After an unusually long spell of low volatility, stocks and bonds sold off in tandem to end a week that was previously on the quiet side following the Labor Day holiday. Coming into Friday, stocks had essentially earned out the high single-digit returns we foresaw for 2016. Low levels of economic growth globally should renew profit growth in future quarters, but neither stocks nor bonds are cheap at this point.

Leaded or Unleaded?

Financial markets were volatile this week, influenced by mixed messages from the Federal Reserve. The Fed minutes released on Wednesday were dovish, suggesting little chance of a Fed rate hike, while San Francisco Fed President Williams

Take Your Time, Do It Right

As we came into the week, markets were continuing to sell off in response to the U.K.’s vote to leave the EU. After falling 1.8 percent on Monday, the S&P 500 began to rally on Tuesday. Through today, the market was up over 3 percent this week. International stock marke

Show Me the Numbers

by Deidra Krys-Rusoff Senior Vice President

The S&P 500, Dow Jones Industrial Average and NASDAQ ended the week nearly flat from last Friday, despite a volatile trading day today. The financial sector retreated 1.4 percent, as investors’ hopes of a Federal Reserve interest rate hike dwindled on the release of today’s nonfarm payrolls report. Utilities and phone stocks rose this week, benefitting from the prospects of lower rates. The Bloomberg Commodity Index rose to a seven-month high and is nearing a level marking of a 20 percent advance from the gauge’s January bottom, close to meeting the common definition of a bull market. The dollar dropped and ended the day trading at $1.14 per euro. International markets were mixed, with European stocks slightly down and the MSCI Emerging Markets Index advancing 1.5 percent to a one-month high. The benchmark 10-year Treasury rallied, with rates falling 15 basis points over the week to yield of 1.70 percent.

What’s in a number? A lot, when the number is the nonfarm payrolls reporting significantly weaker than even the most pessimistic economist expected. May’s payroll numbers rose by a mere 38,000 versus the consensus estimate of 160,000. The report further muddied the economic waters by revising the April increase downwards to 123,000 from 160,000 and March’s numbers to 186,000 from the robustly reported 208,000 increase. The Verizon strike temporarily played into these numbers, subtracting roughly 40,000 from the overall job growth that should reverse after the strike ends. This boost, up to what would have been a gain of 78,000, is still shockingly low. The report shows that the labor market deceleration was widespread. Private-sector hiring was at 25,000 versus 130,000 in April and government hiring added a scant 13,000 jobs to the May numbers. Job losses were seen in construction, manufacturing and wholesale trade. Hiring in the paid professional and business sectors also showed slowing.

Markets initially took the news hard: The S&P 500 Index initially dropped as much as 1 percent from a recent seven month high, the dollar sold off against the euro, and bond prices increased dramatically – dropping the yield of the benchmark 10-year Treasury to 1.70 percent from 1.80. However, U.S. equities pared the early losses to around 0.2 percent as commodity producers extended gains.

The unemployment rate fell to 4.7 percent, but this is unfortunately attributed to declining labor force participation or labor force dropouts. This year’s earlier rebound in jobs participation may be stalling out. One good piece of information from the government report was that the broader U-6 unemployment rate (which reflects underemployment) remained steady at 9.7 percent. Another positive note is that average hourly earnings advanced last month by 0.2 percent, which resulted in earnings 2.5 percent higher than last year’s levels.

The weak jobs number almost certainly takes a Federal Reserve rate hike off of the table for June. The Fed governors have repeatedly stated that their policy decisions will be data-dependent and we didn’t have to wait long to hear how the Fed governors feel about the number. Federal Reserve Governor Lael Brainard spoke to the Council on Foreign Relations this morning and stated, “In this environment, prudent risk management implies there is a benefit to waiting for additional data to provide confidence that domestic activity has rebounded strongly and reassurance that near-term international events will not derail progress toward our goals.” Prior to the jobs report release, the market was pricing in one to two hikes for the remainder of the year. Now the market is placing odds of a hike below 50 percent for July, September and November.

One stand-alone jobs number does not make a trend and this could easily be a one-time blip on the radar. As noted earlier, unemployment numbers are often revised in months following releases and this extremely low number may be revised upwards in coming months. While predicting unemployment numbers is a fool’s game, we can confidently predict that everyone will be watching and waiting for the June unemployment numbers release on July 8.

Our Takeaways for the Week:

- Despite a volatile trading day, markets ended the week nearly flat from last week

- May jobs number shocks economists; however, employment numbers are often revised

- Low payrolls growth likely takes June Fed hike off the table

Irresistible Force

When we met with clients in January of this year we highlighted our thesis that while 2015’s equity returns were anemic and there were concerns at the outset of 2016, we maintained that the equity bull market was not over. This

Rescue Me

That’s the message we heard loud and clear from the markets this week. As economies and markets around the world wobble to start the new year, they were looking to central banks to bail them out. Mario Draghi gave markets around the world some solace with his dovish news conference yesterday.

Monster Mash

by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Monster Mash

No holiday better describes earnings season than Halloween. When companies announce earnings, investors are hoping for treats but often times end up getting tricks. In our view, improving corporate earnings are the catalyst to improving stock market returns in the coming year. As we close out the best month for the stock market since 2011, we should review some of the tricks and treats of earnings season.

Treat

Apple reported earnings earlier this week and beat expectations on almost every level. IPhone sales continue to grow at a robust pace around the world. The company sold 48 million iPhones in the third quarter, up 22 percent from last year. Analysts expect the company to sell 79 million iPhones in the final quarter of the year. Average selling prices of the phones continue to rise, which enhances profitability and will lead to $60 billion in free cash flow this year alone.

Tricks

As expected, the energy sector has had a rough time of it this earnings season. Earnings for the S&P 500 energy sector were expected to be down 73 percent this quarter and that indeed has been the case. During these distressing times all companies begin to dramatically scale back investment and reduce headcount. We feel that higher quality companies with good assets, low debt levels and quality management teams will benefit from the eventual rise in oil prices.

Trick and Treat

In no place is the bifurcations of earnings season more evident than in footwear. Nike reported earnings that beat analyst estimates by 12 percent and the stock responded with a nine percent pop the next day. Nike also reported a solid outlook for the coming quarters as well. Sketchers, on the other hand, tricked investors and missed earnings by a whopping 21 percent last week and the stock dropped 31.5 percent with the news.

Why have stocks responded so positively to a mixed earnings environment? Expectations for third quarter earnings had been lowered so much that companies have been able to meet and often beat those reduced forecasts. Also, the much advertised slowdown in China has not had as big of an impact on earnings as investors feared. While the investment slowdown in China has hurt some industrial companies, the Chinese consumer has actually helped the likes of both Apple and Nike.

Takeaways for the week

- There have been more treats than tricks this earnings season which has driven the S&P 500 higher by nine percent this month

- Earnings season continues to be very volatile and stock selection has been key

May Days and Where Fall May End Up

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

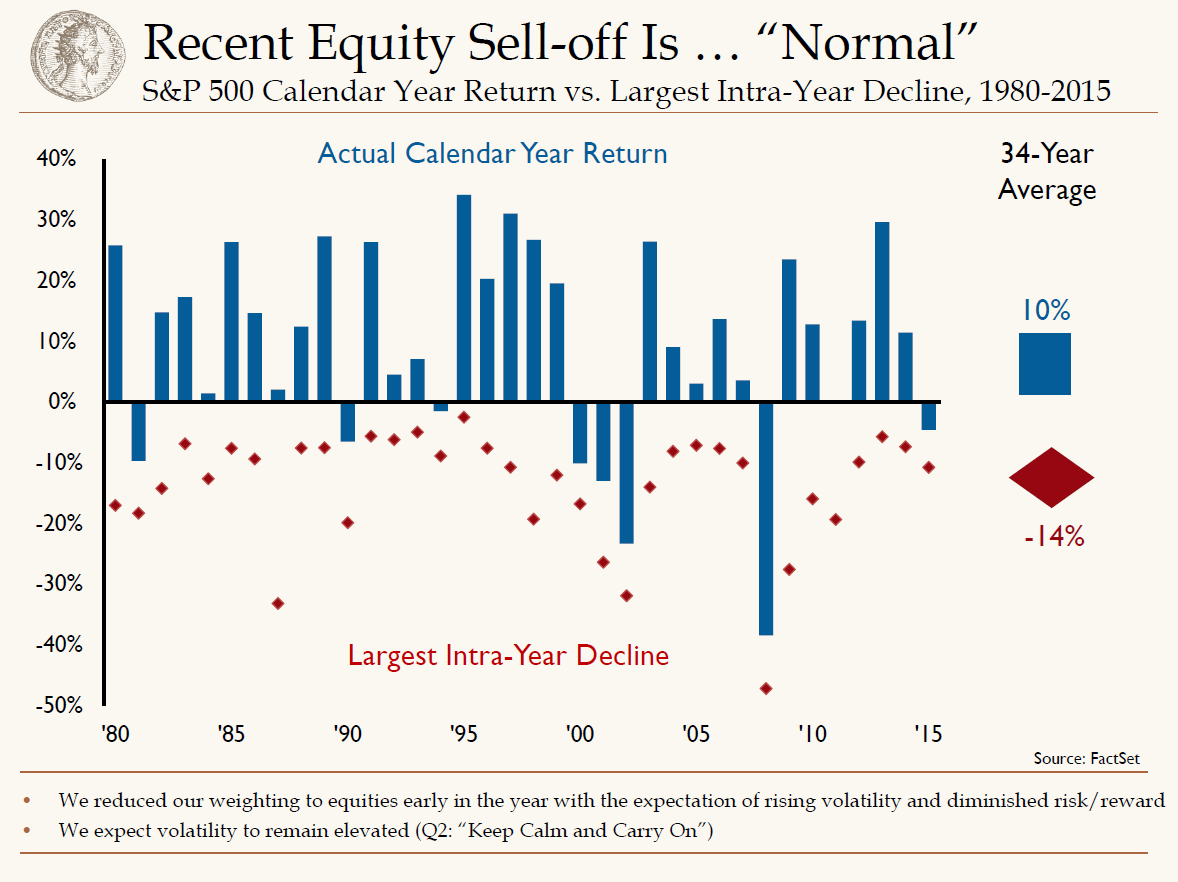

Volatility reigned supreme over the summer. The old Wall Street adage of, “Sell in May and go away,” was prophetic in 2015. Investors had become somewhat complacent the first several months of the year. The market was trading in a relatively tight range and volatility was at a minimum. In mid-May, the S&P 500 closed its all-time high of 2,130.82. As we rolled into June, the media was posing the question, “Should investors sell and move to the sidelines?” June through September is historically the worst period for investing; however, stocks are still positive. Selling in May and going away, in hindsight, would have been the right move. Emerging markets, notably China, Russia and Brazil, began to cause concerns. A major selloff in Chinese equities, lower-than-expected economic growth and a currency devaluation resulted in a major sell off in equities globally. The S&P 500 hit a low of 1,867 for the year at the end August and volatility increased meaningfully. During this period, we had to remind clients that volatility is very common; we have just been in a period of low volatility. In 2013 and 2014, only 15 percent of the time, the S&P 500 was up or down over 1 percent. In 2015, that is closer to 25 percent, which is more in-line with the long-term average. Also, the chart below highlights intra-year volatility; however on average, stocks are still positive.

Over the last 35 years, the average largest intra-year decline has been 14 percent, as shown by the red diamonds. Even in the face of these declines and volatility, the average return for the S&P 500 is 10 percent. This year, we saw a 12 percent drop from peak to trough and we believe that we have already seen the lows of 2015.

As we move into earnings season, the S&P 500 is roughly flat on the year. The volatility experienced in the summer continues as investors sort out exactly how slow global, primarily emerging market, economic growth is? How healthy is the U.S. consumer? And when will the Federal Reserve finally raise interest rates?

Regarding the Fed, the market is discounting a 30 percent chance of a December rate hike. While the employment picture in the U.S. continues to improve, low inflation and global uncertainty has kept the Fed on the sidelines. We believe that the likelihood is closer to 50/50 for a year-end rate. Whenever it occurs, the pace will be a lot slower than previous tightening cycles.

The emerging markets continue to be a headwind to U.S. growth. With recessions in Russia and Brazil, coupled with massive currency devaluations, U.S. exports continue to struggle in those markets. China, while still growing, is slowing. Earlier this month, the Chinese reported GDP growth of 6.9 percent for the third quarter. We believe that the real growth is lower, but positive. The primary slowdown is coming from the industrial areas, while the consumer continues to remain relatively strong. We’ve seen this in the individual companies we follow. For instance, Caterpillar is showing major declines in their business in China, while Apple and Nike are still experiencing growth.

Finally, while exports to emerging markets have been a headwind for the U.S. economy, the key factor is still the consumer. We believe that the state of the U.S. consumer is strong and continues to get better. Consumer confidence is high and wages are slowly moving up. The factor that we are not yet seeing on a meaningful basis is increased spending. The drop in gas prices has resulted in consumers paying down debt, rather than spending more. We believe that eventually this savings will be deployed into the economy as gas prices remain. This will result in an additional tailwind for U.S. economic growth.

With this backdrop, we believe that with interest rates rising and U.S. economy delivering healthy growth, investors should not shy away from equities. If they got out of the market earlier this year due to the volatility, we would be putting those funds back to work.

Our Takeaways for the Week

- Volatility is more common than investors perceive

- We continue to be positive on the U.S. economy and consumer

A Light in the Black

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

A Light in the Black

What a week! With concerns about growth in China, continued deterioration of the Chinese equity market and U.S. investors rushed to the sidelines by redeeming over $17 billion in equity mutual funds and ETFs. This, coupled with concern over when the Fed will raise rates, led U.S. equities to experience a 12 percent correction from recent highs on Tuesday (see last week’s blog for more detail). This was long overdue as it had been almost four years since the S&P 500 had corrected by at least 10 percent, which was the third longest period in history. However, after six consecutive days of selling, on Wednesday the near-term bottom was reached on the S&P at 1867, down from its all-time high of 2130 which was reached on May 21, 2015.

Understandably, rapid downward moves in equities can be disconcerting. We don’t know if we’ve seen the bottom; however, we believe there is a light at the end of this tunnel in the form of domestic market fundamentals. For example, U.S. GDP was revised higher on Thursday from 2.3 percent q/q annualized to 3.7 percent. This was driven by several factors - primarily capital spending and consumer spending. Earlier this month we also saw retail sales numbers revised higher. When this data was originally reported, we did view it with some skepticism since our bottoms-up analysis did show better strength than the broad government reports.

After analysis of the earnings reports for the companies we own, it revealed annual growth in earnings of 2 percent; however, excluding Energy, growth was close to 13 percent. Even when looking at the broad market, earnings growth (excluding Energy) was around 5 percent. This growth was driven by the U.S. consumer and healthcare. These fundamentals signal to us that the U.S. economy is healthy and improving.

Earnings Growth for the 10 Economic Sectors of the S&P 500

| Q2 y-o-y growth | 2015e | |

| Consumer Discretionary | 9.2% | 11.3% |

| Consumer Staples | 2.5% | 1.7% |

| Financials | 6.8% | 15.9% |

| Healthcare | 14.4% | 12.7% |

| Industrials | -4.5% | -1.0% |

| Info Tech | 4.5% | 4.9% |

| Basic Materials | 6.0% | -1.0% |

| Telecom | 8.5% | 8.3% |

| Utilities | 6.5% | 1.6% |

| Total (ex. Energy) | 5.3% | 7.0% |

| Energy | -55.7% | -56.3% |

| Total | -0.7% | 1.0% |

Source: FactSet

The table above highlights the underlying sectors of the U.S. market, showing both the actual growth rate for the second quarter and an estimate for 2015. The key to focus on is that commodity prices are bringing down Energy and Basic Materials, and the strong U.S. dollar and China is hurting Industrials. However, when you lift up the hood of the market, corporate America is still exhibiting solid growth.

Our Takeaways for the Week

- Corporate earnings remain healthy

- While volatility may remain until the Fed tightens, we still like equities long-term

Narancich Quoted in Portland Business Journal

Oregon stocks stumble as market plunges

by Matthew Kish

The stocks of 18 of Oregon's 20 biggest public companies dropped Monday as the stock market tumbled. The S&P 500, Dow Jones industrial average and the Nasdaq Composite each closed down nearly 4 percent.

Northwest Pipe Co. (NASDAQ: NWPX) and Lattice Semiconductor Corp. (NASDAQ: LSCC) were the only large Oregon stocks to post gains. Each ended the day up less than 1 percent.

While there's no consensus on the market stumble, local analysts pointed to weakness in the Chinese economy and uncertainty about central banks and interest rates.

"I would venture to guess it’s more people being skittish about the direction of the Fed right now," said Chris Abbruzzese, chief investment officer for Portland's Rain Capital Management. "The Federal Reserve is going to be less supportive of equities markets going forward.”

They also said the market was due to hit a speed bump.

"The markets had been unusually stable and had come up quite a bit over the past three years," said Kraig Kerr, a senior vice president and financial adviser at D.A. Davidson in Portland. "So most people were expecting a correction at some point and were surprised it hadn’t happened earlier."

Shawn Narancich, executive vice president of equity research and portfolio management at Ferguson Wellman Capital Management, said the firm doesn't see anything "sinister" happening.

"Our mantra continues to be keep calm and carry on," Narancich said.

Ferguson Wellman expects the U.S. economy to continue growing in the second half. The economy is adding jobs and inflation is low. Consumer spending, which accounts for roughly 66 percent of the economy, remains strong.

"Gas prices are going to start dropping," he said. "Unemployment is low. Disposable incomes are up."

Rain Capital’s Abbruzzese said there’s also “quite a bit of evidence” that “we’re due, if not overdue,” for a resurgence in spending on capital projects that would stimulate the economy.

Kerr said D.A. Davidson's advice for clients depends on circumstances.

"Clients that are going to need cash in the near term may want to consider locking in gains," he said. "For the most part if a client has a well balanced portfolio we're not doing anything."

Abbruzzese said Monday's market volatility highlights the need for investment strategies that minimize risk.

“This is the type of market where we really thrive,” he said. “The approach thrives because we are more mindful of risk factors in portfolio construction.”

Here's a look at how Oregon's biggest stocks fared:

Nike Inc. (NYSE: NKE) — down 2.81 percent to $103.87

Precision Castparts Corp. (NYSE: PCP) — down 1.95 percent to $228.85

Lithia Motors Inc. (NYSE: LAD) — down 2.82 percent to $101.89

StanCorp Financial Group Inc. (NYSE: SFG) — down 0.85 percent to $112.59

Schnitzel Steel Industries Inc. (NASDAQ: SCHN) — down 2.66 percent to $16.10.

Keep Calm and Carry On

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Feeling Violated

Worries about competitive currency devaluations emanating from China’s small haircut to the yuan last week were supplanted this week by manufacturing related fears that the world’s second largest economy could be experiencing a hard landing. The result was a tough week for equity investors, as European stocks entered correction territory and U.S. stocks fell five percent.

Timing is Everything

As the sell-off accelerated into today’s close, we couldn’t help but wonder what market soothing policy moves the Chinese might institute next, nor could we ignore the palpable sense that the Fed’s lift-off from zero interest rate policy just got delayed again. Volatility in stocks will register with Yellen & Co. as they attempt to time this cycle’s first interest rate hike. However, more impactful will be the continued deflation in commodities that threatens to leave the price level far from the Fed’s stated goal of two percent inflation. As oil seeks out new cyclical lows and Treasuries benefit from a flight-to-quality bid, the trade-weighted dollar actually declined today. At a time of increased economic and market turmoil overseas, this hints of US monetary policy remaining easier for longer.

Reasons For Optimism

Low fuel prices and an increasingly healthy job market are combining to boost the collective spending power of U.S. consumers, helping drive the economy to what we believe will be a stronger second half of the year. Notwithstanding this week’s pullback in stocks, we look forward to a better second half of the year for corporate America, which should benefit from easier foreign currency comparisons and a turnaround in oil prices, two key factors that have helped keep earnings flat so far this year. As profit visibility improves, we expect stocks to make forward progress.

Ringin’ the Till

With all but a small number of companies having now reported, the sun is setting on a second quarter earnings season characterized again by companies under promising and over delivering. Retailers book-ended Q2 numbers this week by reporting a decidedly mixed bag of results. While America’s largest retailer struggles to grow, Wal-Mart’s rival Target came through with earnings just strong enough to make investors believe that this beleaguered retailer has put the worst of its merchandising and credit breech struggles behind it. Standing out to the upside was Home Depot, which reported another impressive quarter of sales driven by higher house prices and rising home improvement spending. While closing down for the week amidst market turmoil, Home Depot’s stock outperformed the broader market as management once again raised its profit forecast for the year.

Our Takeaways from the Week

- A sell-off in global equities pierced the veil of U.S. market tranquility

- Retailers concluded second quarter earnings season by reporting mixed results

Taking a Bigger Bite Out of the Apple

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

Apple reported earnings earlier this week. Due to recent strength in the stock, investors took profits. Specifically, sales grew 27 percent year-over-year, driven by 55 percent growth in iPhone revenues. This resulted in profit growth of 40 percent. These growth rates are very rare for companies with annual revenues over $200 billion and a market capitalizations (the share price multiplied by total number of shares outstanding) in excess of $700 billion. Therefore, sustainability does frequently come up.

On a similar note, with Apple’s market capitalization of $725 billion, it is now considered the highest valued company in the world. With that value, it is now 4 percent of the S&P 500, the most common equity benchmark. When active investors attempt to beat their benchmark, knowing some of the major constituents is critical for investment managers. In the case of Apple, if an investor believes that Apple is going to perform better than the S&P 500, they now have to allocate more than 4 percent of their portfolio to that stock. If they do not and Apple were to perform better than the S&P 500, investment managers will not keep up.

From a diversification standpoint, most investment managers are hesitant to hold positions greater than 4 percent, thus would now be underweight Apple. Since Apple is a very large component of the large-cap equity benchmarks, we recently reviewed the 10 largest actively managed core and growth mutual funds. For core managers trying to beat the S&P 500 when Apple is a 4 percent position, eight of 10 are underweight, and the other two are equal. When looking at growth managers when Apple is 7 percent of the benchmark (i.e., Russell 1000 Growth), nine managers are underweight and only one is equal. This data revealed that Apple is extremely underowned among the world’s largest mutual funds. If those funds were to move to an equal weight position relative to the benchmark, we would see over $29 billion worth of buying, which is roughly 235 million shares. Since we have a positive view on Apple, we believe this data is also positive.

Just like clockwork, this time of year the financial press will be prognosticating about the old adage, “sell in May and go away.” This comes to the forefront since equity markets often experience lackluster performance in the spring and summer months. However, it does not necessarily mean that investors lose money. Since 1978, from May to September, stocks median return was 3 percent, lagging the performance of equities from September to May. This has resulted in a median performance of 11 percent. We believe this doesn’t signal “a sell” since there are still positive returns to be had, just more potential volatility. The negative returns captured in the chart below are the result of two poor months, July and September.

Source: FactSet

Our Takeaways from the Week

o Apple continues to be an "underowned" stock which may provide outside buying power adding support to the name

o While summer is often a results in lackluster equity period for performance, we don’t think investors should trade based on the calendar

Pushin' Forward Back

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The official start of earnings season kicks off next week and it looks like earnings for the broad market are going to be negative five percent. There are two main culprits for this. First, the recent strength in the U.S. dollar took large multinational companies by surprise, which resulted in major revenue and earnings revisions lower in 2015. The S&P 500, a standard large cap equity benchmark, has approximately 35-40 percent of its constituent’s revenues outside the United States. Therefore, a major strengthening of the U.S. dollar (see the below chart) results in U.S. goods being more expensive.

For example, if $1.00 = 0.80 Euro, then if a U.S. manufacturer were selling a $100 item in Europe, customers there would be spending 80 Euros. With the recent strengthening, $1.00 is now the equivalent of 0.95 Euros, thus that same $100 item would cost 95 Euros. This is a major price increase and headwind for U.S. exporters. We saw this instance with companies like Microsoft, Caterpillar, and more. On the other hand, the weakening Euro makes those products cheaper in the U.S. Thus, we believe European exporters should stand to benefit from this, and will be a catalyst to stimulating growth in Europe. As such, we recently increased our exposure to the International markets.

Down In a Hole

The other culprit for the major negative revisions for earnings is the reduction in the price of oil. In the past six months, the price of oil has been cut in half which is having a dramatic effect on the earnings in the oil patch. The year-over-year change in energy earnings in the first quarter is a negative 65 percent. Excluding this area of the market, earnings are forecasted to grow by three percent.

Outshined

These two attributes are setting up for a tough year for headline growth numbers. Earnings growth estimates have declined from seven to two percent for 2015. However, if you exclude Energy, earnings growth should come in closer to nine percent. Our belief is the overall economy is improving and the consumer will be the main beneficiary. While recent consumer spending data has been mixed, we are seeing an improving trend, particularly in consumer confidence. Therefore, continued low interest rates and energy prices throughout 2015 are a tax cut for consumers, and with a tightening labor market, we expect to see an increase in wages. This is all setting up to be a good year for “Main Street.”

Our Takeaways for the Week:

- The strong dollar and low oil prices are a headwind for US earnings growth

- Main Street will be the winner in 2015

Liquid Courage

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Volatility increased this past week in most asset classes with oil being in focus. In the last two weeks, crude oil is up roughly 20 percent, its best two-week move in 17 years. While the demand picture has not changed, we have seen U.S. oil and gas companies announce major employment cuts and capital expenditure reductions for 2015. We believe that there has been some “short covering” in the market which has led to recent strength. Our belief is that by year-end, oil prices will be between to $60-$70/barrel, due to reduced supply in the U.S. In the face of this, we do believe we see some opportunity in energy stocks. While earnings continue to come down, we think we can find value in select names with strong balance sheets.

All Over the Road

As mentioned earlier, the energy complex was not the only asset class exhibiting volatility. In the first five weeks of 2015, the S&P 500 has been either up or down more than 1 percent 11 times, which is 44 percent of the trading days. To put it in perspective, last year the S&P 500 moved this much only 15 percent of the time. The chart below highlights the last five years.

Days the S&P 500 Was Up or Down More Than 1 Percent

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Number of Days | 96 | 50 | 38 | 38 | 11 |

| Percent of total trading days | 38% | 20% | 15% | 15% | 44% |

Source: FactSet

This year is setting up to be similar to 2011, a year that saw a lot of uncertainty due to surprisingly poor U.S. GDP growth, a U.S. debt downgrade and the European crisis coming to the forefront. All this uncertainty resulted in a flat market for 2011, but it was a rollercoaster ride. We believe the fundamentals of the U.S. economy and the recent actions of the European Central Bank leave the foundation of the global economy a little firmer. We don’t think the volatility mitigates itself; however, we do believe that equity returns will be better than 2011.

Working for the Weekend

Heading into a wet weekend on the west coast, the monthly jobs report this morning was very strong with the U.S. economy adding 257,000 jobs in January. The unemployment rate ticked up to 5.7 percent due to an increase in people looking for jobs, which is a positive for the economy. This is only a small part of the story. Job gains for December and November were revised higher by 147,000. The third leg of the stool of the January jobs report was an uptick in wages. Wages bounced back after a disappointing December, rising 0.5 percent month-over-month. With a strong labor market and unemployment close to the Fed’s target, we believe this wage growth will persist throughout 2015. This further reinforces our view that 2015 will be a good year for “Main Street.”

Our Takeaways for the Week:

- Main Street will fare better than Wall Street in 2015

- Adding to high quality energy names at this time could pay dividends in 2015

The January Effect

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The January Effect

Historically, investors have cited the so-called January indicator in an attempt to forecast future returns. If the S&P 500 is positive in the first five trading days of January, then 75 percent of the time, stocks have enjoyed a positive return for that entire calendar year. With stocks seeking a positive gain the first five days of 2015, we can be hopeful for more of the same come December. With stocks delivering gains two-thirds of the time anyway, this looks to be only modestly significant. While we don't make investment calls based on calendar events and historically superstitions, we at least recognize when the odds are in our favor. As a footnote, the S&P 500 was down the first five days in 2014, and yet we ended the year with positive gains.

Don’t Chase the Hot Dot

Jack Bogle is on cloud nine. The biggest proponent of passive investment management, and founder of The Vanguard Group, saw over $200 billion of inflows from investors in 2014 as frustration increased with active management. In 2014, depending on asset class, 75-90 percent of active equity managers trailed their benchmark. While this lack of alpha is a concern, it is not the most important contribution to an investor’s overall return. The biggest factor is the allocation between stocks and bonds, and then which equities you favor (large cap, small cap, international, ETF, etc.) The U.S. large cap space was the best game in 2014, and the more exposure the better for investors. Finally, there will be periods where passive does better than active; however, over longer periods of time, active is superior. Over the past five years, 50 percent of institutional active managers have outperformed. Over the past 10 years, 75 percent of active managers have outperformed.* The key for investors is patience. Chasing last year’s performance has never been the best policy and taking a long-term view is the best approach.

Our Takeaways for the Week:

- 2015 should be a positive year for stocks, though it likely will be volatile

- Over the long-term, active management beats passive

*Source: Mentor

Here Comes Santa Claus

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

The Federal Reserve delivered some early Christmas cheer with a new policy statement on Wednesday, and by Thursday afternoon the Dow average had advanced 700 points. Please excuse us for being frustrated by the constant attention to the Fed and the parsing of every statement they utter. This tends to happen during any Fed tightening cycle. The chart below shows the average S&P 500 performance around the last five Fed tightening cycles. As you can see, about six months before the Fed starts raising rates the market goes through a correction of 5–7 percent and volatility rises.

The U.S. economy continues to hum along, and there is no lack of positive economic indicators. We believe that the Fed will be raising short-term interest rates in the middle of next year and they are doing their best to signal that move to the markets well in advance. The most recent examples last week were jobless claims, which dropped to a six-week low, consumer comfort climbing to a seven-year high, leading economic indicators rising an additional .6 percent and retail sales increasing by the most they have in eight months. In short, there is plenty of good economic news to go around, and enough momentum for the Fed to justify raising rates next year.

Wind of Change

While oil prices fell modestly this week, energy stocks began to rally. Since the peak in oil prices in June, the S&P energy sector fell 25 percent. This week oil prices are down another 2 percent, but oil stocks in the S&P were up 7 percent. We can’t say that we are surprised. Whenever you get such a dramatic drop in prices, it tends to produce bargains. Financial buyers aren’t necessarily brave enough to step into these situations, but strategic buyers are. This week Repsol, a Spanish oil company, made an offer to buy Talisman Energy for $12.9 billion. Talisman’s share price was as low as $3.96 on December 8, and now trades for just over $9.00 per share. We made the case last week that the sell-off in oil was overdone, and it appears others are coming to the same conclusion.

Our Takeaways from the Week

- The stock market will continue to experience increased volatility in the coming months as the Fed communicates its tightening plans

- The sell-off in oil stocks is overdone, and there is value in the sector

- Our warmest wishes for a happy holiday season!

Somebody’s Watching Me

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

There were two high profile data breaches this week which highlighted the importance of cyber security, as well as “implied privacy.” Home Depot announced that they had a breach where credit and debit cards used at its stores may have been compromised. Initial speculation was that this may have just happened within the last few weeks; however, some reports indicate the breach may extend back to April of 2014. There were also reports from Goodwill, Dairy Queen and Supervalu that some of their locations may have experienced a data breach. What this shines a light on is the importance of corporate security, as well as vigilant consumers. One potential solution to this problem would be the implementation of “chip and pin” debit/credit cards. Most of the world has already implemented this means of transaction, but the U.S. has not. The main difference between “chip and pin” cards and standard debit cards is, when using a chip card, there is no magnetic strip to swipe. The card is put in a Point of Sale (POS) terminal, the chip is read, and the consumer has to input a PIN number. The security for these transactions is much more reliable. The chip cannot be copied like a magnetic strip can (as we saw in the Target case, and it looks like the Home Depot breach as well.) Visa and MasterCard are big proponents of this technology; however, it has been very slow to roll out in the U.S. The Netherlands company NXP Semiconductor is a key player in the technology for these cards.

The distribution of several celebrities’ nude pictures this week has also highlighted the importance of personal cyber security. Over the weekend, more than 100 personal iCloud accounts were hacked and private photos were leaked to the media, with several prominent actresses being victimized. Apparently, this was a case of hackers easily decoding individuals’ passwords. While this action is not condoned, individuals have to remember that any material that is stored in the cloud runs the risk of being compromised.

Less Than Zero

The European Central Bank continued to take rates lower this week by reducing its deposit rate to -0.2 percent from -0.1 percent. You are reading that correctly, that is a negative number. This seems to be more symbolic, rather than having much of an impact on the market. The market impact decision came in the same announcement that the ECB will increase its purchase of ABS (Asset-Backed Securities). This is very similar to what the U.S. Fed had been doing with its purchase of mortgage-backed securities. The key item missing is that the ECB did not announce a plan to purchase sovereign debt. The ECB is hoping banks will sell their ABS to them and in its place, make loans. Europe continues to sputter out of recession with expectations of GDP growth and inflation below 1 percent. This move by the ECB showed the market that it is willing to support European economies, although one has to wonder if they have enough power to do so.

Why Worry

The employment report this morning was a disappointment with the U.S. only adding 142,000 jobs in the month of August; expectations were for over 200,000. Ferguson Wellman believes this data will eventually be revised upward. The economic data the last few months has been very robust and is not consistent with this weak jobs number. Therefore, we aren’t concerned about the number unless other economic data starts to signal a slowdown.

Gameday

With the Seattle Seahawks opening game win Thursday, it reminds us of the Super Bowl stock market prediction. Some may recall when we highlighted the belief that if the Seattle Seahawks won the Super Bowl this year it would foretell a positive year to the market. So far so good with a 9 percent+ gain in the S&P 500 to date. Even with this strong run, we believe that earnings growth and low inflation will continue to be tailwinds for equities, pushing them higher to year-end.

Our Takeaways for the Week

- Internet security will become more of a focus for companies and individuals

- Global central banks are supporting economies - coupled with strong earnings, this is a positive for stocks

Motion Simulating Progress

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Talk, Talk, Talk

It seems that every time you turn around, the Fed is trying to communicate information to the capital markets or to Congress. This week, Janet Yellen made a trip to Congress to speak to the Joint Economic Committee where she gave a very balanced view of the economy and of possible future Fed actions.

Chairwoman Yellen said that the U.S. economy paused in the first quarter, but appeared to be gaining steam in the current quarter. This view dovetails perfectly with our own views at Ferguson Wellman. The questions from Congressional members centered on job growth, unemployment and the labor participation rate. As we watch testimony of this type, it is interesting to observe the new Fed Chair sidestep the clearly partisan questions and get to the heart of what the Fed is tasked to do and what duties are tasked to Congress. This inculcation occurs every time the Fed Chair is invited to give testimony. The Fed has a dual mandate ― maximum employment and stable prices. This slower than usual recovery has placed an increased focus on employment, and what the definition of “full” employment actually is. Congress and the markets want to identify the exact unemployment rate at which the Fed will begin raising rates, which we think is foolhardy. The Fed Chairwoman explained the importance of not reading too much into any one data series, and any one data point. Rather, it will depend on a number of factors.

Here in our office we are turning our focus toward wage-related inflation. Increasing wages are often a precursor to overall inflation for the economy, and just like the Fed, we will be looking for acceleration at the margin for a number of indicators, not any one indicator.

What’s Going On

What has surprised us has been the movement of rates going lower in the face of better growth. Many explanations have been floating around and we suspect it is a combination of slower growth in the first quarter of the year and low rates around the world, making the yield on the 10-Year U.S. Treasury look appealing. We continue to believe that an improving labor market and positive GDP growth will move rates higher in the coming months.

Our Takeaways from the Week

- While Chairwoman Yellen is adept at dealing with Congress, we hope that the Fed can reduce their commentary in the future which we believe will reduce overall volatility in the fixed income markets

- Strong first quarter earnings for the S&P 500 continue to support higher stock prices in the future

Spring Break Movies

by Tim Carkin, CAIA, CMT

Senior Vice President

by Tim Carkin, CAIA, CMT

Senior Vice President

Divergent

This week the market is showing some interesting divergence. The S&P 500 performance is paltry, nearly flat on the year. Technology, biotech and consumer discretionary sectors, which are more heavily weighted in the NASDAQ, started selling off heavily last week leaving the NASDAQ down more than seven percent year to date. This week small cap stocks, which had been performing admirably, sold off more than four percent and are now negative on the year. Citigroup, Morgan Stanley and other large financials also sold off heavily after the Fed’s latest stress test results. On the plus side, emerging market stocks rallied significantly this week in hopes of new Chinese stimulus.

Need for Speed

A few good economic readings came out this week. Last month’s Q4 GDP number was revised up to an annualized 2.6 percent from 2.4 percent. This came as consumer spending in February rose by the most in three years and jobless claims declined last week to the lowest level in four months. Personal consumption expenditures (PCE), a favorite economic indicator of past Fed Chairman Bernanke ticked up 0.1 percent in February. Lower jobless claims and a low inflation rate give the Fed a little cushion to work with when considering stimulus and rate increases.

Rise of an Empire?

The constant media attention of developments in the standoff between Ukraine and Russian is weighing on the market. We did get good news on that front in an announcement from the IMF of $14-18 billion in aid. In addition, our Senate approved $1 billion in loan guarantees and the EU promised more than 10 billion euros in the next few years. On the other hand, Yulia Tymoshenko, former Prime Minister of Ukraine, announced her candidacy for president. This ensures the standoff will remain in the news through the Ukrainian elections on May 25th.

Takeaways for the Week

- Geopolitics is a major overhang to the momentum in the U.S. economy

Let's Make a Deal

by Jason Norris, CFA

Senior Vice President of Research

by Jason Norris, CFA

Senior Vice President of Research

Let’s Make a Deal

After two weeks of a partial government shutdown and on the eve hitting the debt ceiling, the Senate cobbled together a short-term fix to reopen the Federal government and kicked the debt ceiling “can” down the road for a couple months. Despite all the hysterics in the media that included dire warnings and countdown clocks, the U.S. economy, as well as the equity markets, held up fine. While we expect a short-term hit to economic growth due to the shutdown, we do not believe it will have a lasting effect. Though equity markets have been volatile during this period, stocks actually traded higher in October, resulting in an all-time high for the S&P 500. We believe that consumer confidence will pick back up through the remainder of the year. The wildcard in Washington is whether or not there will be a “grand bargain” before we hit the debt ceiling again or will the short-term band aids be more common, thus creating more uncertainty.

While interest rates fell a bit over this time, it was another story for the U.S. dollar as the major European currencies are close to 52-week highs relative to the greenback. While this may not positively impact a planned European vacation, it will benefit major exporters because their goods will be relatively cheaper in the world market.

Blackened Big Blue

IBM reported a disappointing and sloppy quarter earlier this week. While once a bellwether for the technology space, the company has struggled in recent years, and have been unable to post revenue growth on a year-over-year basis for eight quarters. However, IBM has been able to hit profit targets due to reduced costs, lower tax rates and share buybacks. The key metric we have been watching is free cashflow and this has not been compelling enough for us to step in at current levels, even though the stock is 20 percent off its high.

Earnings Redux

Third quarter earnings have been coming in mixed across the market. Semiconductor stocks are seeing a slower fourth quarter while Google’s growth continues to exhibit strength. The regional banks are experiencing sluggish loan growth and some compression in net interest margin. However, they are hitting profit targets due to cost cutting. Although the big industrials, such as GE and Honeywell, have delivered healthy reports this week, they are showing a bit of caution in their outlooks over the next few quarters. Looking toward 2014, overall corporate earnings are still forecasted to grow close to 10 percent. While this may prove to be too optimistic, we remain bullish on equities due to continued earnings growth and low inflation, which should translate into further P/E expansion.

Out Takeaways from the Week

- Even at current levels, equities are still attractive on growth and value metrics

- While Washington tried its best to slow down the U.S. economy, we believe overall growth with continue as consumer confidence picks up