As we look ahead to the Federal Reserve’s December 10 policy meeting, markets are pricing in a greater than 90% chance of a .25% cut in the Fed Funds rate. As my colleague Blaine Dickason wrote last week, the Fed is laser-focused on the jobs market. While this week’s labor market data points to a cooling trend, it doesn’t suggest a contraction.

Slow Ride

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

I had a terrible first car - a 1978 Honda Wagon. It came equipped with vinyl seats, a manual choke, AM Radio and was a shade of brown that resembled a very well-worn Buster Brown shoe from that time. Growing up in Montana, the 1978 Honda wagon also did not like to start in below zero weather. It required stomping on the gas several times and pulling out the manual choke as far as it would go. The Wagon had all of 60 horsepower which made driving up a hill or passing another car a tenuous endeavor and frequently required putting the gas pedal all the way to the floor. There was no difference in the Honda's power if the pedal was depressed completely to the floor versus let off a little. The same could be said for the Federal funds rate being effectively zero or .25 percent. There is not much difference in the impact on economic growth.

On Thursday, the Federal Reserve left the Fed funds rate unchanged, citing global growth concerns. Ultimately, this move seems to be more about the messaging to the markets rather than actually being impactful to economic growth. The Fed does not want to further upset the applecart given recent volatility in world markets by appearing too hawkish and therefore causing financial market participants to fear the Fed will tighten too aggressively.

The Fed funds rate is important as it is one of the tools the Federal Reserve has to stimulate or slow down the economy. Should there be an external shock that requires intervention, with short term interest rates at or near zero, the Federal Reserve has no "dry powder" to stimulate the economy. As such, the Federal Reserve is highly motivated to normalize interest rate policy to allow more flexibility should a crisis arise that requires them coming to the rescue.

With all the hand wringing around when the first rate hike since 2006 will occur, it is also important to remember that a rate increase is good news. It means that the economy is strong enough that the Federal Reserve wants to make certain that it does not get overheated. The labor market has finally healed from the financial crisis and our economy continues to grow.

Our Takeaways for the Week:

- Domestically our consumption driven economy is doing well with a strong labor market and inflation that is well in hand.

- Internationally, the economic uncertainty in China and resulting turbulence in emerging markets has caused the Fed to remain on hold

Connecting The Dots

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Last week's Fed announcement had something for everyone. The Fed removed the word "patient" from its forecast for increasing interest rates. This is an acknowledgement that the economic recovery is well underway and the strong employment data month-after-month is a confirmation of this fact. Taken in a vacuum, this change in the Fed’s message could be construed as being "hawkish" meaning that the Fed is in a hurry to raise interest rates to keep the economy from overheating. However, the Fed also dropped its own interest rate forecast which could be construed as being "dovish" meaning that the Fed is reluctant to raise interest rates. As a result, there was a strong rally in both the bond and stock markets which is what we mean by something for everyone.

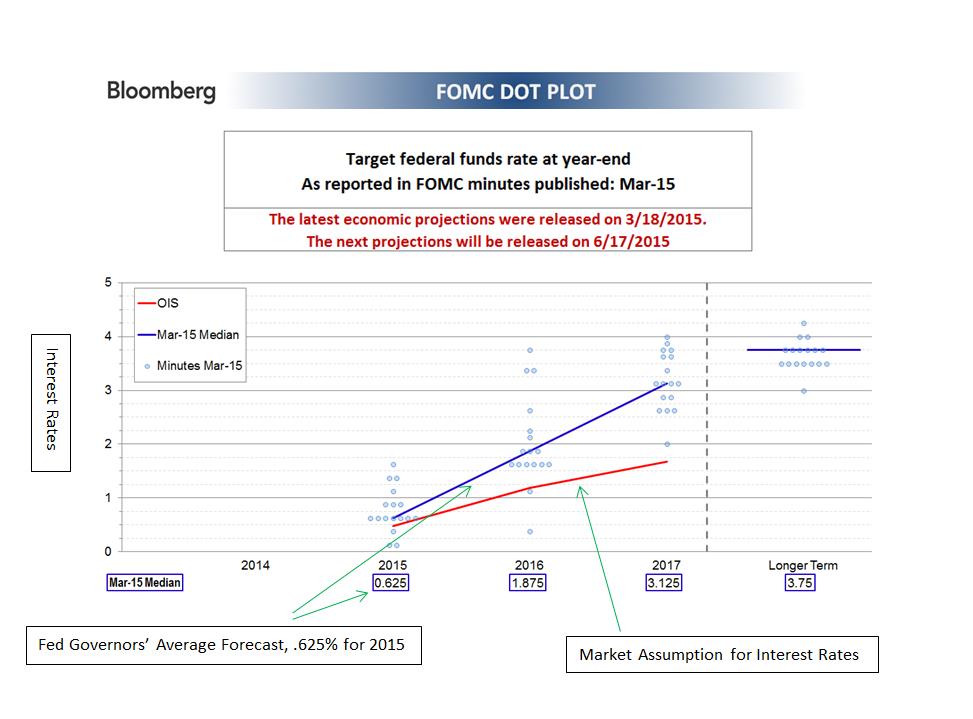

The Fed's interest rate forecast or "Dot Plot" is a relatively new construct from the Fed. There has been a concerted effort to communicate more openly with the markets by the Fed. This endeavor was successful in the Bernanke-era Fed and has also been continued by the Yellen-era Fed. It is pejoratively called "open mouth policy” because what the Fed communicates to the market is ultimately as important as what the Fed actually does.

In the “Dot Plot” each Fed Governor posts their interest rate forecast on a chart which is then released with the minutes of the Fed meetings. Each dot is only one person’s opinion; however, the dots when taken in context, gives investors an idea of what the Fed Governors are thinking. Ultimately, these individuals have the ability to influence when short-term interest rates actually rise. Historically, when short-term interest rates have risen, longer-term interest rates have also climbed. Our research partner Bloomberg has done a good job illustrating what the Fed is trying to communicate with the "Dot Plot."

The blue line above represents an average of the Fed Governor’s forecasts for the next three years. These forecasts range from .625 percent for short-term interest rates by the end of 2015 to 3.125 percent by the end of 2017. The red line depicts what the market is discounting for interest rates over the next three years. The market discounts a number of different circumstances - both the Fed raising interest rates and not raising interest rates. This Federal Reserve forecast is assuming that rates are going to be raised. There has been much hand-wringing over when the Fed will actually act. Ultimately, when the Fed actually raises rates is unimportant. The important thing is that the economic growth is robust enough that rates should rise to keep the economy from overheating.

Our Takeaway for the Week:

- We think short-term interest rates are going to rise. This is good news in that the economy is healthy enough that the Fed should act to keep it from overheating