In recent months, investors have understandably been obsessing over the Fed and inflation. This week was action-packed for the markets, with the Fed meeting and October employment report taking place. Writing about the Fed has come to feel like Groundhog Day…

Fed Pain

Investors were expecting Wednesday's Federal Reserve announcement of a .75% increase in short-term interest rates. However, they were unprepared for Fed Chairman Powell's hawkish press conference afterward, resulting in a decline in both the stock and bond markets.

No Blinking in the Tetons

The major event in the capital markets this week took place Friday morning in Jackson Hole, Wyoming. Every year, Federal Reserve Bank leadership meets for a conference to discuss current and future policy. Ahead of today’s meeting, some investors had been optimistic that Powell would soften his stance on the pace of tightening.

Connecting The Dots

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Last week's Fed announcement had something for everyone. The Fed removed the word "patient" from its forecast for increasing interest rates. This is an acknowledgement that the economic recovery is well underway and the strong employment data month-after-month is a confirmation of this fact. Taken in a vacuum, this change in the Fed’s message could be construed as being "hawkish" meaning that the Fed is in a hurry to raise interest rates to keep the economy from overheating. However, the Fed also dropped its own interest rate forecast which could be construed as being "dovish" meaning that the Fed is reluctant to raise interest rates. As a result, there was a strong rally in both the bond and stock markets which is what we mean by something for everyone.

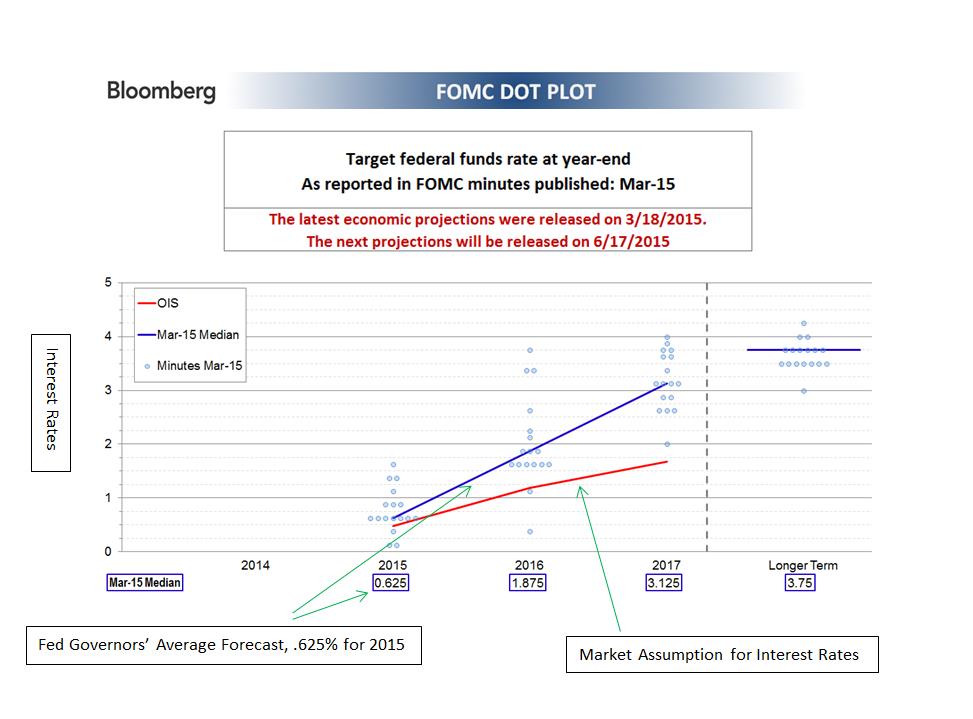

The Fed's interest rate forecast or "Dot Plot" is a relatively new construct from the Fed. There has been a concerted effort to communicate more openly with the markets by the Fed. This endeavor was successful in the Bernanke-era Fed and has also been continued by the Yellen-era Fed. It is pejoratively called "open mouth policy” because what the Fed communicates to the market is ultimately as important as what the Fed actually does.

In the “Dot Plot” each Fed Governor posts their interest rate forecast on a chart which is then released with the minutes of the Fed meetings. Each dot is only one person’s opinion; however, the dots when taken in context, gives investors an idea of what the Fed Governors are thinking. Ultimately, these individuals have the ability to influence when short-term interest rates actually rise. Historically, when short-term interest rates have risen, longer-term interest rates have also climbed. Our research partner Bloomberg has done a good job illustrating what the Fed is trying to communicate with the "Dot Plot."

The blue line above represents an average of the Fed Governor’s forecasts for the next three years. These forecasts range from .625 percent for short-term interest rates by the end of 2015 to 3.125 percent by the end of 2017. The red line depicts what the market is discounting for interest rates over the next three years. The market discounts a number of different circumstances - both the Fed raising interest rates and not raising interest rates. This Federal Reserve forecast is assuming that rates are going to be raised. There has been much hand-wringing over when the Fed will actually act. Ultimately, when the Fed actually raises rates is unimportant. The important thing is that the economic growth is robust enough that rates should rise to keep the economy from overheating.

Our Takeaway for the Week:

- We think short-term interest rates are going to rise. This is good news in that the economy is healthy enough that the Fed should act to keep it from overheating

Take Your Time

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Take Your Time

Greece and Euro Area finance ministers reached a tentative agreement Friday to buy time for Greece to get their financial house in order. The EU has agreed to provide liquidity for up to four additional months if Greece provides a sufficient list of measures they are willing to undertake.1

Greece will have a primary budget surplus in 2015 which means they will have a budget surplus - if you don’t count debt payments. While this may seem unrealistic, it does mean the Greek government could continue to operate if they stop paying their creditors. However, this would not be in the best interest of anyone. Greek bonds would drop in value, as would some of the bonds of other peripheral countries. This situation is known as financial contagion. Greece in and of itself is not a huge economy (it is approximately the size of Indiana), but the world is trying to judge the effectiveness the European Union. Can they hold it together?

We believe that the EU can indeed keep it together in the near-term. In the future, it may be in the best interest of some countries, Greece as one example, to move out of the Eurozone. If a country finds itself politically unable to work within the confines of the European Union, they may want to exit the agreement in order to control their own budgets and currency. The EU would rather have this happen during a time of strength, rather than at a time of ongoing economic stress.

Waiting on a Friend (Fed)

The Federal Reserve board meeting minutes were released Wednesday and markets deemed them to be dovish; meaning that the Fed is afraid of raising rates too soon and choking off a fragile recovery. The surprise to us is that people continue to refer to this as a recovery. Both U.S. GDP and the S&P 500 are at all-time highs and the U.S. passed through recovery territory years ago. While nothing is a foregone conclusion, we believe the Fed will raise rates later this year. There will be a lot of hand wringing over the first Fed rate hike (there always is), but we believe the economy is on very sound footing and can handle higher rates. While it could happen in June, it will most likely happen in the second half of the year. This topic will be discussed ad nauseam throughout the year, but we view tightening as a positive. A rate hike will be a signal to the markets that the financial crisis is officially behind us and extraordinary measures of liquidity are no longer needed.

Takeaways for the Week:

- The Greek debt story is not over, but they do have more time

- We expect the Fed to raise rates later this year

1 Source: Bloomberg