As part of the modernization of the federal government and with a goal of improving efficiency and reducing fraud, the president signed an executive order on March 25 to phase out the use of paper checks by the U.S. government.

Trust Protector: A Tool for Flexibility in Estate Planning

In an era of evolving tax laws and shifting estate planning strategies, flexibility has become an important consideration in wealth planning.

Considering a Move? What To Know About Changing Domicile

In recent years, a growing number of individuals and families have considered changing their state of domicile as a strategy to reduce their state income tax burden. Not surprisingly, states with lower income taxes and taxpayer-friendly structures experienced strong inbound migration according to IRS migration data based on 2021 and 2022 tax return filings. Whether prompted by high state income, estate or property taxes, the decision to change domicile is significant with legal and financial implications.

IRS Publishes Clarification on SECURE Acts

The passage of the SECURE Act in 2019 and SECURE 2.0 Act in 2022 ushered in sweeping changes for taxpayers regarding retirement account distributions. These changes, including a significant modification to how certain designated beneficiaries must distribute inherited retirement accounts, are crucial for anyone possessing or inheriting a retirement account to understand.

2024 Required Minimum Distributions for IRA Beneficiaries Waived Again by IRS

Tyler Conroy, CFP®, writes about the IRS waiving required minimum distributions in 2024 and shares a resource for individuals for whom this may apply.

Wealth Management Strategy Fourth Quarter 2020: Ready, Set, Wait ...

The SECURE Act Creates Significant Changes for Retirement Plans

In one of the most significant retirement legislation changes in a decade, the President and Congressional leaders recently approved a bill that will have an impact on certain retirement funds.

Tax Seasoning: SALT and Preparers

April 15 a.k.a. Tax Day for the United States, is fast approaching. As we near the finish line, many Americans are already seeing the impact; the IRS reported in congressional testimony earlier this month that they have issued 2.2 percent fewer refunds compared to the same time last year.

Protect Yourself from Tax Scams

Each year, the IRS issues its annual “Dirty Dozen.” This is a list of top scams that taxpayers should be aware of, along with information on how to spot, avoid and report them.

Wired and Connected

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

For technology junkies, the Re/code conference in Southern California is one of the highlights of the year. It is a broad mix of public and private companies speaking on innovation today and what the future holds -- from automobiles and wireless to media and culture.

One of the most popular segments of the conference is Mary Meeker’s annual presentation of internet trends. Meeker is a partner at venture firm Kleiner Perkins; however, her thrust into the spotlight came about 20 years ago when she was an internet analyst for Morgan Stanley. The key point to her 190+ page slide deck was that the internet is still in its very early stages and mobile is becoming more of a dominant aspect of the web. While the consumer and businesses have been pushing the internet, there are several other areas of the economy where opportunities are still great. Government, education and healthcare are just a few examples of sectors that have not yet fully leveraged the internet.

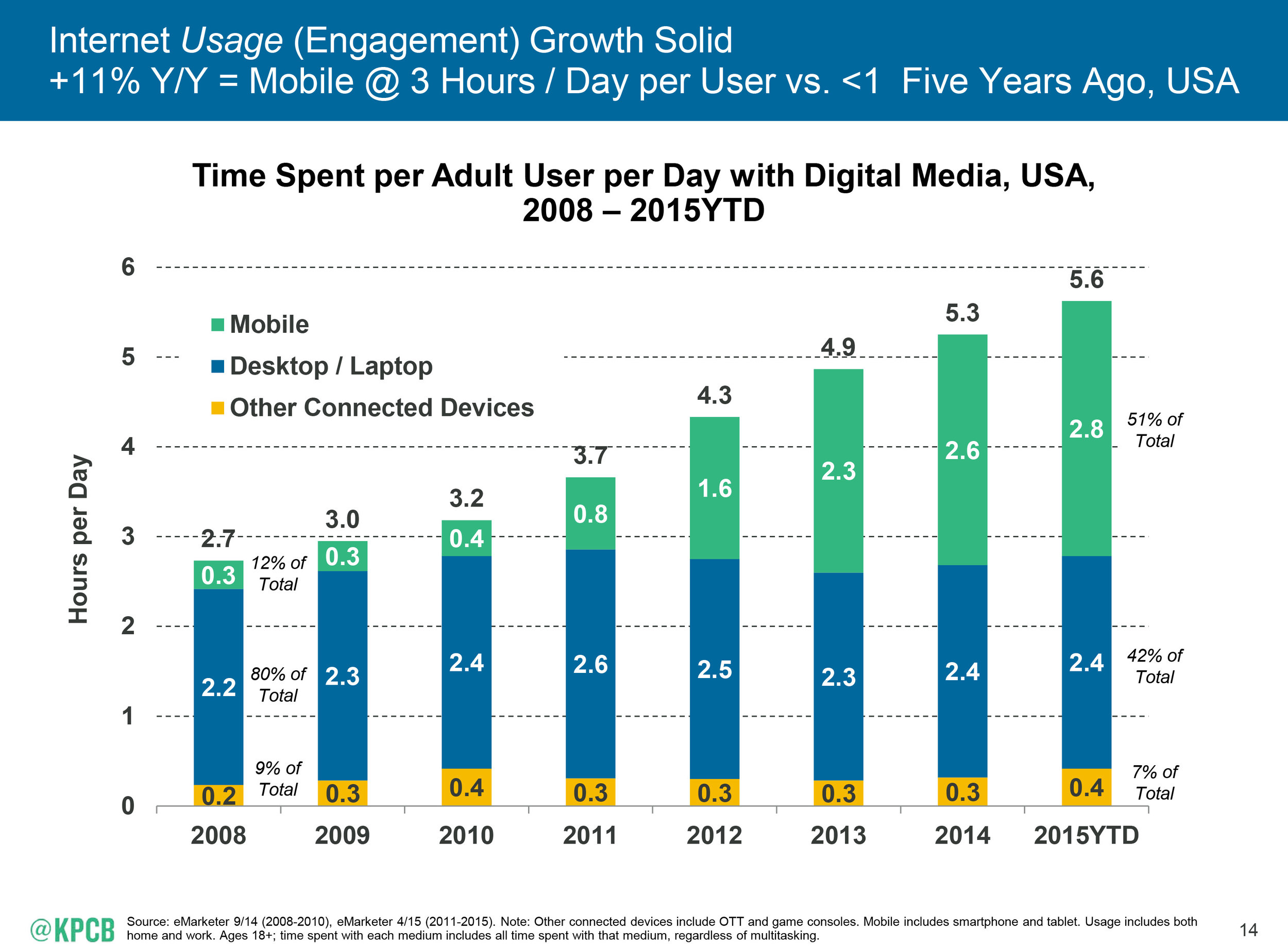

As users, traffic, and transactions increase online – security becomes more of a focus. What has been a common news event of late, there are breaches at various institutions that can put both individuals and those entities at risk. The IRS unfortunately is the most recent institution to be significantly impacted. As more people connect to mobile devices, security and encryption are even more essentials. The chart below highlights time spent with digital media on different devices.

Accessing digital media continues to grow at a double-digit rates and the growth is primary coming from mobile. This growth in connectivity globally continues to benefit companies such as Apple, Samsung and Avago.

Increased transactions as well as a growth in private information shared digitally, specifically wirelessly, does increase the need for better security, as well as the opportunity for companies to analyze consumer behavior and offer personalized deals. These trends have resulted in chief information officers (CIOs) to forecast security and analytics spending to continue to increase as a percentage of information technology (IT) spending. Morgan Stanley released a survey earlier this week highlighting a 210 bps increase in the growth of network security spending in 2015 (12.8 percent up from 10.7 percent). To put in perspective, overall IT spending usually grows in the low-to-mid-single digits. Some beneficiaries of this trend would be Cisco, Checkpoint and Palo Alto Networks.

Watch What You Do

As consumer utilize more wireless devices and with the most recent launch of the Apple Watch, some legal issues become a bit fuzzy. In several states, it is against the law to use your wireless handset while driving. What if you are using your watch? This was the case in Quebec earlier this month where a watch owner was fined $120 for operating his watch while driving. As devices become more integrated, especially in cars, safety regulators are going to have a tough time keeping up.

Our Takeaways for the Week

- Mobile is becoming the dominant means of interent access

- Cybersecurity will be a theme for years to come