowded."

Robert Turner, chairman of Turner Investments in Berwyn, Pa., calls this "the most joyless" bull market in history, given the doubts attendant to every point rise in the Dow. But you won't find much hand-wringing in his office, as he expects strength in corporate fundamentals to persist. "For 18 quarters, earnings have come in above expectations, and that won't change," he notes. "Shares are still reasonably valued. These runs don't end unless excesses are created, and I don't see any excesses."

Healthy corporate balance sheets and a world economy that is slowly healing also are working in stocks' favor, says Stephen Drexler, a managing director of Wells Fargo Advisors in Colorado Springs, Colo. "Slow and steady with little fanfare and still much to worry about isn't a bad backdrop," he says.

Yet, even after adding up the pluses, the pros have pulled in their horns some since spring. Back then, a record 74% of poll respondents said they were bullish on stocks.

Today's bulls see the U.S. market advancing by only single digits through next June. Based on their consensus estimate, the Dow will rise 7% between now and then, ending this year at about 15,700 and mid-2014 at 16,486. The bulls see the S&P 500 gaining 5%, to 1824, by the middle of next year, and the Nasdaq adding 5%, to 4116, in that span.

The managers' subdued forecasts reflect the fact that 71% of poll participants now regard stocks as fairly valued, compared with 58% in the spring. Only 15% consider the U.S. market undervalued, down from 26% last April.

The S&P 500 is trading for 14 times next year's expected earnings of $122.19, which, from a historical perspective, makes the market neither rich nor cheap. Just over half of the Big Money managers expect the price/earnings multiple to expand in the next 12 months, while 11% see a contraction, and the rest see no change.

"We're unlikely to see the gains in stocks that we've had in the past couple of years, just because valuations are higher," observes Todd P. Lowe, president of Parthenon, a Louisville, Ky., money manager. "Also, the Federal Reserve is going to unwind [its bond-buying program]. We're not optimistic it will be able to do so seamlessly."

John Fox, co-manager of the $900 million FAM Value fund, sees long-term returns "in the high-single/low-double digits over five to 10 years," reinforcing the need for savvy stock-picking. He looks to capture faster growth overseas by investing in U.S. companies with big footprints in Europe and China. Also, he applauds corporations with substantial cash flow that enhance value by buying back shares, paying dividends, and merging.

According to the Big Money pros, rising corporate profits, stronger economic growth, and better employment news are the three factors that would be most likely to send U.S. stocks sharply higher in the next six months. Better news about China's economy also would reverberate positively here.

The managers finger continued political dysfunction as the most likely rally-killer, followed by earnings disappointments and slowing economic growth. "The rhetoric from both political parties is holding back the recovery," says C.T. Fitzpatrick, founder of Vulcan Value Partners, in Birmingham, Ala.

Hands down, the Big Money managers view the stock market as the best place for your money over the next 12 months—and the next five years. On a near-term basis, 80% expect equities to outperform all else, while 6% are betting on cash, and 6% on real estate.

About half of the managers think the U.S. will be the best-performing market in the next 12 months; 24% say European equities will shine brightest as the Continent emerges from a multiyear slump; and 8% are putting their money on Japan. Many managers expect emerging markets to do best over five years, outperforming the U.S., a reflection of the rapid growth of developing economies.

Among stock-market sectors, the managers like technology best, given the industry's strong fundamentals. Thirty-two percent are betting that tech will lead the pack in the year ahead, with 11% backing financials, and 10%, energy stocks.

Norman Conley, chief executive of JAG Capital Management in St. Louis, sees revenue growth as a key to lifting sectors. "There is only so much you can achieve from balance-sheet machinations, and the markets are slowly starting to recognize that," he says.

Conley favors industrial and technology stocks, and prefers biotech stocks to relatively staid large-cap drug and consumer-staples companies.

Utilities get little respect from our crowd. With bond yields edging up, about a third of the Big Money crowd thinks utility shares will be the worst performers in the next 12 months. The managers also worry about the outlook for consumer-cyclical and financial issues.

The managers' big bet on tech is apparent from their favorite stocks, a list topped this fall by Apple (ticker: AAPL), Google (GOOG), and Microsoft (MSFT). Strip out Apple's net cash, notes Fitzpatrick of Vulcan, and the shares, now $508, sell for only seven times expected earnings.

Other favorites include Samsung Electronics (005930.Korea), EMC (EMC), energy-pipeline operator Kinder Morgan (KMI), and CF Industries (CF), a fertilizer producer.

As usual, there is broader agreement on the market's most overvalued issues, with Tesla Motors (TSLA), the electric-car maker, the managers' No. 1 pan. The company is expected to sell only about 20,000 cars this year, but sports a market value of $22 billion, or $1.1 million per vehicle.

Netflix (NFLX), Amazon.com (AMZN), Facebook (FB), and Salesforce.com(CRM) also look too richly priced in the view of survey respondents. And some think the same of, yes, Apple.

The big money poll is conducted twice yearly, in the spring and fall, with the help of Beta Research in Syosset, N.Y. Our latest survey, mailed in mid-September, just after the Fed's policy makers met, drew responses from 135 institutional investors, representing some of the U.S.' largest asset managers as well as smaller firms.

Just 8% of respondents describe themselves as bearish about the outlook for stocks through next June. Nearly one in four is neutral, up from 19% in the spring. The bears expect the Dow to close the year at about 14,450, and drop to 14,016 by next June. They see the S&P 500 falling to 1609 by year end and 1561 by mid-2014, and the Nasdaq trading at about 3400 in nine months, 13% below its current level.

Most bears say the bull market's fate is tied to future Fed moves to curb quantitative easing, as its bond-buying program is known. The Fed has been purchasing bonds to drive down interest rates and stimulate economic growth.

Jason Brady, manager of the Thornburg Strategic Income fund, says that accommodative central-bank policy has pushed money into risky assets, artificially inflating stock prices. If corporate earnings falter and the Fed starts to taper, the rationale for current prices will be undermined.

Brady expects this negative scenario to play out over time; he sees the Dow holding at 15,000 for the remainder of this year before dropping to 14,000 six months hence. "If quantitative easing has been really effective in spurring economic growth, taking it away can only lower growth prospects," he contends.

William Tempel, chief investment officer at Reynolds Capital Management, a family office based in Fort Worth, Texas, argues that price distortions created by two rounds of QE make it difficult for equity investors to determine what true value is. "It is difficult to get a good understanding of what you should be buying when it is financed with 2% money," he avers.

Consequently, Tempel has been investing in start-up businesses, such as a salt-extraction enterprise in the domestic oil- and gas-producing region known as the Bakken shale. Start-ups, he notes, offer opportunities to build value independent of the Fed's moves.

Seventy-two percent of Big Money managers are bullish on real estate, in part because its returns aren't correlated with financial markets. Thirty-four percent are bullish on commodities, and 29% like gold. The yellow metal rallied 3% on Thursday, to $1,320 an ounce, amid short-covering and expectations that the cost of the government's shutdown would further postpone the Federal Reserve's plans to taper its asset buying. Gold closed the week at $1,316 an ounce.

Largely because of the U.S. central bank's policies, it's hard to rouse a kind word for bonds from the managers. Only 9% are bullish on U.S. Treasuries, though 18% think positively of corporate bonds. Just 4% see any value in bond-related mutual and exchange-traded funds.

Greg Melvin, chief investment officer at Pittsburgh's CS McKee, says that stocks will outperform, even with the market "fairly valued," precisely because of the dismal prospects for bonds. "Our client base of pension funds has no alternative but to put money into stocks to meet their actuarial assumptions," he says. "Rates will go up for the next 30 years, leaving almost zero return for bonds."

What's true of institutions could also pertain to individual investors. Chas Smith, president of CPS Investment Advisors in Lakeland, Fla., expects the rotation into stocks, which began this year, to gather steam as retirees book losses on their fixed-income accounts. "This will cause bond-fund redemptions," he says. "The Fed has manipulated interest rates to artificially low levels. Rates have to rise."

Like most investors, the Big Money managers are trying to gauge when the Fed will pull back from the market and let the economy stand on its own. After all, 80% say monetary policy influences their investment decisions significantly or somewhat. Only 4% say it's of no consequence.

Two-thirds of our respondents disagreed with the central bank's decision last month to postpone tapering, although 80% expect the Fed to reduce its bond purchases starting in next year's first half. As one manager said in written comments, "If the economy is improving, the bond-buying program should end. If the economy isn't improving after multiple years of bond-buying, it may be time to try a different strategy."

Another noted that while QE has been beneficial personally, persistently low rates "are destroying savers, senior citizens, and people in the middle and lower classes."

Or, as James Spence, co-founder of Spence Asset Management in Las Cruces, N.M., put it, "the Fed assumes there is no cost to using monetary policy to cure problems not caused by monetary policy."

As the Fed pulls away from the market, bond yields are expected to rise. The yield on the 10-year Treasury has already jumped to 2.58% from a low of 1.6% in May, and 3% no longer seems so distant. Indeed, 76 of the Big Money managers expect the 10-year to yield 3% to 3.5% a year from now, while 17% see yields of 4% or more.

For all of the doubts they express about QE and its chief architect, Federal Reserve Chairman Ben Bernanke, the money managers are split in their assessment of the strategy's results. Two-thirds say that quantitative easing has been beneficial to neutral for the U.S. economy, at least until this point, although it could prove harmful if prolonged.

Gross domestic product increased in the second quarter at an annual rate of 2.5%, and a third of the managers look for that pace to be sustained in the next year. Another 21% foresee GDP growth of 3.5% or more.

At these growth rates, inflation doesn't seem a worry, at least to half of the managers in our survey. As for the rest, 36% predict that prices will rise, and 13% aren't sure.

Most respondents expect unemployment to stay stuck at about 7% to 7.5% in the next 12 months, but slip to 6%-6.5% the following year—yet another sign of modest progress. The managers also see continued good news for the housing market, which has picked up this year.

The Big Money men and women see little change in oil prices in the year ahead. West Texas crude is trading at $100.81 a barrel, and their mean forecast puts it at $104.37 in 12 months. John White, of Triple Double Advisors in Houston, thinks prices might drop, however, now that Libya is back in the oil market. The growth of domestic shale-oil and gas production underpins his optimism about the U.S. economy and the stock market. "The U.S. is benefiting from cheaper and more abundant natural gas," he says. "This should allow us to build out manufacturing and infrastructure."

Most of the investment managers in our survey pay less attention to fiscal than monetary policy, but that doesn't mean they don't keep a close eye on Washington, especially these days. While it's early to be handicapping the 2014 midterm elections, we asked them to do just that.

More than 90% expect the Republicans to retain control of the House of Representatives in the next Congress, and 68% look for the Democrats to keep the keys to the Senate. That suggests more wrangling and less clarity ahead about taxes, government spending, and regulation.

The S&P 500 has rallied 22% this year, with little help from Congress but plenty from the Fed. It has been tough even for professional investors to keep pace. Still, 65% of Big Money managers say they're beating the market this year, and the rest probably are rushing to catch up. That's another reason to think the bulls will stay in the driver's seat for now.

Ralph Cole Honored as Duck of the Year

October 24, 2013 Ferguson Wellman is proud to announce that portfolio manager and senior vice president, Ralph Cole, CFA, was named “Duck of the Year” by the Oregon Club of Portland. The club committee considers many attributes when naming the yearly honoree, including volunteerism, passion and loyalty to University of Oregon Athletics.

Cole has served as past president of the Oregon Club of Portland and is currently on its board. He is a devoted fan, attending all the major bowl games the Ducks have competed in and visiting every Pac-12 football venue with the exception of Utah.

Among his most significant contributions to the culture of the Ducks is his recommendation that the song, “Shout,” by the Isley Brothers be played between the third and fourth quarters during home football games at Autzen Stadium.

Cole was informed of the honor at an annual luncheon hosted by the Oregon Club. Cole’s family and colleagues were in attendance, and he was presented the award by Matt Cole, his brother and fellow past president of Oregon Club of Portland.

Ralph Cole, Ken O'Neil and George Hosfield

###

Krys-Rusoff Quoted in the Portland Business Journal

Coast Aquarium Freed from Some (High-Interest) Bonds

By Matthew Kish

The Portland Business Journal

November 1, 2013

The Oregon Coast Aquarium this week said it will buy back more than $500,000 in bonds early, another sign that its once-shaky finances continue to improve.

The 1998 departure of Keiko, the killer whale made famous in the movie “Free Willy,” ripped a giant hole in the aquarium’s balance sheet by leaving it without a main attraction.

Since then, the popular tourist venue has struggled to stay ahead of $12.4 million in debt it accrued before Keiko’s departure.

Its finances have been on the upswing since CEO Carrie Lewis set in place a turnaround plan in 2011. It ended its 2012 fiscal year with a nearly $850,000 profit, a huge turnaround from 2011 when it lost nearly $300,000.

This week, it said it will spend $340,000 to pay off bonds due in 2015. It’ll spend another $185,000 to retire part of the $660,000 in bonds that come due in 2016.

Deidra Krys-Rusoff, a portfolio manager at Portland-based Ferguson Wellman who specializes in bonds, said the move will free the aquarium from some high interest payments. The 2015 bonds paid 4.4 percent interest. The 2016 paid 4.5 percent.

“We’re going along well and we’d like to see this continue in the future and I think it will,” said Rick Goulette, the aquarium’s chief financial officer.

What to Expect When You Are Expecting a New Fed Chair

by Brad Houle, CFA

Senior Vice President

by Brad Houle, CFA

Senior Vice President

Ben Bernanke’s tenure as Fed Chairman is coming to an end this year. He became Fed Chairman in 2006 and led the organization through the financial crisis. Prior to his tenure as Fed Chairman, he was an economics professor at Princeton University. One of his primary areas of interest was the Great Depression and that perspective shaped the Federal Reserve’s response to the crisis.

Janet Yellen has been nominated as the next chair of the Federal Reserve Open Market Committee. She is expected to be confirmed and would start to serve her term in early 2014. The financial markets are in favor of a Yellen Fed in that her viewpoint is thought to be similar to the outgoing Ben Bernanke. She is characterized as being “dovish” which means that she is in favor continuing zero interest rate policy and quantitative easing for an extended period of time until unemployment is reduced to a more acceptable level. Financial markets crave as much certainty and continuity as possible and the Yellen Fed fits the bill. She was tasked by the outgoing Chair Bernanke to facilitate a more open and transparent Fed. It is expected that Yellen will use this platform to steer expectations of market participants.

Countless articles and endless analysis of the Yellen Federal Reserve in the financial press have debated the minutia and theorized what a Yellen Fed will be like. At Ferguson Wellman, we have a unique perspective on the Yellen Federal Reserve. Jim Rudd, CEO of Ferguson Wellman, had the opportunity to serve as the Chair of the Portland Fed for several years under Janet Yellen who was then President of the 12th District of the Federal Reserve of San Francisco. Having witnessed her management skill first hand, Jim commented that she embraces the culture of the Fed and has the ability to manage the process of setting monetary policy. He also indicated she was on the front line of the real estate crisis in the Fed 12th district during the Great Recession and that had a lasting impact on her and how she views the fragility of the recovery.

Takeaway This Week

- There were not a lot of surprises from the Fed minutes released on Wednesday. The only material change was language surrounding an acknowledgement of a slowing in the housing recovery

Technically Speaking

by Timothy D. Carkin, CAIA, CMTSenior Equity Trader

by Timothy D. Carkin, CAIA, CMTSenior Equity Trader

With the partial shutdown of the government behind us, the equity markets have been on a near constant rise seemingly setting new highs daily. “Kicking the can down the road” gave investors the excuse to jump back into the markets as evidenced by the S&P 500’s 100-point gain since October 9. As the market ran up, Chicago Board Operative Exchange Volatility Index (VIX) was dropping. This is positive – it signals investors’ acceptance of the continued market highs. Looking further into the equity markets we see confirmation of the rally with industrial, healthcare, and consumer discretionary sectors setting new highs. Not surprisingly, almost 70 percent of the Dow Transportation Index are within 3 percent of their 52-week high. Strength in these sectors, coupled with an increase in volume, and a reduction in volatility is a recipe for a continuation of the bull market.

The market’s reaction to Microsoft’s earnings this morning, opening up more than 6 percent, was supportive of a bullish rally. In a typical market rally, quality stocks lead the market up. As the proverbial rising tide lifts all boats, the lower quality stocks rally as well. As the market exhausts, investors seek out newer opportunities and start to buy up those riskier, lower quality stocks, eventually driving valuations to excess leading the market to correct. Continued leadership of other bellwethers like Boeing, Verizon, Nike and American Express is a good sign of the health of this rally.

With all that said, one simple truth is that the market does not go straight up. Most equity markets can handle a loss of a few percent without losing their bullish momentum. As you can see in the chart below, we are at the upper bounds of the market channel. Trading down to the trendline would be perfectly normal and still maintain the trend. However, if that pullback is preceded by higher volatility or rallying lower quality stocks, this might indicate a more significant pullback.

Our Takeaways from the Week

- Market momentum is strong, even at market highs

- As the rally continues, watch for signs of stress

Let's Make a Deal

by Jason Norris, CFA

Senior Vice President of Research

by Jason Norris, CFA

Senior Vice President of Research

Let’s Make a Deal

After two weeks of a partial government shutdown and on the eve hitting the debt ceiling, the Senate cobbled together a short-term fix to reopen the Federal government and kicked the debt ceiling “can” down the road for a couple months. Despite all the hysterics in the media that included dire warnings and countdown clocks, the U.S. economy, as well as the equity markets, held up fine. While we expect a short-term hit to economic growth due to the shutdown, we do not believe it will have a lasting effect. Though equity markets have been volatile during this period, stocks actually traded higher in October, resulting in an all-time high for the S&P 500. We believe that consumer confidence will pick back up through the remainder of the year. The wildcard in Washington is whether or not there will be a “grand bargain” before we hit the debt ceiling again or will the short-term band aids be more common, thus creating more uncertainty.

While interest rates fell a bit over this time, it was another story for the U.S. dollar as the major European currencies are close to 52-week highs relative to the greenback. While this may not positively impact a planned European vacation, it will benefit major exporters because their goods will be relatively cheaper in the world market.

Blackened Big Blue

IBM reported a disappointing and sloppy quarter earlier this week. While once a bellwether for the technology space, the company has struggled in recent years, and have been unable to post revenue growth on a year-over-year basis for eight quarters. However, IBM has been able to hit profit targets due to reduced costs, lower tax rates and share buybacks. The key metric we have been watching is free cashflow and this has not been compelling enough for us to step in at current levels, even though the stock is 20 percent off its high.

Earnings Redux

Third quarter earnings have been coming in mixed across the market. Semiconductor stocks are seeing a slower fourth quarter while Google’s growth continues to exhibit strength. The regional banks are experiencing sluggish loan growth and some compression in net interest margin. However, they are hitting profit targets due to cost cutting. Although the big industrials, such as GE and Honeywell, have delivered healthy reports this week, they are showing a bit of caution in their outlooks over the next few quarters. Looking toward 2014, overall corporate earnings are still forecasted to grow close to 10 percent. While this may prove to be too optimistic, we remain bullish on equities due to continued earnings growth and low inflation, which should translate into further P/E expansion.

Out Takeaways from the Week

- Even at current levels, equities are still attractive on growth and value metrics

- While Washington tried its best to slow down the U.S. economy, we believe overall growth with continue as consumer confidence picks up