Investors were expecting Wednesday's Federal Reserve announcement of a .75% increase in short-term interest rates. However, they were unprepared for Fed Chairman Powell's hawkish press conference afterward, resulting in a decline in both the stock and bond markets.

The Funambulist Fed

This year has been anything but straightforward for investors, and the most recent Fed minutes are prolonging this state of confusion. While we have seen some reduced inflation pressure in the last several weeks, the Fed minutes point out that “risks to inflation were weighted to the upside,” citing factors such as further supply chain disruptions, continued geopolitical turmoil and persistent real wage growth. For investors, the focus continues to surround the pace of Fed rate hikes for the remainder of the year.

Connecting The Dots

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Last week's Fed announcement had something for everyone. The Fed removed the word "patient" from its forecast for increasing interest rates. This is an acknowledgement that the economic recovery is well underway and the strong employment data month-after-month is a confirmation of this fact. Taken in a vacuum, this change in the Fed’s message could be construed as being "hawkish" meaning that the Fed is in a hurry to raise interest rates to keep the economy from overheating. However, the Fed also dropped its own interest rate forecast which could be construed as being "dovish" meaning that the Fed is reluctant to raise interest rates. As a result, there was a strong rally in both the bond and stock markets which is what we mean by something for everyone.

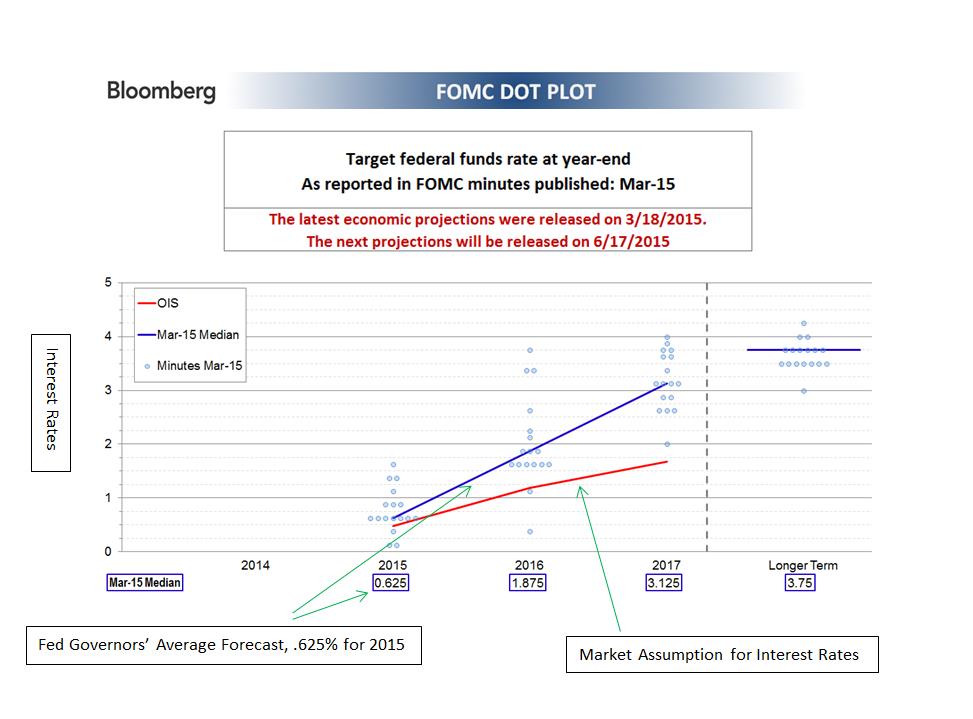

The Fed's interest rate forecast or "Dot Plot" is a relatively new construct from the Fed. There has been a concerted effort to communicate more openly with the markets by the Fed. This endeavor was successful in the Bernanke-era Fed and has also been continued by the Yellen-era Fed. It is pejoratively called "open mouth policy” because what the Fed communicates to the market is ultimately as important as what the Fed actually does.

In the “Dot Plot” each Fed Governor posts their interest rate forecast on a chart which is then released with the minutes of the Fed meetings. Each dot is only one person’s opinion; however, the dots when taken in context, gives investors an idea of what the Fed Governors are thinking. Ultimately, these individuals have the ability to influence when short-term interest rates actually rise. Historically, when short-term interest rates have risen, longer-term interest rates have also climbed. Our research partner Bloomberg has done a good job illustrating what the Fed is trying to communicate with the "Dot Plot."

The blue line above represents an average of the Fed Governor’s forecasts for the next three years. These forecasts range from .625 percent for short-term interest rates by the end of 2015 to 3.125 percent by the end of 2017. The red line depicts what the market is discounting for interest rates over the next three years. The market discounts a number of different circumstances - both the Fed raising interest rates and not raising interest rates. This Federal Reserve forecast is assuming that rates are going to be raised. There has been much hand-wringing over when the Fed will actually act. Ultimately, when the Fed actually raises rates is unimportant. The important thing is that the economic growth is robust enough that rates should rise to keep the economy from overheating.

Our Takeaway for the Week:

- We think short-term interest rates are going to rise. This is good news in that the economy is healthy enough that the Fed should act to keep it from overheating

Slowdown?

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The first couple weeks of trading in October have been volatile, primarily on the downside. While the U.S. economy continues to print positive data points, most other regions around the globe seem to be experiencing some headwinds. We continue to see deteriorating economic data coming out of the Eurozone. Germany had been stronger; however, recent data is pointing to the country possibly entering into recession. Industrial production and manufacturing orders came in weak, and this concern has pushed the yield on the 10-year German Bund to 0.84 percent.

China is a wildcard as well. Growth has been slowing moderately; however, Thursday evening technology investors were greeted with bad news from a key component supplier. Microchip Semiconductor, a supplier of chips that go into a broad array of consumer, household and industrial products, issued a warning citing weakness in China. The company believes this is a short-term issue, but demand just three months ago was strong. This resulted in a drubbing of the Philadelphia Semiconductor index and caused the industry to be down over 5 percent on Friday. Even though there may be some general hiccups in demand, we continue to play the semiconductor space through specific technologies and applications, primarily in the wireless space.

We don’t anticipate a slowdown here in the states. The U.S. economy should continue to exhibit solid growth and decouple itself from the rest of the globe. The most recent positive development has been the decline in energy prices over the last couple weeks, which will result in a nice increase of discretionary income for U.S. consumers.

When Doves Cry

The Fed released its meeting minutes earlier this week and the capital markets were pleasantly surprised. There had been some concern that the Fed may become more hawkish and looking to tighten. However, contents of the minutes showed the Fed to be focused on the data. They highlighted benign inflation, a strengthening U.S. dollar (which is positive for low inflation) as well as increased risks of a global slowdown due to Europe’s stalling growth. We still believe that the Fed will be looking to raise the funds rate in the second quarter of 2015. Even though inflation remains low, U.S. economic growth will support the beginning of a rate hike cycle.

European Central Bank President Mario Draghi also signaled his dovish intentions for the ECB earlier this week. At a speaking engagement in Washington D.C., he stated that the bank was willing and able to alter its current bond buying program which may eventually move from just asset-backed securities to actual sovereign debt. We believe the ECB will be active in the market and will attempt to push growth higher to fight any possibility of deflation.

Our Takeaways for the Week:

- While the Eurozone looks to be slowing, U.S. economic growth remains healthy which is positive for both the U.S. dollar and equities

- The Fed will remain data dependent when determining when to increase rates, which probably won’t happen for another 6-9 months