by Shawn Narancich, CFA

Executive Vice President of Research

by Shawn Narancich, CFA

Executive Vice President of Research

Early Christmas Gifts

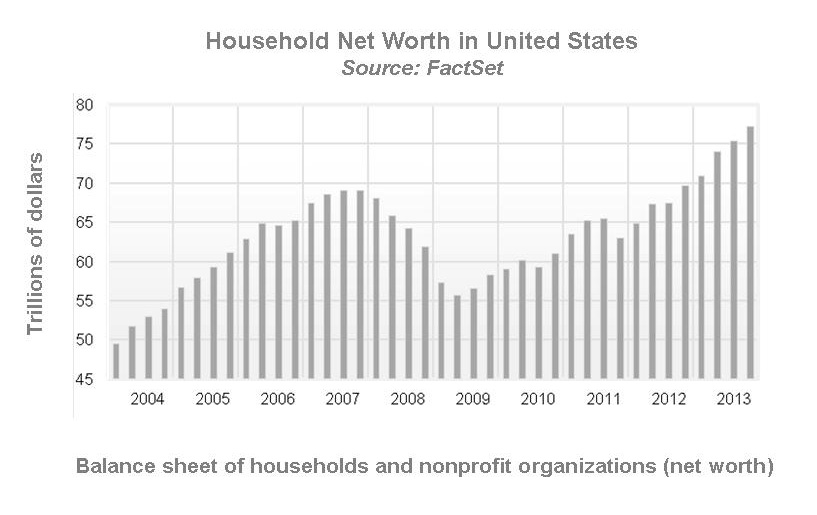

In what turned out to be a surprisingly action-packed week before Christmas, the markets finally shook off the shackles of worry concerning what would happen when the Fed began tapering its program of quantitative easing (QE). Bernanke proved that he’s no lame duck chairman and investors learned that stocks can still go up despite a slightly less accommodative Fed. In reducing monthly purchases of Treasury and mortgage-backed bonds by $10 billion per month, our central bank is acknowledging a slowly improving labor market and an expanding economy that is being boosted by several key drivers: a renaissance in U.S. energy production and manufacturing and, increasingly, the wealth effect of rising house and stock prices that is giving a nice lift to consumer spending. Looking ahead, we expect incoming Fed Chair Janet Yellen to continue what Bernanke started. Our view is that further reductions to QE will be commensurate with continued improvement in labor markets, subject as always to the Fed’s other key mandate—keeping inflation low.

Always a Bear Market Somewhere

In stark contrast to stock prices that are once again setting new highs, gold prices have fallen substantially. After attracting increasing amounts of attention as a hedge against monetary dislocation and unchecked growth in the money supply, gold is increasingly being abandoned by investors now more attracted to robust stock market returns and, for those with a lower risk tolerance, bonds that are now offering real rates of return. From its high in August 2011, gold is now down 36 percent. It may be pretty to look at, but with the Fed now in the early stages of unwinding QE, it has lost its shine.

Blue Burner

Sticking to the commodity theme, one key source of energy whose price is going the opposite direction is natural gas. Much maligned by investors because of its seeming ubiquity, the front-month contract is up 31 percent since August. Cold weather has boosted the demand for natural gas, one of the nation’s most common sources of home heating. Weather vicissitudes aside, we like the longer-term demand case for the cleaner burning fuel to take market share of electricity generation from its dirtier cousin coal. Will gas currently priced for $4.40 per-million-BTUs go to $5.50? In the short-term, probably not, because the prolific shale fields in Pennsylvania, Wyoming and Texas will induce considerably more production if prices continue to rise.

Nevertheless, key suppliers can make a lot of money with natural gas prices in the $4.00 to $5.00 range. More importantly, our economy should increasingly benefit from using low cost natural gas and natural gas liquids to generate cheaper power and manufacture plastics. In the latter case, low cost ethane, propane and butane feedstocks are displacing oil-based naptha, incenting major chemical companies like Dow and the petrochemical arm of Shell to locate plastic manufacturing facilities stateside. The beneficial result for America is new jobs, additional exports, and healthier levels of GDP growth.

In this festive season, we wish all our friends and clients a Merry Christmas and a very happy and healthy new year.

Our Takeaways from the Week

- Investors took the start of Fed tapering in stride, as stocks rallied to new highs

- A continued flow of encouraging economic data points to faster GDP growth in 2014

Disclosures