When we met with clients in January of this year we highlighted our thesis that while 2015’s equity returns were anemic and there were concerns at the outset of 2016, we maintained that the equity bull market was not over. This

May Days and Where Fall May End Up

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

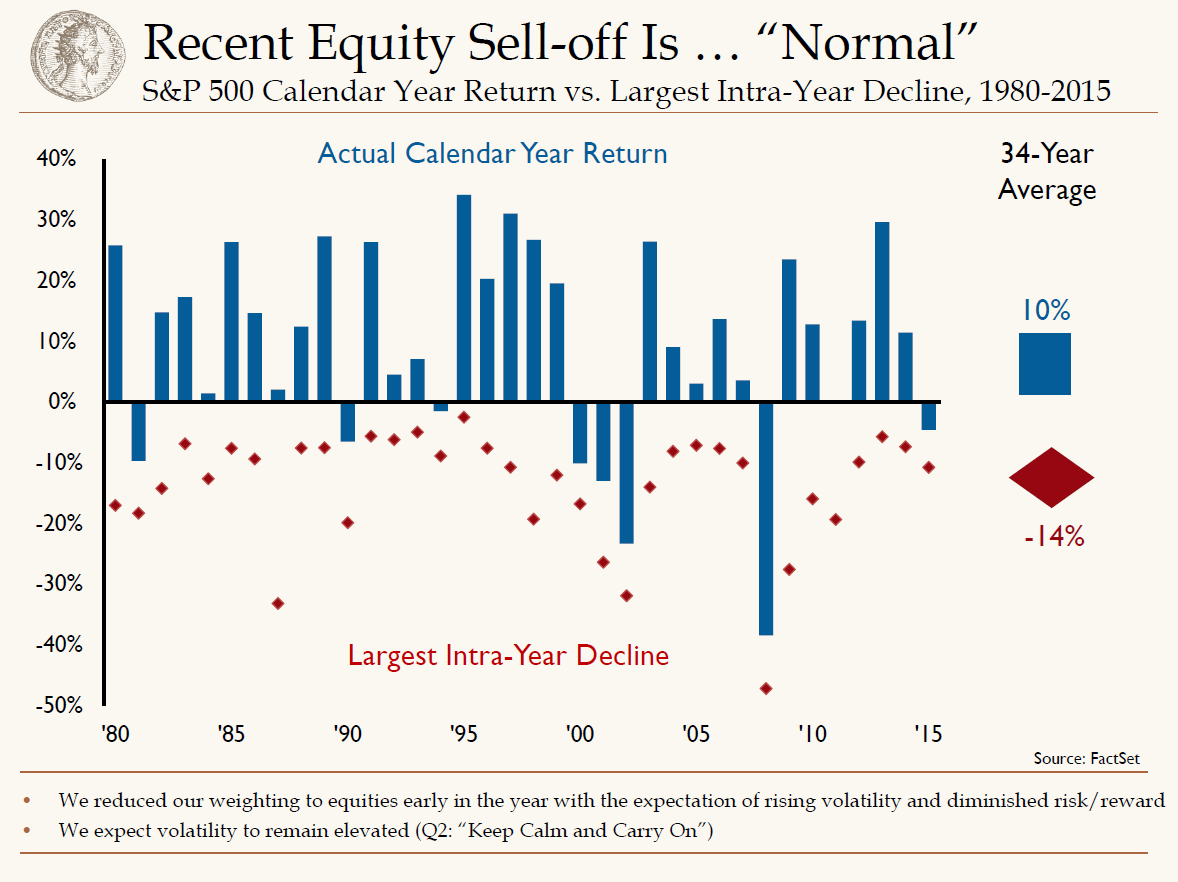

Volatility reigned supreme over the summer. The old Wall Street adage of, “Sell in May and go away,” was prophetic in 2015. Investors had become somewhat complacent the first several months of the year. The market was trading in a relatively tight range and volatility was at a minimum. In mid-May, the S&P 500 closed its all-time high of 2,130.82. As we rolled into June, the media was posing the question, “Should investors sell and move to the sidelines?” June through September is historically the worst period for investing; however, stocks are still positive. Selling in May and going away, in hindsight, would have been the right move. Emerging markets, notably China, Russia and Brazil, began to cause concerns. A major selloff in Chinese equities, lower-than-expected economic growth and a currency devaluation resulted in a major sell off in equities globally. The S&P 500 hit a low of 1,867 for the year at the end August and volatility increased meaningfully. During this period, we had to remind clients that volatility is very common; we have just been in a period of low volatility. In 2013 and 2014, only 15 percent of the time, the S&P 500 was up or down over 1 percent. In 2015, that is closer to 25 percent, which is more in-line with the long-term average. Also, the chart below highlights intra-year volatility; however on average, stocks are still positive.

Over the last 35 years, the average largest intra-year decline has been 14 percent, as shown by the red diamonds. Even in the face of these declines and volatility, the average return for the S&P 500 is 10 percent. This year, we saw a 12 percent drop from peak to trough and we believe that we have already seen the lows of 2015.

As we move into earnings season, the S&P 500 is roughly flat on the year. The volatility experienced in the summer continues as investors sort out exactly how slow global, primarily emerging market, economic growth is? How healthy is the U.S. consumer? And when will the Federal Reserve finally raise interest rates?

Regarding the Fed, the market is discounting a 30 percent chance of a December rate hike. While the employment picture in the U.S. continues to improve, low inflation and global uncertainty has kept the Fed on the sidelines. We believe that the likelihood is closer to 50/50 for a year-end rate. Whenever it occurs, the pace will be a lot slower than previous tightening cycles.

The emerging markets continue to be a headwind to U.S. growth. With recessions in Russia and Brazil, coupled with massive currency devaluations, U.S. exports continue to struggle in those markets. China, while still growing, is slowing. Earlier this month, the Chinese reported GDP growth of 6.9 percent for the third quarter. We believe that the real growth is lower, but positive. The primary slowdown is coming from the industrial areas, while the consumer continues to remain relatively strong. We’ve seen this in the individual companies we follow. For instance, Caterpillar is showing major declines in their business in China, while Apple and Nike are still experiencing growth.

Finally, while exports to emerging markets have been a headwind for the U.S. economy, the key factor is still the consumer. We believe that the state of the U.S. consumer is strong and continues to get better. Consumer confidence is high and wages are slowly moving up. The factor that we are not yet seeing on a meaningful basis is increased spending. The drop in gas prices has resulted in consumers paying down debt, rather than spending more. We believe that eventually this savings will be deployed into the economy as gas prices remain. This will result in an additional tailwind for U.S. economic growth.

With this backdrop, we believe that with interest rates rising and U.S. economy delivering healthy growth, investors should not shy away from equities. If they got out of the market earlier this year due to the volatility, we would be putting those funds back to work.

Our Takeaways for the Week

- Volatility is more common than investors perceive

- We continue to be positive on the U.S. economy and consumer

Seasons

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Seasons

The more things change, the more they stay the same. Five months ago, we rebuked the old Wall Street adage of “sell in May and go away” which, through the end of August, was a good call. From May 1st to Aug 31st, the S&P 500 was up just over 7 percent. However, just like clockwork, the month of September looks to be producing the same results it historically has. Since 1928, September is the only month out of the twelve that has an average negative return. With only a couple of trading days left, it looks like that trend will not be “bucked” this year. Even though there is still time to pull even, the end of the month is usually the weakest (see below).

Source: Renaissance Macro Research

Send for the Man

While this has been a bad week for stocks, it was also not a good week for healthcare mergers and acquisitions. On Monday afternoon, U.S. Treasury Secretary Jack Lew issued some administrative rules making it harder for U.S. companies to start inversion mergers. This type of merger allows a U.S. company to buy a smaller foreign company and relocate offshore to lower tax jurisdictions (see an earlier post for details). Most of these deals are centered in the healthcare space and while these changes will not stop potential inversions, they are designed to make them more difficult. For example, Medtronic is currently in talks to purchase Covidian (based in Ireland) and would use a meaningful amount of offshore cash to finance the deal. With these new rules, Medtronic would not have access to that cash without paying U.S. taxes. Therefore, they will have to look for other financing means, most likely debt, thus slightly increasing the cost. We still believe the deal will be completed, but it does show that the U.S. Treasury is adamant about changing this part of the U.S. tax code. AbbVie and Shire may also be affected; however, the tax benefits are not as meaningful and the gains from the Shire pipeline are significant enough to proceed.

Lesson Learned

Last week was not a good week for Apple. After announcing a record weekend of sales for the iPhone6 and iPhone6+ with over 10 million handsets sold (and this without shipping any to China), any good financial news was eclipsed by issues with the iPhone6+ bending and a botched iOS update. Investors didn’t have patience for the stock during the last few days. We believe that despite these hiccups, this iPhone launch will net over 60 million units this month, and based on pricing and component costs, should be accretive to gross margins.

What we know

- The trend of September probably won’t be broken and stocks will give back some of their summer gains

- Both buy and sell side analysts have been on the phone with their tax attorneys due to Secretary Jack Lew’s administrative order regarding inversions